Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are modeling a potential M&A transaction. Which of the following would NOT be a positive adjustment to the Acquirer's Pro forma Assets? 1. Cash

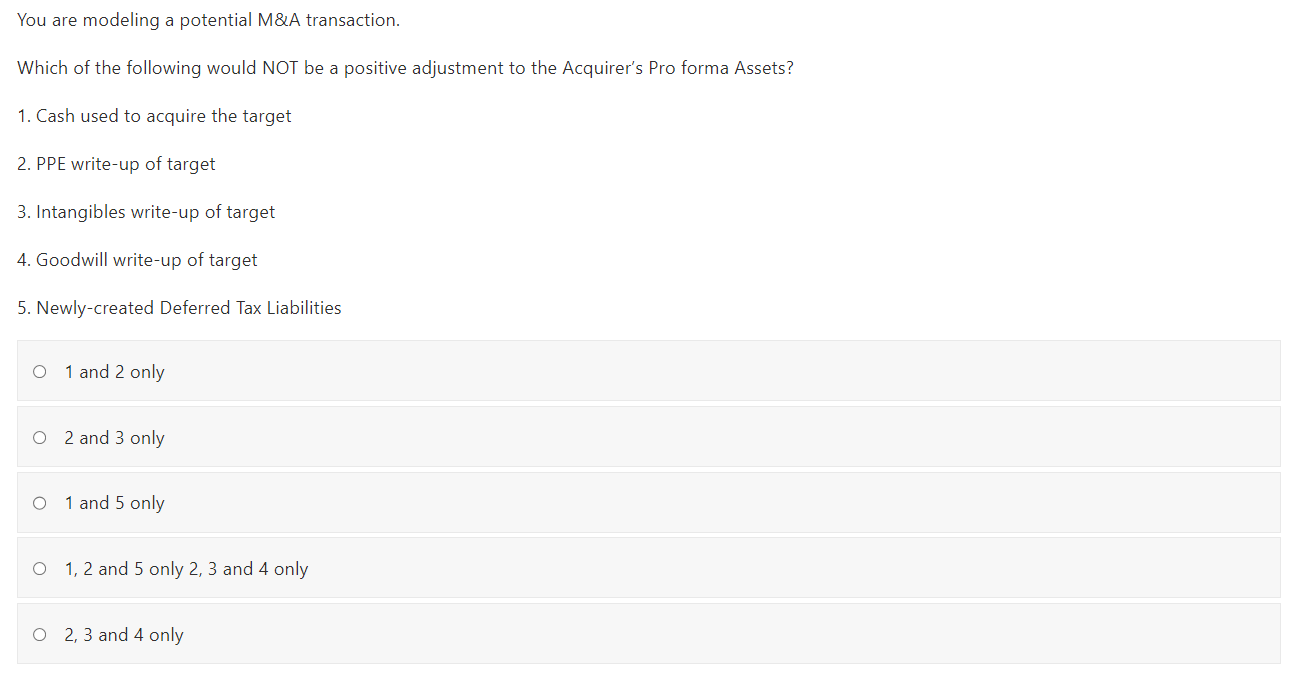

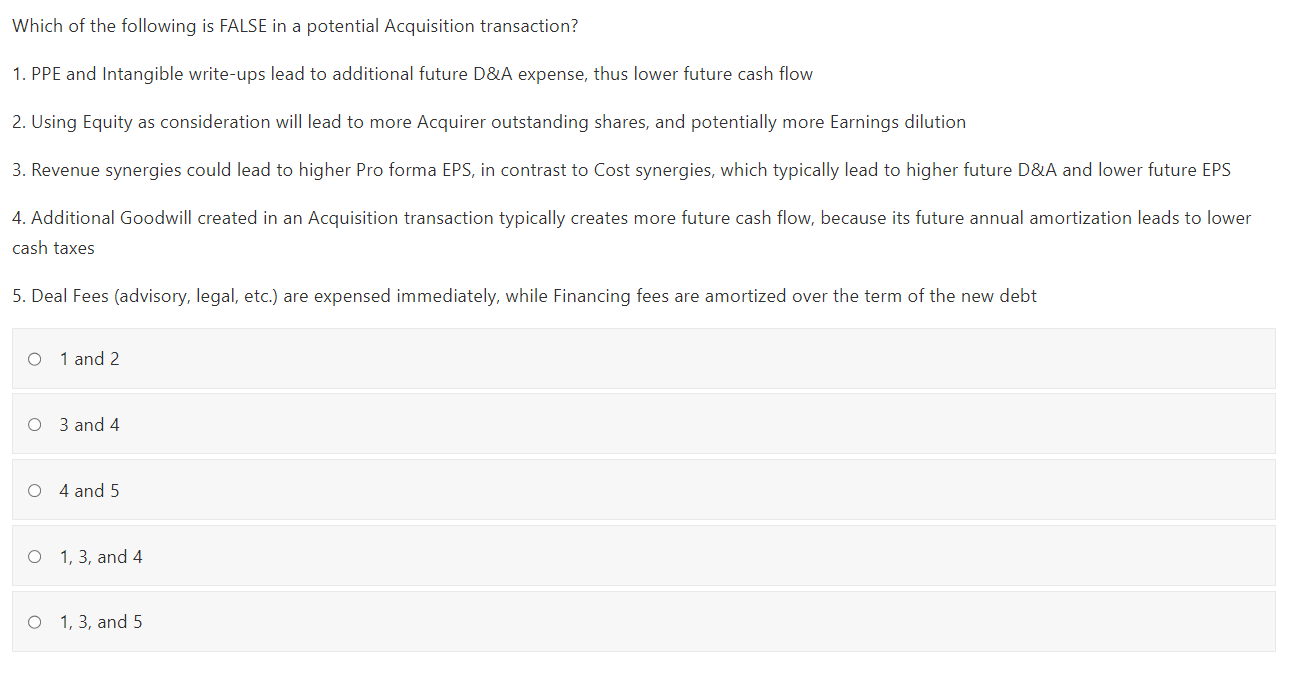

You are modeling a potential M\&A transaction. Which of the following would NOT be a positive adjustment to the Acquirer's Pro forma Assets? 1. Cash used to acquire the target 2. PPE write-up of target 3. Intangibles write-up of target 4. Goodwill write-up of target 5. Newly-created Deferred Tax Liabilities 1 and 2 only 2 and 3 only 1 and 5 only 1,2 and 5 only 2,3 and 4 only 2, 3 and 4 only Which of the following is FALSE in a potential Acquisition transaction? 1. PPE and Intangible write-ups lead to additional future D\&A expense, thus lower future cash flow 2. Using Equity as consideration will lead to more Acquirer outstanding shares, and potentially more Earnings dilution 3. Revenue synergies could lead to higher Pro forma EPS, in contrast to Cost synergies, which typically lead to higher future D\&A and lower future EPS 4. Additional Goodwill created in an Acquisition transaction typically creates more future cash flow, because its future annual amortization leads to lower cash taxes 5. Deal Fees (advisory, legal, etc.) are expensed immediately, while Financing fees are amortized over the term of the new debt 1 and 2 3 and 4 4 and 5 1,3 , and 4 1,3 , and 5

You are modeling a potential M\&A transaction. Which of the following would NOT be a positive adjustment to the Acquirer's Pro forma Assets? 1. Cash used to acquire the target 2. PPE write-up of target 3. Intangibles write-up of target 4. Goodwill write-up of target 5. Newly-created Deferred Tax Liabilities 1 and 2 only 2 and 3 only 1 and 5 only 1,2 and 5 only 2,3 and 4 only 2, 3 and 4 only Which of the following is FALSE in a potential Acquisition transaction? 1. PPE and Intangible write-ups lead to additional future D\&A expense, thus lower future cash flow 2. Using Equity as consideration will lead to more Acquirer outstanding shares, and potentially more Earnings dilution 3. Revenue synergies could lead to higher Pro forma EPS, in contrast to Cost synergies, which typically lead to higher future D\&A and lower future EPS 4. Additional Goodwill created in an Acquisition transaction typically creates more future cash flow, because its future annual amortization leads to lower cash taxes 5. Deal Fees (advisory, legal, etc.) are expensed immediately, while Financing fees are amortized over the term of the new debt 1 and 2 3 and 4 4 and 5 1,3 , and 4 1,3 , and 5 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started