Answered step by step

Verified Expert Solution

Question

1 Approved Answer

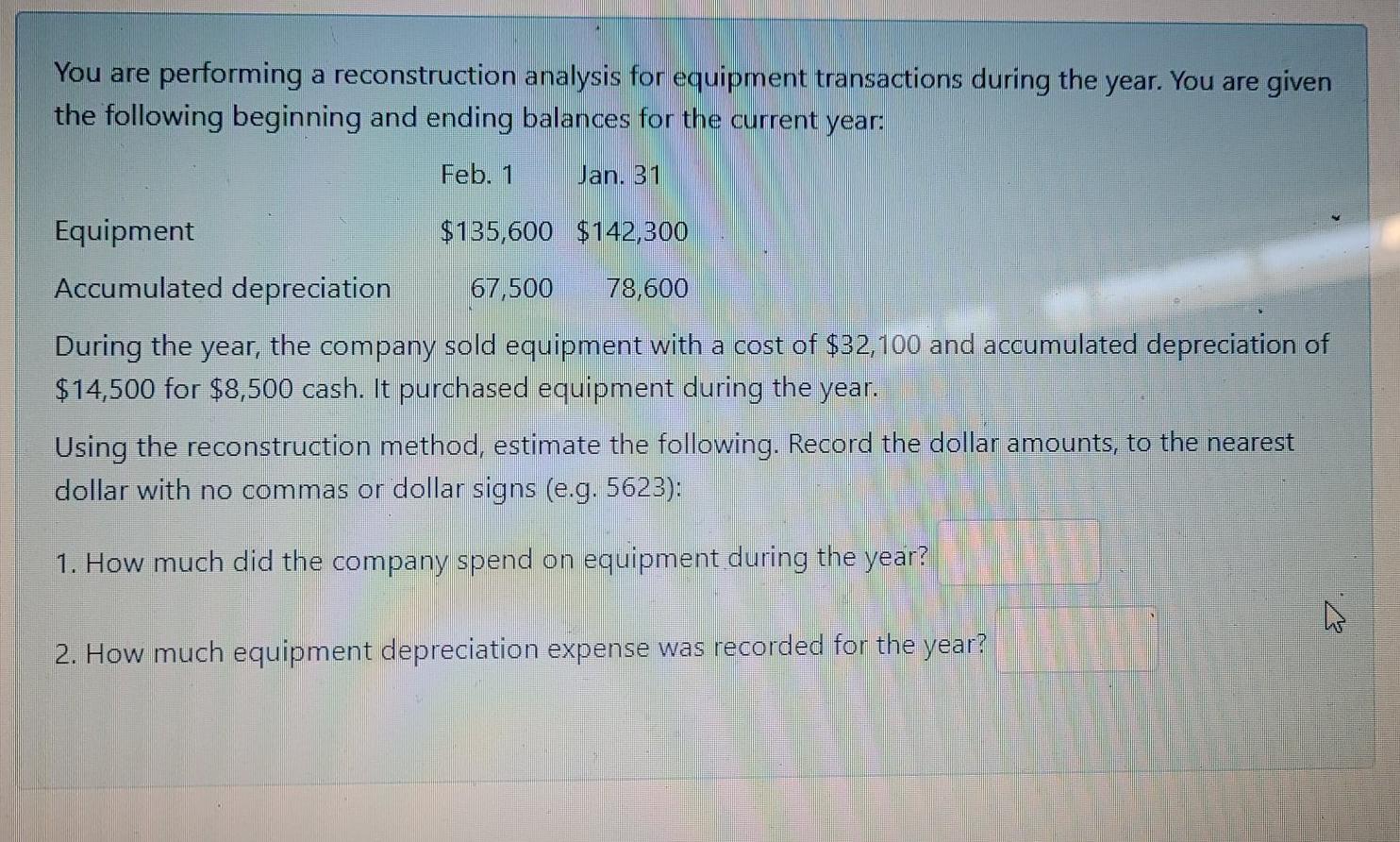

You are performing a reconstruction analysis for equipment transactions during the year. You are given the following beginning and ending balances for the current year.

