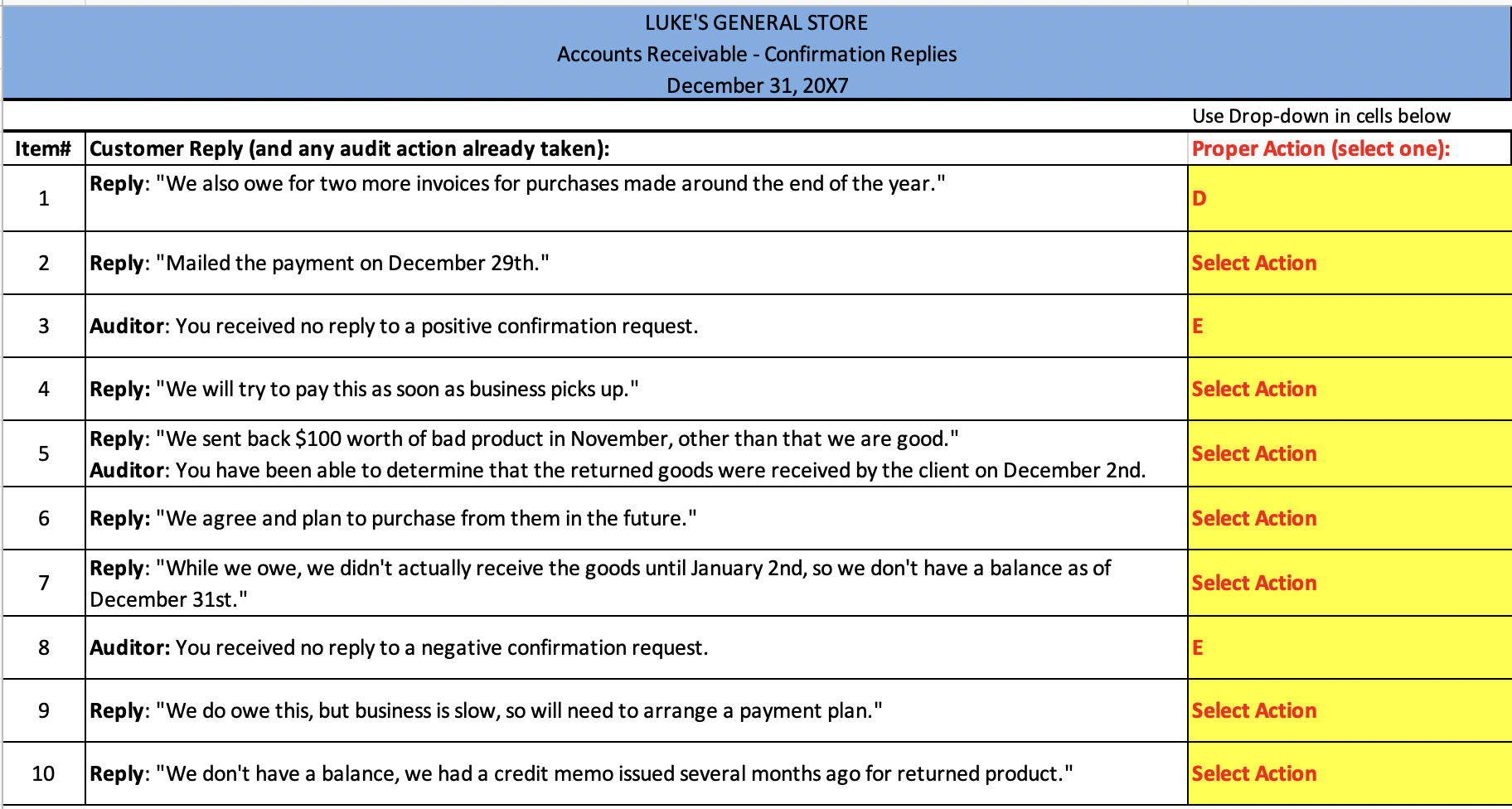

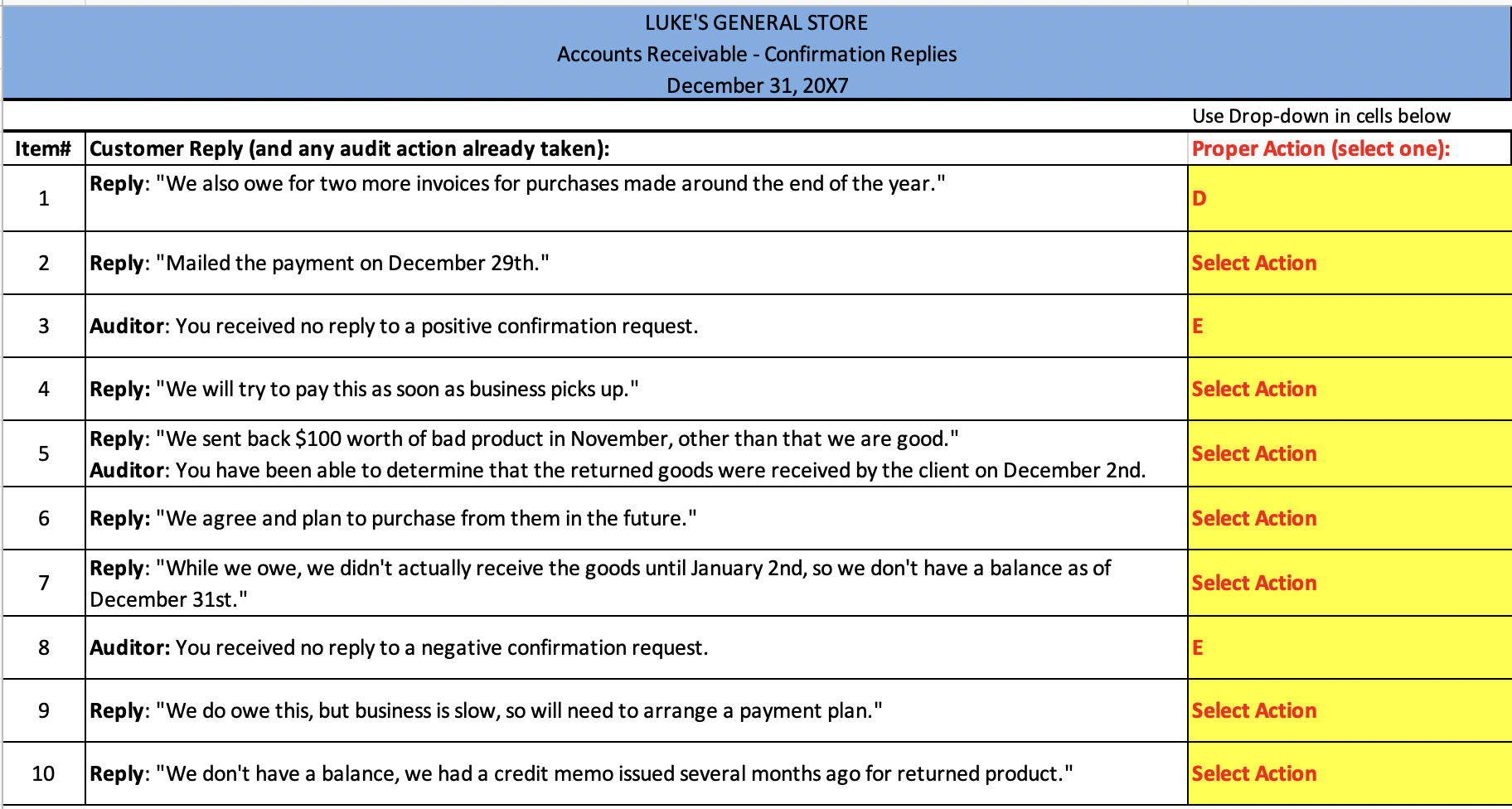

You are involved with the audit of Luke's General Store and have been asked to consider the confirmation reply results indicated above. For each confirmation reply above, select the proper action to be taken from the list of possible actions.

