Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are just 25 years old and you have $50,000 in your retirement saving accounts. You expect to retire at the age of 65

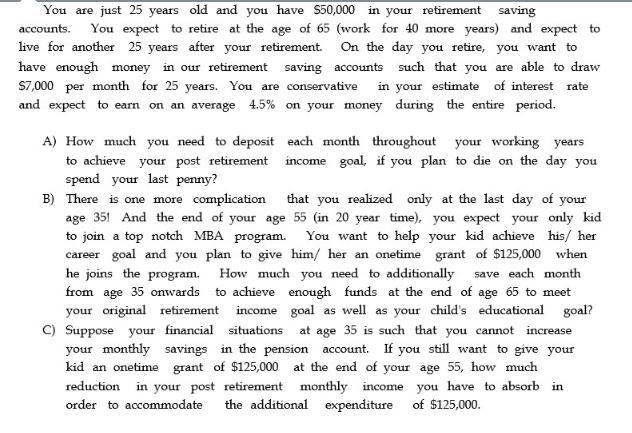

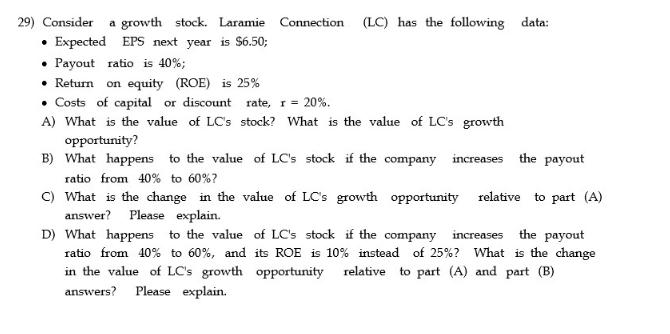

You are just 25 years old and you have $50,000 in your retirement saving accounts. You expect to retire at the age of 65 (work for 40 more years) and expect to live for another 25 years after your retirement. On the day you retire, you want to have enough money in our retirement saving accounts such that you are able to draw $7,000 per month for 25 years. You are conservative in your estimate of interest rate and expect to earn on an average 4.5% on your money during the entire period. A) How much you need to deposit to achieve your post retirement spend your last penny? B) There is one more complication that you realized only at the last day of your age 35! And the end of your age 55 (in 20 year time), you expect your only kid to join a top notch MBA program. You want to help your kid achieve his/her career goal and you plan to give him/ her an onetime grant of $125,000 when he joins the program. How much you need to additionally save each month from age 35 onwards to achieve enough funds at the end of age 65 to meet your original retirement income goal as well as your child's educational goal? C) Suppose your financial situations at age 35 is such that you cannot increase your monthly savings in the pension account. If you still want to give your kid an onetime grant of $125,000 at the end of your age 55, how much reduction in your post retirement monthly income order to accommodate the additional expenditure you have to absorb in of $125,000. each month throughout your working years income goal, if you plan to die on the day you 29) Consider a growth stock. Laramie Connection (LC) has the following data: Expected EPS next year is $6.50; Payout ratio is 40%; Return on equity (ROE) is 25% Costs of capital or discount rate, r = 20 %. A) What is the value of LC's stock? What is the value of LC's growth opportunity? the payout B) What happens to the value of LC's stock if the company increases ratio from 40% to 60%? C) What is the change in the value of LC's growth opportunity relative to part (A) answer? Please explain. the payout D) What happens to the value of LC's stock if the company increases ratio from 40% to 60%, and its ROE is 10% instead of 25%? What is the change in the value of LC's growth opportunity relative to part (A) and part (B) answers? Please explain.

Step by Step Solution

★★★★★

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

A To calculate the monthly deposit required to achieve the postretirement income goal we can use the future value of an annuity formula The future value of an annuity can be calculated using the follo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started