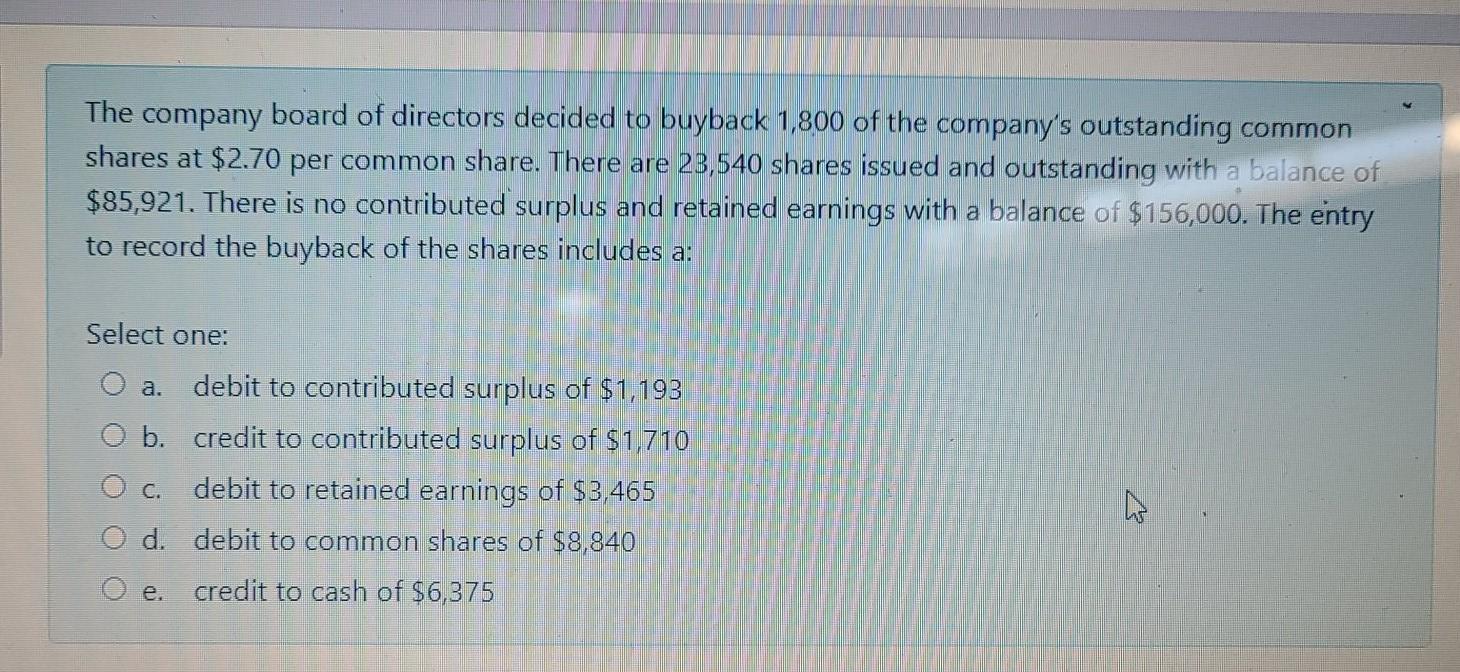

You are performing a reconstruction analysis for equipment transactions during the year. You are given the following beginning and ending balances for the current year. Feb. 1 Jan. 31 Equipment $135,600 $142,300 Accumulated depreciation 67,500 78,600 During the year, the company sold equipment with a cost of $32,100 and accumulated depreciation of $14,500 for $8,500 cash. It purchased equipment during the year. Using the reconstruction method, estimate the following. Record the dollar amounts, to the nearest dollar with no commas or dollar signs (e.g. 5623): 1. How much did the company spend on equipment during the year? 2. How much equipment depreciation expense was recorded for the year? The company board of directors decided to buyback 1,800 of the company's outstanding common shares at $2.70 per common share. There are 23,540 shares issued and outstanding with a balance of $85,921. There is no contributed surplus and retained earnings with a balance of $156,000. The entry to record the buyback of the shares includes a: a. Select one: debit to contributed surplus of $1,193 O b. credit to contributed surplus of $1,710 O c. debit to retained earnings of $3,465 O d. debit to common shares of $8,840 credit to cash of $6,375 e

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started