Question

You are performing the year-end audit of Halvorson Fine Foods, Inc. for December 31, 2018. The client has prepared the following schedule for the fixed

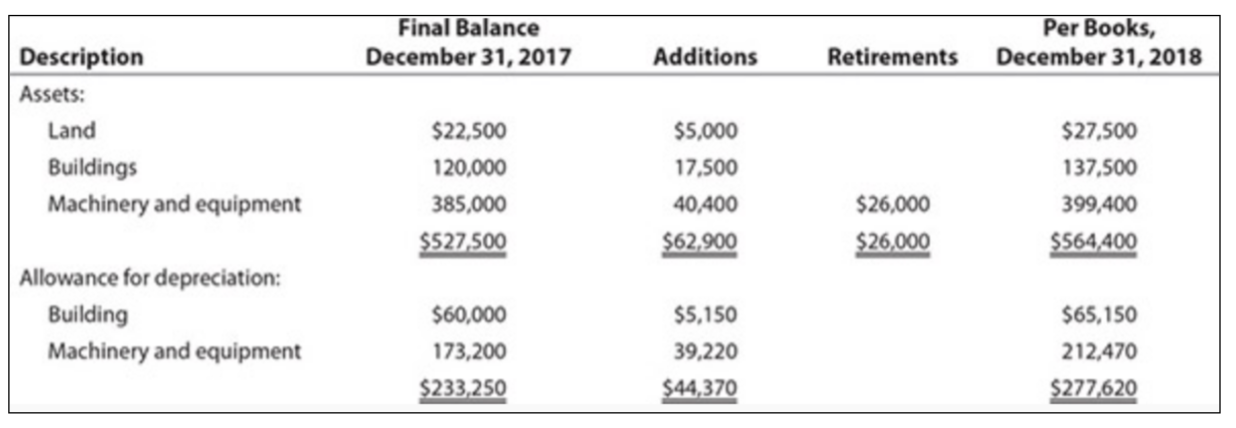

You are performing the year-end audit of Halvorson Fine Foods, Inc. for December 31, 2018. The client has prepared the following schedule for the fixed assets and related allowance for depreciation accounts.

You have compared the opening balances with your prior-year audit working papers. You find the following information, labeled as 1 through 6, during your current-year audit. Review this information and suggest what substantive procedures will be adopted.

1. All equipment is depreciated on a straight-line basis (no salvage value taken into consideration) based on the following estimated lives: buildings, 25 years; all other items, 10 years. The companys policy is to take one-half years depreciation on all asset acquisitions and disposals occurring during the year.

2. On April 1 of the current year, the company entered into a ten-year lease contract for a die-casting machine with annual rentals of $5,000, payable in advance every April 1. The lease is cancelable by either party (60 days written notice is required), and there is no option to renew the lease or buy the equipment at the end of the lease. The estimated useful life of the machine is ten years with no salvage value. The company recorded the die-casting machine in the machinery and equipment account at $40,400, the present value at the date of the lease, and $2,020, applicable to the machine, has been included in depreciation expense for the year.

3. The company completed the installment of machinery in the plant on June 30 of the current year. And the routine repair and maintenance expenses of $10,000 are capitalized to the cost of machinery.

4. The amount shown in the retirements column for the machinery and equipment asset represents cash received on September 5, on disposal of a machine purchased in July 2004 for $48,000. The bookkeeper recorded a depreciation expense of $3,500 on this machine in 2018.

Final Balance December 31, 2017 Additions Retirements Per Books, December 31, 2018 Description Assets: Land Buildings Machinery and equipment $5,000 $22,500 120,000 385,000 $527,500 17,500 40,400 $62,900 $26,000 $26,000 $27,500 137,500 399,400 $564,400 Allowance for depreciation: Building Machinery and equipment $5,150 $60,000 173,200 $233,250 39,220 $44,370 $65,150 212,470 $277,620

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started