Question

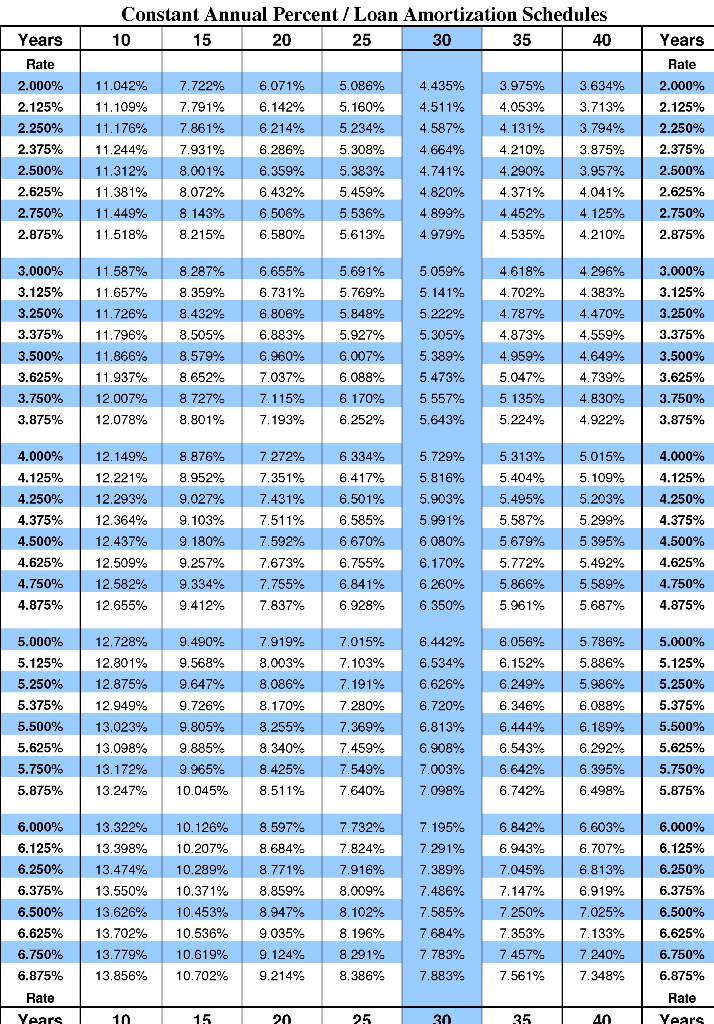

You are looking to purchase a new home. You are talking to a lender about a 3.625% interest rate loan for 30 years that amortizes

You are looking to purchase a new home. You are talking to a lender about a 3.625% interest rate loan for 30 years that amortizes monthly.

What is your mortgage constant?

1 How to enter your answer? Let's say your calculated answer is 0.02759. That is the same thing as 2.759% so you should enter 2.759 as your final answer. Decimals matter for mortgage constants, interest rates, and cap rates, so don't round this example to 2.8. You need to keep at east two decimal places.

2.

You are looking to purchase a home. You have agreed to a price and are now discussing loan terms with a lender. The mortgage amount is $540,000. If the loan constant is 5.729%, how much is your monthly debt service?

3.

You want to buy a house and wonder what you can afford. Banks look at collateral, creditworthiness and capacity (ability to pay) when making loans. Assume you have sufficient down payment and credit score. Your bank has a requirement of 28% housing expense ratio and your gross annual income is $69,000.

Based on those assumptions, how much can you afford to pay in total housing costs each month?

Keep note of this amount as you will need it for reference in a later question.

4

You are looking to purchase a new home that is listed at $316,000. You intend to make an offer to buy this house at the full listed price. You have saved enough to make a 20% down payment, so the loan amount will be 80% of the purchase price. You are talking to a lender about a 30-year, fixed rate, amortizing loan. The mortgage constant is 0.05389. What is the amount of your monthly debt service?

5.

Lenders look at PITI, which is Principal, Interest, Taxes, and Insurance. You calculated debt service (Principal and Interest) in the previous question. Now assume that property taxes are $2,400 per year and insurance is $60 per month. Based on these assumptions and the debt service amount you calculated in the previous question, what is your total monthly PITI?