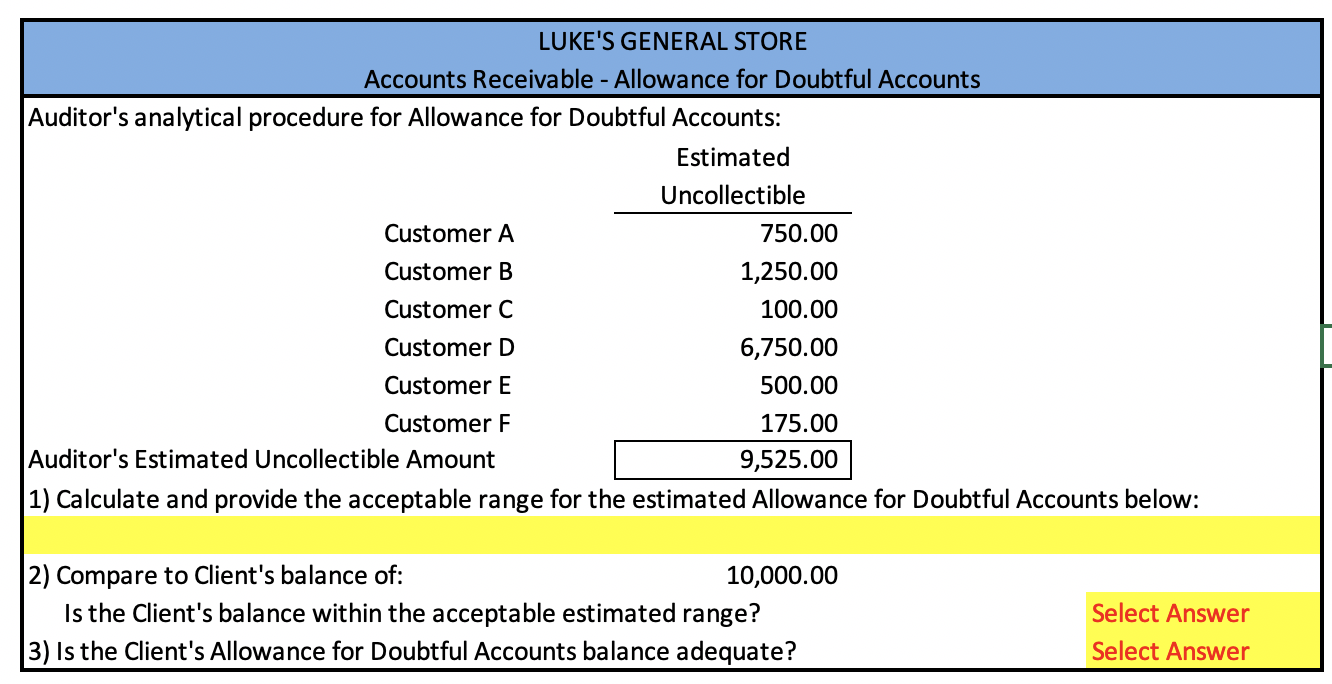

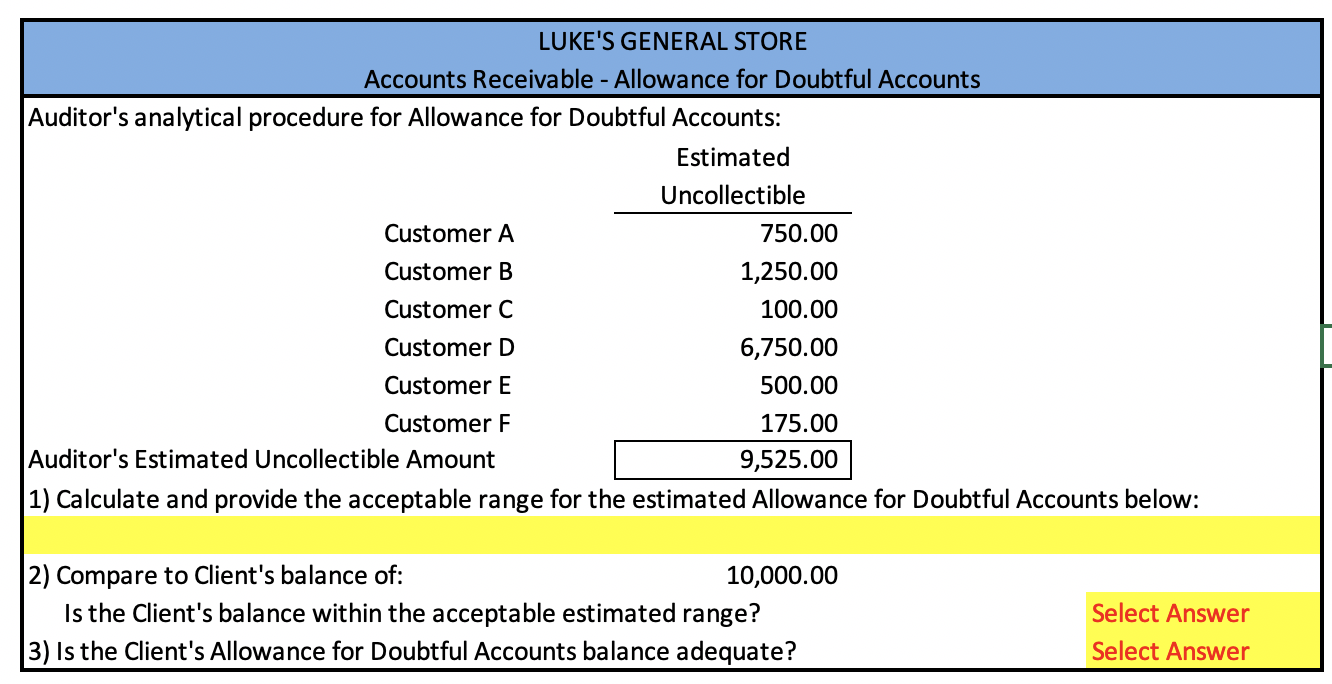

For the estimated Allowance for Doubtful Accounts to determine if it is adequate, complete the analytical procedure on the right. 1) Show your calculation for the acceptable range (use +/- 5%) 2) Compare the client's balance to the acceptable range and select Yes (within the range) or No (not within the range) 3) Determine if the client's allowance is adequate and select Yes or No.

