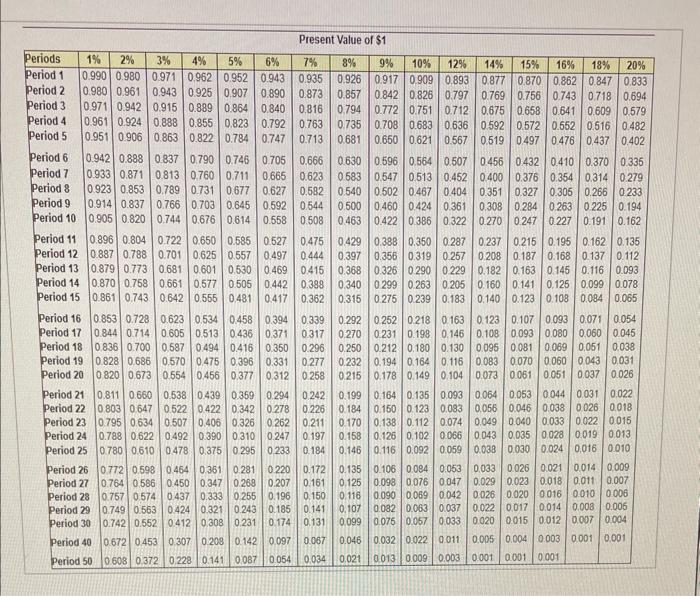

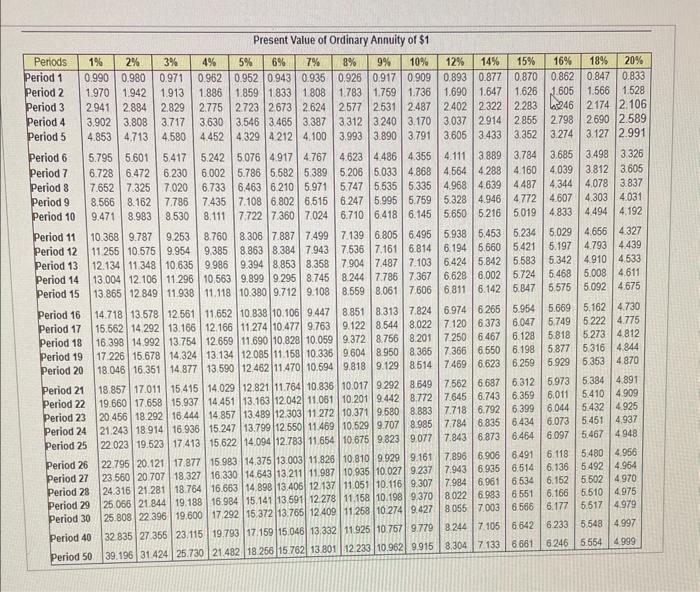

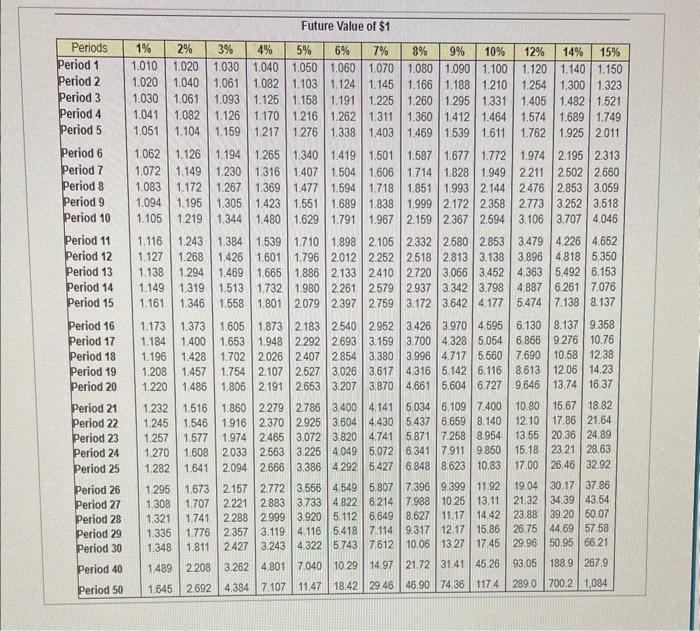

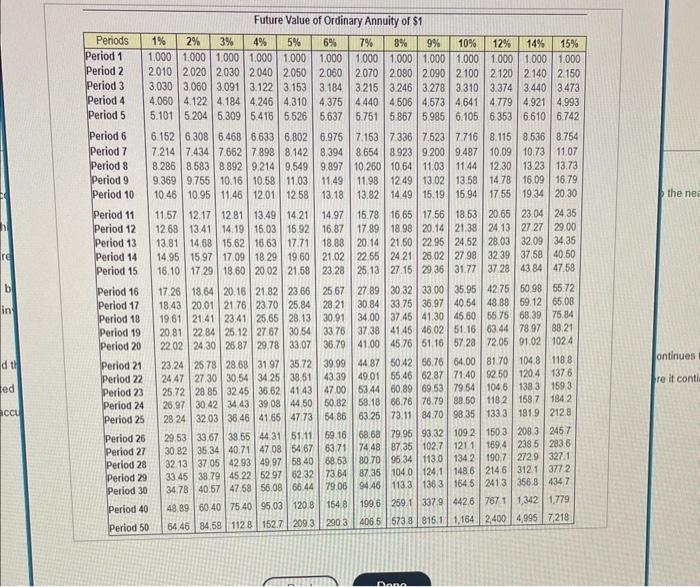

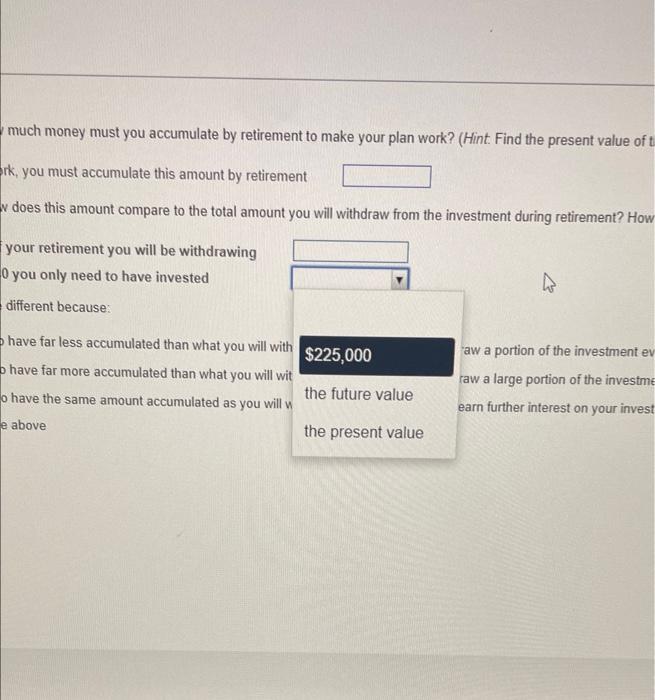

You are planning for a very early retirement. You would like to retire at age 40 and have enough money saved to be able to withdraw $225,000 per year for the next 40 years (based on family history, you think you will live to age 80 ). You plan to save by making 15 equal annual installments (from age 25 to age 40 ) into a fairly risky investment fund that you expect will eam 12% per year. You will leave the money in this fund until it is completely depleted when you are 80 years old (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of $1 table.) (Click the icon to view Future Value of Ordinary Annuity of $1 table.) Read the requirements Requirement 1. How much money must you accumulate by retirement to make your plan work? (Hint. Find the present value of the $225,000 withdrawals.) (Round your final answer to the nearest whole dollar.) To make the plan work, you must accumulate this amount by retirement Requirement 2. How does this amount compare to the total amount you will withdraw from the investment during retirement? How can these numbers be so different? Over the course of your retirement you will be withdrawing However, by age 40 you only need to have invested These numbers are different because: A. You need to have far less accumulated than what you will withdraw because you only withdraw a portion of the investment every year-the balance remains invested where it continues to earn 12% interest. B. You need to have far more accumulated than what you will withdraw because you will withdraw a large portion of the investment every year - the balance remains invested where it continues to eam 12% interest. C. You need to have the same amount accumulated as you will withdraw because you will not earn further interest on your investment when you reach retirement. D. None of the above Requirements 1. How much money must you accumulate by retirement to make your plan work? (Hint. Find the present value of the $225,000 withdrawals.) 2. How does this amount compare to the total amount you will withdraw from the investment during retirement? How can these numbers be so different? Drasent Value of \&1 Present Value of Ordinary Annuity of $1 Future Value of $1 Future Value of Ordinary Annuity of \$1 much money must you accumulate by retirement to make your plan work? (Hint. Find the present value of t rk, you must accumulate this amount by retirement W does this amount compare to the total amount you will withdraw from the investment during retirement? How your retirement you will be withdrawing 0 you only need to have invested different because: have far less accumulated than what you will with aw a portion of the investment ev have far more accumulated than what you will wit raw a large portion of the investme o have the same amount accumulated as you will 1 e above