Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are on the leadership team for a small business, XYZ Incorporated. After years of growth, sales have begun to stagnate over the last two

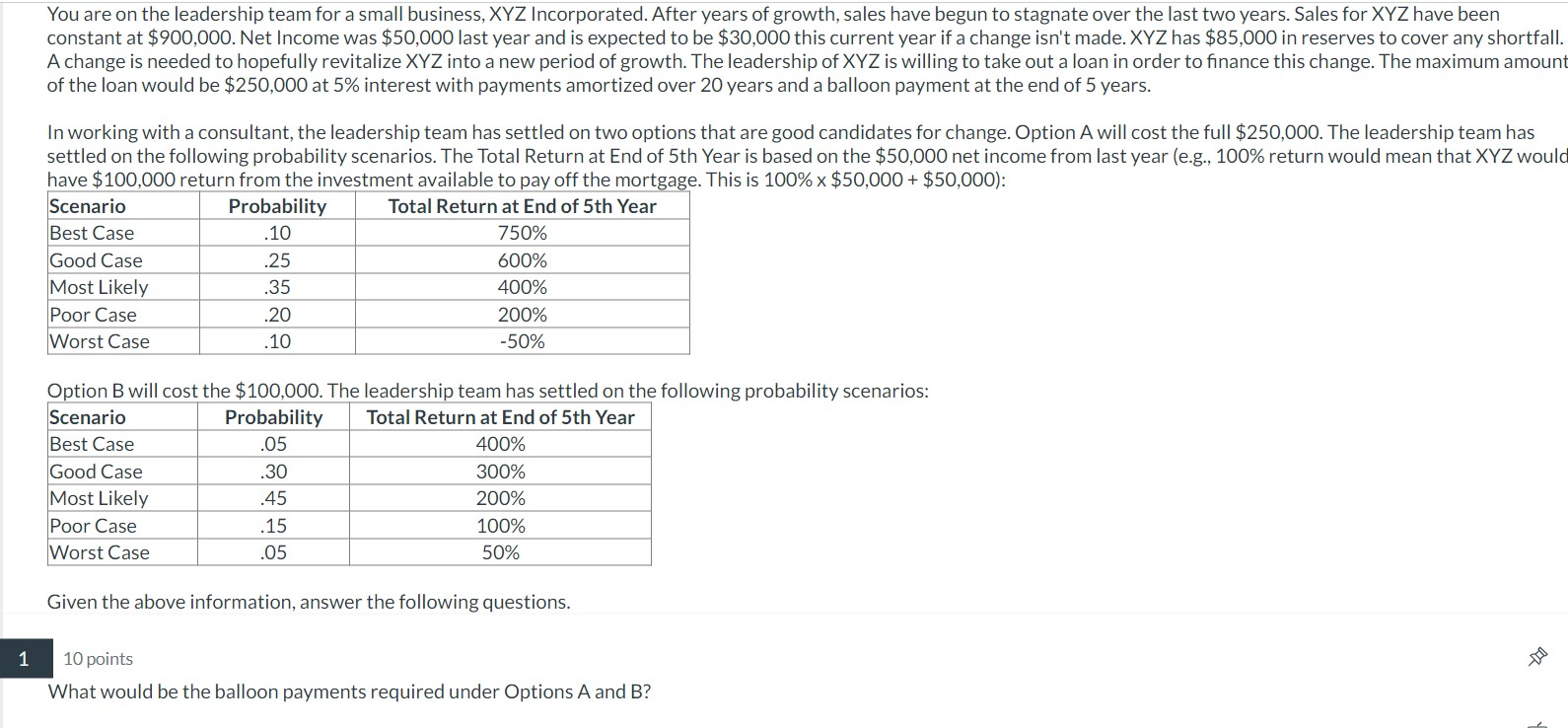

You are on the leadership team for a small business, XYZ Incorporated. After years of growth, sales have begun to stagnate over the last two years. Sales for XYZ have been constant at $900,000. Net Income was $50,000 last year and is expected to be $30,000 this current year if a change isn't made. XYZ has $85,000 in reserves to cover any shortfall. A change is needed to hopefully revitalize XYZ into a new period of growth. The leadership of XYZ is willing to take out a loan in order to finance this change. The maximum amount of the loan would be $250,000 at 5% interest with payments amortized over 20 years and a balloon payment at the end of 5 years. In working with a consultant, the leadership team has settled on two options that are good candidates for change. Option A will cost the full $250,000. The leadership team has settled on the following probability scenarios. The Total Return at End of 5th Year is based on the $50,000 net income from last year (e.g., 100% return would mean that XYZ woulc have $100.000 return from the investment available to pav off the mortgage. This is 100%$50,000+$50,000 ): Option B will cost the $100,000. The leadership team has settled on the following probability scenarios: Given the above information, answer the following questions. 10 points What would be the balloon payments required under Options A and B ? You are on the leadership team for a small business, XYZ Incorporated. After years of growth, sales have begun to stagnate over the last two years. Sales for XYZ have been constant at $900,000. Net Income was $50,000 last year and is expected to be $30,000 this current year if a change isn't made. XYZ has $85,000 in reserves to cover any shortfall. A change is needed to hopefully revitalize XYZ into a new period of growth. The leadership of XYZ is willing to take out a loan in order to finance this change. The maximum amount of the loan would be $250,000 at 5% interest with payments amortized over 20 years and a balloon payment at the end of 5 years. In working with a consultant, the leadership team has settled on two options that are good candidates for change. Option A will cost the full $250,000. The leadership team has settled on the following probability scenarios. The Total Return at End of 5th Year is based on the $50,000 net income from last year (e.g., 100% return would mean that XYZ woulc have $100.000 return from the investment available to pav off the mortgage. This is 100%$50,000+$50,000 ): Option B will cost the $100,000. The leadership team has settled on the following probability scenarios: Given the above information, answer the following questions. 10 points What would be the balloon payments required under Options A and B