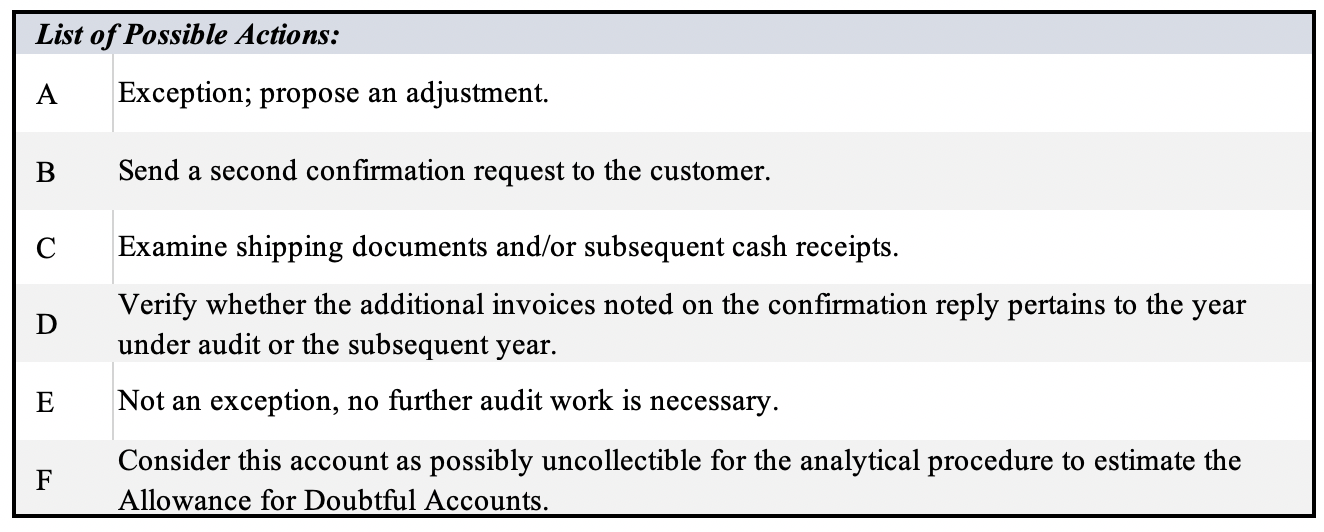

7 Instructions: 8 You are involved with the audit of Luke's General Store and have been asked to consider the confirmation reply results indicated above. For each confirmation 9 reply above, select the proper action to be taken from the list of possible actions. 0 1 For the estimated Allowance for Doubtful Accounts to determine if it is adequate, complete the analytical procedure on the right. 2 | 1) Show your calculation for the acceptable range (use +/- 5%) 3 2) Compare the client's balance to the acceptable range and select Yes (within the range) or No (not within the range) 4 3) Determine if the client's allowance is adequate and select Yes or No. 5 LUKE'S GENERAL STORE Accounts Receivable - Confirmation Replies December 31, 20X7 Use Drop-down in cells below Proper Action (select one): Item# Customer Reply (and any audit action already taken): Reply: "We also owe for two more invoices for purchases made around the end of the year." 1 D 2 Reply: "Mailed the payment on December 29th." Select Action 3 Auditor: You received no reply to a positive confirmation request. E 4 Reply: "We will try to pay this as soon as business picks up." Select Action 5 Reply: "We sent back $100 worth of bad product in November, other than that we are good." Auditor: You have been able to determine that the returned goods were received by the client on December 2nd. Select Action 6 Reply: "We agree and plan to purchase from them in the future." Select Action 7 Reply: "While we owe, we didn't actually receive the goods until January 2nd, so we don't have a balance as of December 31st." Select Action 8 Auditor: You received no reply to a negative confirmation request. E 9 Reply: "We do owe this, but business is slow, so will need to arrange a payment plan." Select Action 10 Reply: "We don't have a balance, we had a credit memo issued several months ago for returned product." Select Action List of Possible Actions: A Exception; propose an adjustment. B Send a second confirmation request to the customer. D Examine shipping documents and/or subsequent cash receipts. Verify whether the additional invoices noted on the confirmation reply pertains to the year under audit or the subsequent year. Not an exception, no further audit work is necessary. E dure to estimate the F Consider this account as possibly uncollectible for the analytical Allowance for Doubtful Accounts. LUKE'S GENERAL STORE Accounts Receivable - Allowance for Doubtful Accounts Auditor's analytical procedure for Allowance for Doubtful Accounts: Estimated Uncollectible Customer A 750.00 Customer B 1,250.00 Customer C 100.00 Customer D 6,750.00 Customer E 500.00 Customer F 175.00 Auditor's Estimated Uncollectible Amount 9,525.00 1) Calculate and provide the acceptable range for the estimated Allowance for Doubtful Accounts below: 2) Compare to Client's balance of: 10,000.00 Is the Client's balance within the acceptable estimated range? 3) Is the Client's Allowance for Doubtful Accounts balance adequate? Select Answer Select