Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are investigating the expansion of your business and have sought out two options for the sourcing of funds for the expansion. The first

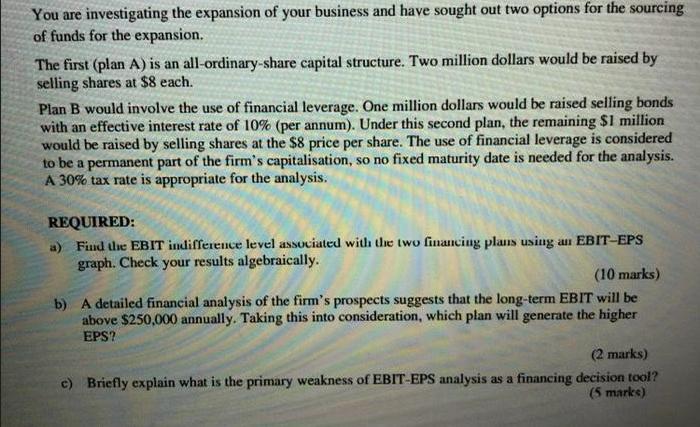

You are investigating the expansion of your business and have sought out two options for the sourcing of funds for the expansion. The first (plan A) is an all-ordinary-share capital structure. Two million dollars would be raised by selling shares at $8 each. Plan B would involve the use of financial leverage. One million dollars would be raised selling bonds with an effective interest rate of 10% (per annum). Under this second plan, the remaining $1 million would be raised by selling shares at the $8 price per share. The use of financial leverage is considered to be a permanent part of the firm's capitalisation, so no fixed maturity date is needed for the analysis. A 30% tax rate is appropriate for the analysis. REQUIRED: a) Find the EBIT indifference level associated with the two financing plans using an EBIT-EPS graph. Check your results algebraically. (10 marks) b) A detailed financial analysis of the firm's prospects suggests that the long-term EBIT will be above $250,000 annually. Taking this into consideration, which plan will generate the higher EPS? (2 marks) c) Briefly explain what is the primary weakness of EBIT-EPS analysis as a financing decision tool? (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

EBITEPS Analysis for Financing Plans a Finding the EBIT Indifference Level Step 1 Calculate EPS for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started