You are on the leadership team for a small business, XYZ Incorporated. After years of growth, sales have begun to stagnate over the last two years. Sales for XYZ have been constant at $900,000. Net Income was $50,000 last year and is expected to be $30,000 this current year if a change isn't made. XYZ has $85,000 in reserves to cover any shortfall. A change is needed to hopefully revitalize XYZ into a new period of growth. The leadership of XYZ is willing to take out a loan in order to finance this change. The maximum amount of the loan would be $250,000 at 5% interest with payments amortized over 20 years and a balloon payment at the end of 5 years. In working with a consultant, the leadership team has settled on two options that are good candidates for change. Option A will cost the full $250,000. The leadership team has settled on the following probability scenarios. The Total Return at End of 5th Year is based on the $50,000 net income from last year (e.g., 100% return would mean that XYZ woulc have $100.000 return from the investment available to pav off the mortgage. This is 100%$50,000+$50,000 ): Option B will cost the $100,000. The leadership team has settled on the following probability scenarios: Given the above information, answer the following questions. 10 points What would be the balloon payments required under Options A and B ? You are on the leadership team for a small business, XYZ Incorporated. After years of growth, sales have begun to stagnate over the last two years. Sales for XYZ have been constant at $900,000. Net Income was $50,000 last year and is expected to be $30,000 this current year if a change isn't made. XYZ has $85,000 in reserves to cover any shortfall. A change is needed to hopefully revitalize XYZ into a new period of growth. The leadership of XYZ is willing to take out a loan in order to finance this change. The maximum amount of the loan would be $250,000 at 5% interest with payments amortized over 20 years and a balloon payment at the end of 5 years. In working with a consultant, the leadership team has settled on two options that are good candidates for change. Option A will cost the full $250,000. The leadership team has settled on the following probability scenarios. The Total Return at End of 5th Year is based on the $50,000 net income from last year (e.g., 100% return would mean that XYZ woulc have $100.000 return from the investment available to pav off the mortgage. This is 100%$50,000+$50,000 ): Option B will cost the $100,000. The leadership team has settled on the following probability scenarios: Given the above information, answer the following questions. 10 points What would be the balloon payments required under Options A and B Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started