Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are offered the following five projects: Alpha, Bravo, Charlie, Delta, and Echo. Each project involves an initial investment today (Year 0) and generates

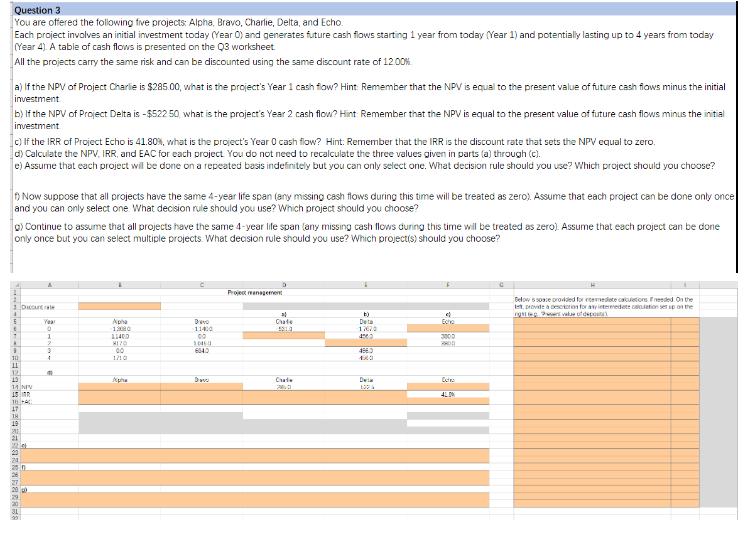

You are offered the following five projects: Alpha, Bravo, Charlie, Delta, and Echo. Each project involves an initial investment today (Year 0) and generates future cash flows starting 1 year from today (Year 1) and potentially lasting up to 4 years from today (Year 4) A table of cash flows is presented on the Q3 worksheet All the projects carry the same risk and can be discounted using the same discount rate of 12.00% a) If the NPV of Project Charlie is $285.00, what is the project's Year 1 cash flow? Hint: Remember that the NPV is equal to the present value of future cash flows minus the initial investment b) If the NPV of Project Delta is -$522 50 what is the project's Year 2 cash flow? Hint Remember that the NPV is equal to the present value of future cash flows minus the initial investment c) If the IRR of Project Echo is 41.80%, what is the project's Year 0 cash flow? Hint: Remember that the IRR is the discount rate that sets the NPV equal to zero. d) Calculate the NPV, IRR, and EAC for each project. You do not need to recalculate the three values given in parts (a) through (c). e) Assume that each project will be done on a repeated basis indefinitely but you can only select one. What decision rule should you use? Which project should you choose? Now suppose that all projects have the same 4-year life span (any missing cash flows during this time will be treated as zero). Assume that each project can be done only once and you can only select one What decision rule should you use? Which project should you choose? o) Continue to assume that all projects have the same 4-year life span (any missing cash flows during this time will be treated as zero). Assume that each project can be done only once but you can select multiple projects. What decision rule should you use? Which project(s) should you choose? 1 Dice 5 t 1 A 1 10 11 12 13 14 NIV 15 103+AC SERRAGENS Year UNHO 3 11 Apha 19020 11400 8170 00 1710 Apha C Devo 11400 00 10460 6040 Davo D Project management al Chate 5219. Chade 20 b) Det 17670 4002 486.3 Dwi 13 4 Echo 3000 2800 Extra 4100 Below space provided for commediate calculations needed. On the provide a description for any intermedete calculation set up on the value of dep ng

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started