Question

You are looking to launch a new hotel chain, Roxy. To launch Roxy you are expected to invest $500nmillion this year (year = 0). You

You are looking to launch a new hotel chain, Roxy.

To launch Roxy you are expected to invest $500nmillion this year (year = 0). You are then expected to generate free cash flows of $27 million a year starting in year 1. From then, these cash flows are expected to grow 3% per year in perpetuity. Assume these cash flows are received at the end of each year.

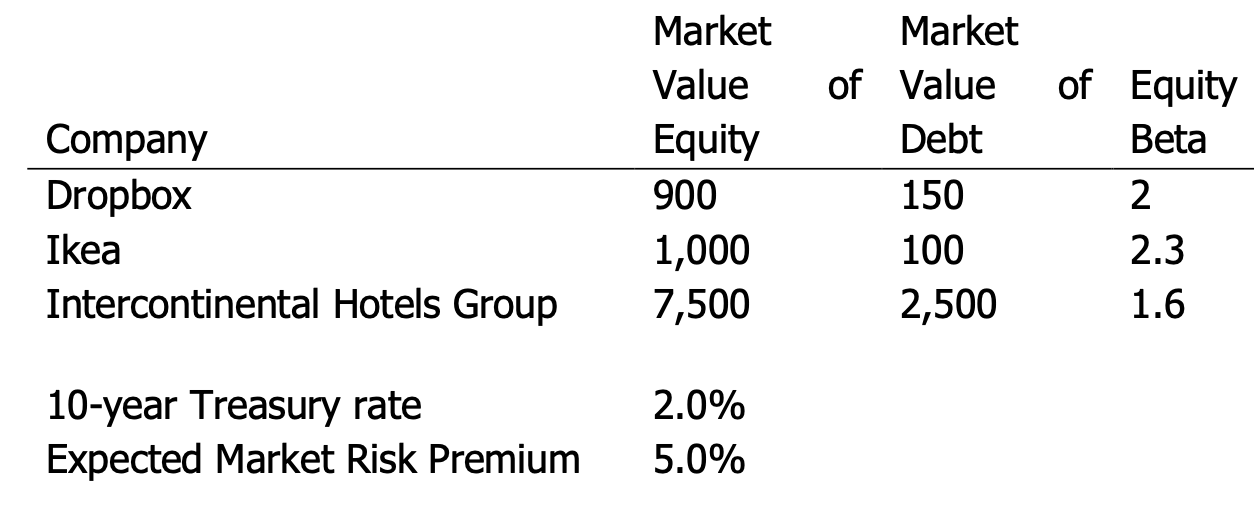

Here are reports of publicly traded firms, and the expected returns on the government bond (treasury) and the risk premium on the value-weighted market portfolio:

Assume CAPM holds for all assets, and the debt of Dropbox, Ikea and Intercontinental Hotels Group is risk free. None of these firms hold excess cash assets.

Assume now that Roxy is financed instead with a debt to value ratio of 25%, and this leverage ratio is not expected to change. Assume that the debt issued is risk free and there are no frictions in financial markets.

Answer the following questions:

a) Calculate Roxys WACC with leverage?

b) Calculate Roxys ROE with leverage?

c) Calculate the value of Roxy with leverage?

Company Dropbox Ikea Intercontinental Hotels Group Market Value Equity 900 1,000 7,500 Market of Value Debt 150 100 2,500 of Equity Beta 2 2.3 1.6 10-year Treasury rate Expected Market Risk Premium 2.0% 5.0% Company Dropbox Ikea Intercontinental Hotels Group Market Value Equity 900 1,000 7,500 Market of Value Debt 150 100 2,500 of Equity Beta 2 2.3 1.6 10-year Treasury rate Expected Market Risk Premium 2.0% 5.0%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started