Question

You are making a $120,000 investment and feel that a 22% rate of return is reasonable, given the nature of the risks involved. You

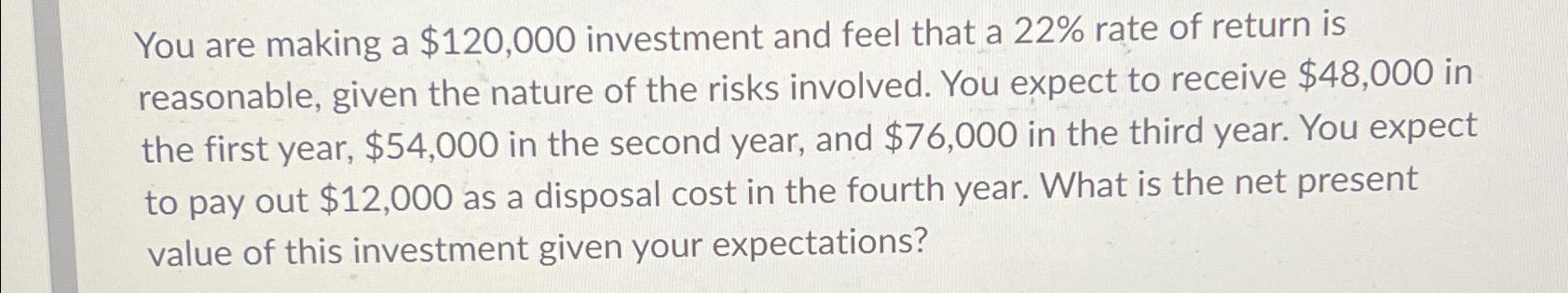

You are making a $120,000 investment and feel that a 22% rate of return is reasonable, given the nature of the risks involved. You expect to receive $48,000 in the first year, $54,000 in the second year, and $76,000 in the third year. You expect to pay out $12,000 as a disposal cost in the fourth year. What is the net present value of this investment given your expectations?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the net present value NPV of the investment w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Analysis with Microsoft Excel

Authors: Timothy R. Mayes, Todd M. Shank

7th edition

1285432274, 978-1305535596, 1305535596, 978-1285432274

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App