Question

You are investing in a portfolio consisting two shares D and E. You plan to invest 70% of your available funds in D and the

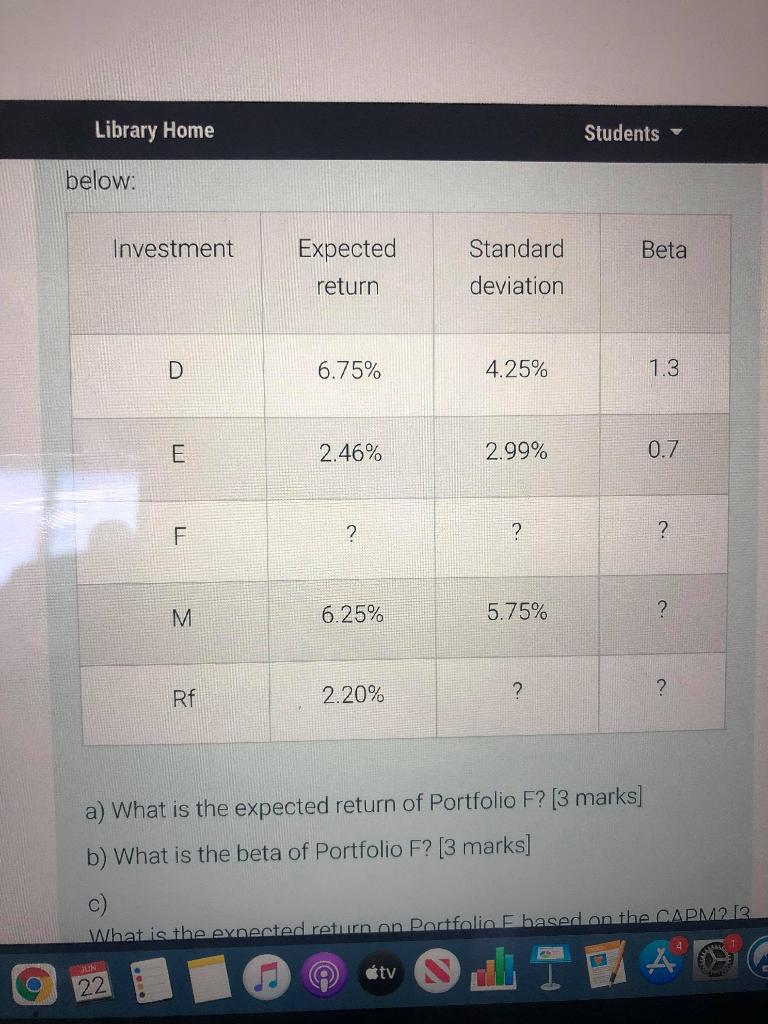

You are investing in a portfolio consisting two shares D and E. You plan to invest 70% of your available funds in D and the balance in E. You will refer this portfolio as Portfolio F. The expected returns of each share, standard deviation of returns and beta of each of these shares, the market portfolio return (M) and the riskfree asset return (Rf), are shown in the table below:

a) What is the expected return of Portfolio F? [3 marks]

b) What is the beta of Portfolio F? [3 marks]

c) What is the expected return on Portfolio F, based on the CAPM? [3 marks]

d) What is the standard deviation of the risk-free asset? [3 marks]

Library Home Students below: Investment Expected Standard Beta return deviation D 6.75% 4.25% 1.3 E 2.46% 2.99% 0.7 F ? 2 ? M M 6.25% 5.75% ? Rf 2.20% ? ? a) What is the expected return of Portfolio F? [3 marks] b) What is the beta of Portfolio F? [3 marks] What is the eynected retum on Portfolio based on the CAPM2 13 JUN tv 22Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started