Please show work, Thank you

Constant Annual Percent/Loan Amortization Schedules 10 15 20 25 30 35 40 Years Years 40 Rate 2.000% 2.125% 2.250% 2.375% 2.500% 2.625% 2.750% 2.875% 11.042% 11.109% 11.176% 11.244% 11.312% 11.381% 11.449% 11.518% 7.722% 7.791% 7.861% 7.931% 8.001% 8.072% 8.143% 8.215% 6.071% 6.142% 6.214% 6.286% 6.359% 6.432% 6.506% 6.580% 5.086% 5.160% 5.234% 5.308% 5.383% 5.459% 5.536% 5.613% 4.435% 4.511% 4.587% 4.664% 4.741% 4.820% 4.899% 4.979% 3.975% 4.053% 4.131% 4.210% 4.290% 4.371% 4.452% 4.535% 3.634% 3.713% 3.794% 3.875% 3.957% 4.041% 4.125% 4.210% Rate 2.000% 2.125% 2.250% 2.375% 2.500% 2.625% 2.750% 2.875% 3.000% 3.125% 3.250% 3.375% 3.500% 3.625% 3.750% 3.875% 11.587% 11.657% 11.726% 11.796% 11.866% 11.937% 12.007% 12.078% 8.287% 8.359% 8.432% 8.505% 8.579% 8.652% 8.727% 8.801% 6.655% 6.731% 6.806% 6.883% 6.960% 7.037% 7.115% 7.193% 5.691% 5.769% 5.848% 5.927% 6.007% 6.088% 6.170% 6.252% 5.059% 5.141% 5.222% 5.305% 5.389% 5.473% 5.557% 5.643% 4.618% 4.702% 4.787% 4.873% 4.959% 5.047% 5.135% 5.224% 4.296% 4.383% 4.470% 4.559% 4.649% 4.739% 4.830% 4.922% 3.000% 3.125% 3.250% 3.375% 3.500% 3.625% 3.750% 3.875% 4.000% 4.125% 4.250% 4.375% 4.500% 4.625% 4.750% 4.875% 12.149% 12.221% 12.293% 12.364% 12.437% 12.509% 12.582% 12.655% 8.876% 8.952% 9.027% 9.103% 9.180% 9.257% 9.334% 9.412% 7.272% 7.351% 7.431% 7.511% 7.592% 7.673% 7.755% 7.837% 6.334% 6.417% 6.501% 6.585% 6.670% 6.755% 6.841% 6.928% 5.729% 5.816% 5.903% 5.991% 6.080% 6.170% 6.260% 6.350% 5.313% 5.404% 5.495% 5.587% 5.679% 5.772% 5.866% 5.961% 5.015% 5. 109% 5.203% 5.299% 5.395% 5.492% 5.589% 5.687% 4.000% 4.125% 4.250% 4.375% 4.500% 4.625% 4.750% 4.875% 5.000% 5.125% 5.250% 5.375% 5.500% 5.625% 5.750% 5.875% 12.728% 12.801% 12.875% 12.949% 13.023% 13.098% 13.172% 13.247% 9.490% 9.568% 9.647% 9.726% 9.805% 9.885% 9.965% 10.045% 7.919% 8.003% 8.086% 8.170% 8.255% 8.340% 8.425% 8.511% 7.015% 7.103% 7.191% 7.280% 7.369% 7.459% 7.549% 7.640% 6.442% 6.534% 6.626% 6.720% 6.813% 6.908% 7.003% 7.098% 6.056% 6.152% 6.249% 6.346% 6.444% 6.543% 6.642% 6.742% 5.786% 5.886% 5.986% 6.088% 6.189% 6.292% 6.395% 6.49% 5.000% 5.125% 5.250% 5.375% 5.500% 5.625% 5.750% 5.875% 6.000% 6.125% 6.250% 6.375% 6.500% 6.625% 6.750% 6.875% Rate Years 13.322% 13.398% 13.474% 13.550% 13.626% 13.702% 13.779% 13.856% 10.126% 10.207% 10.289% 10.371% 10.453% 10.536% 10.619% 10.702% 8.597% 8.684% 8.771% 8.859% 8.947% 9.035% 9.124% 9.214% 7.732% 7.824% 7.916% 8.009% 8.102% 8.196% 8.291% 8.386% 7.195% 7.291% 7.389% 7.486% 7.585% 7.684% 7.783% 7.883% 6.842% 6.943% 7.045% 7.147% 7.250% 7.353% 7.457% 7.561% 6.603% 6.707% 6.813% 6.919% 7.025% 7.133% 7.240% 7.348% 6.000% 6.125% 6.250% 6.375% 6.500% 6.625% 6.750% 6.875% Rate 10 15 20 25 30 35 40 YearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started