Question

You are managing a $525 million stock fund and have decided to hedge against a possible market crash using S&P 500 index futures contract

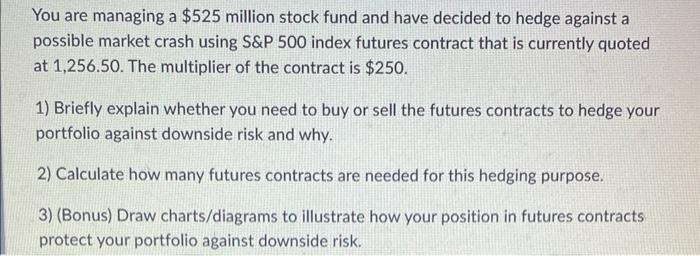

You are managing a $525 million stock fund and have decided to hedge against a possible market crash using S&P 500 index futures contract that is currently quoted at 1,256.50. The multiplier of the contract is $250. 1) Briefly explain whether you need to buy or sell the futures contracts to hedge your portfolio against downside risk and why. 2) Calculate how many futures contracts are needed for this hedging purpose. 3) (Bonus) Draw charts/diagrams to illustrate how your position in futures contracts protect your portfolio against downside risk.

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 To hedge against a possible market crash you would need to buy the SP 500 index futures contracts ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Investing

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk

12th edition

978-0133075403, 133075354, 9780133423938, 133075400, 013342393X, 978-0133075359

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App