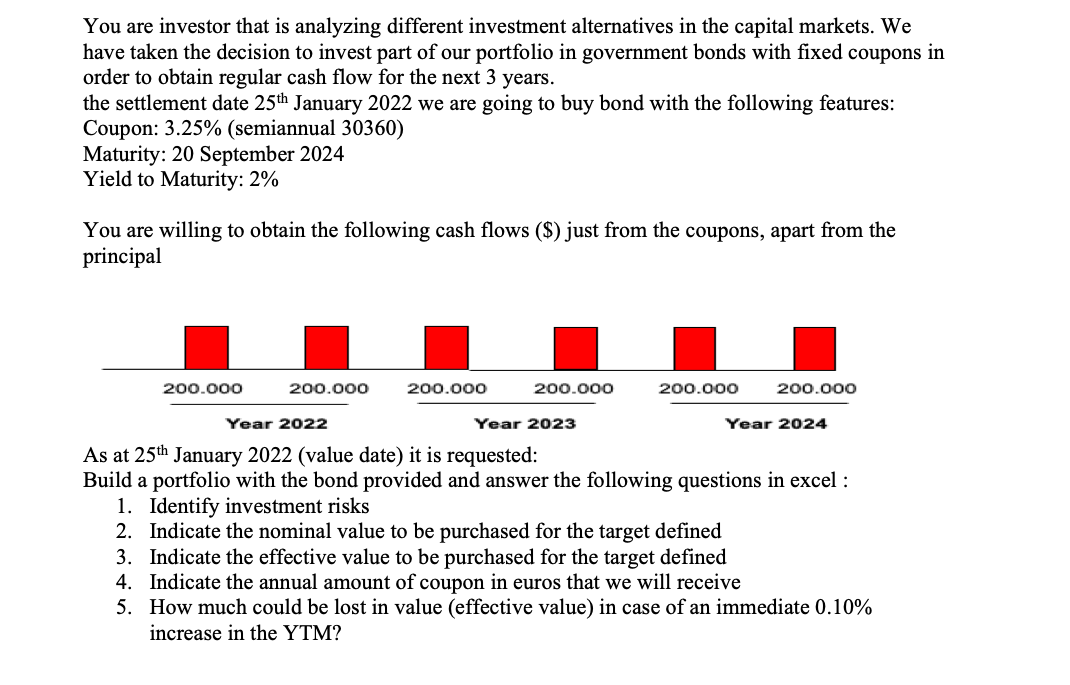

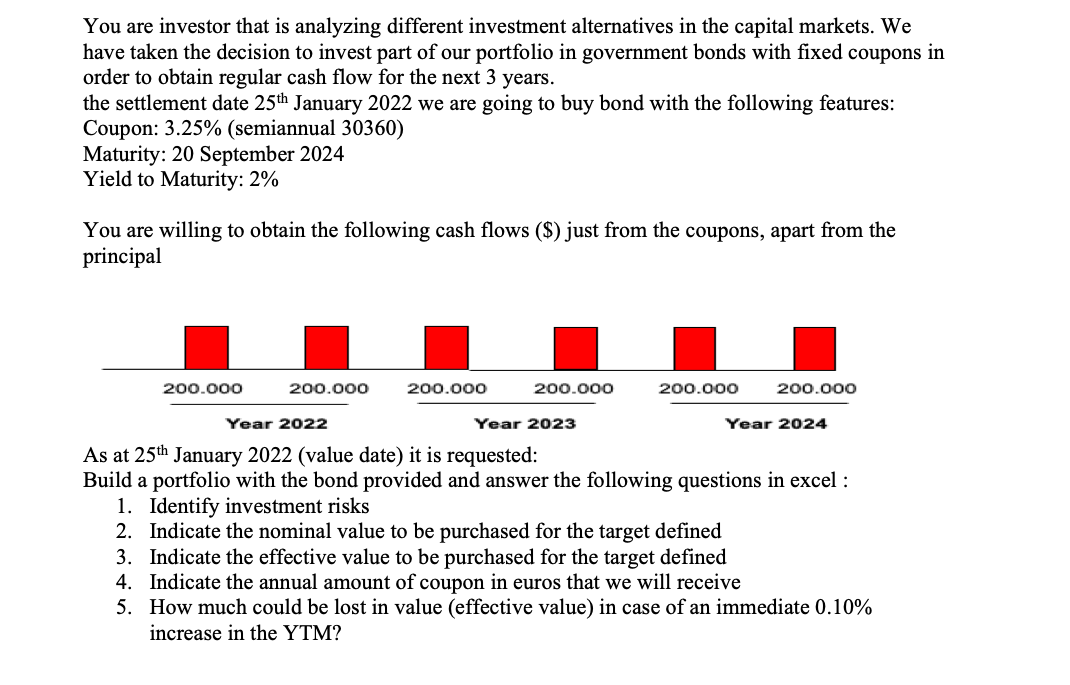

You are investor that is analyzing different investment alternatives in the capital markets. We have taken the decision to invest part of our portfolio in government bonds with fixed coupons in order to obtain regular cash flow for the next 3 years. the settlement date 25th January 2022 we are going to buy bond with the following features: Coupon: 3.25% (semiannual 30360) Maturity: 20 September 2024 Yield to Maturity: 2% You are willing to obtain the following cash flows ($) just from the coupons, apart from the principal 200.000 200.000 200.000 200.000 200.000 200.000 Year 2022 Year 2023 Year 2024 As at 25th January 2022 (value date) it is requested: Build a portfolio with the bond provided and answer the following questions in excel : 1. Identify investment risks 2. Indicate the nominal value to be purchased for the target defined 3. Indicate the effective value to be purchased for the target defined 4. Indicate the annual amount of coupon in euros that we will receive 5. How much could be lost in value (effective value) in case of an immediate 0.10% increase in the YTM? You are investor that is analyzing different investment alternatives in the capital markets. We have taken the decision to invest part of our portfolio in government bonds with fixed coupons in order to obtain regular cash flow for the next 3 years. the settlement date 25th January 2022 we are going to buy bond with the following features: Coupon: 3.25% (semiannual 30360) Maturity: 20 September 2024 Yield to Maturity: 2% You are willing to obtain the following cash flows ($) just from the coupons, apart from the principal 200.000 200.000 200.000 200.000 200.000 200.000 Year 2022 Year 2023 Year 2024 As at 25th January 2022 (value date) it is requested: Build a portfolio with the bond provided and answer the following questions in excel : 1. Identify investment risks 2. Indicate the nominal value to be purchased for the target defined 3. Indicate the effective value to be purchased for the target defined 4. Indicate the annual amount of coupon in euros that we will receive 5. How much could be lost in value (effective value) in case of an immediate 0.10% increase in the YTM