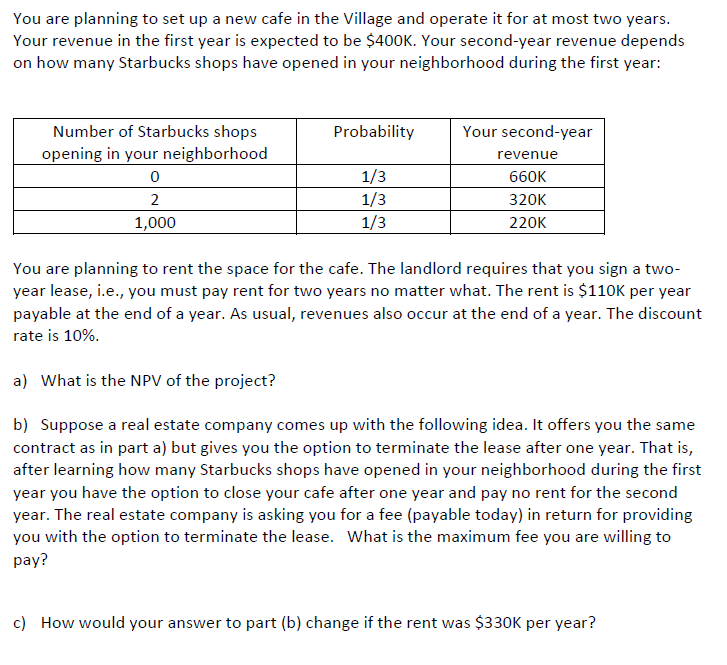

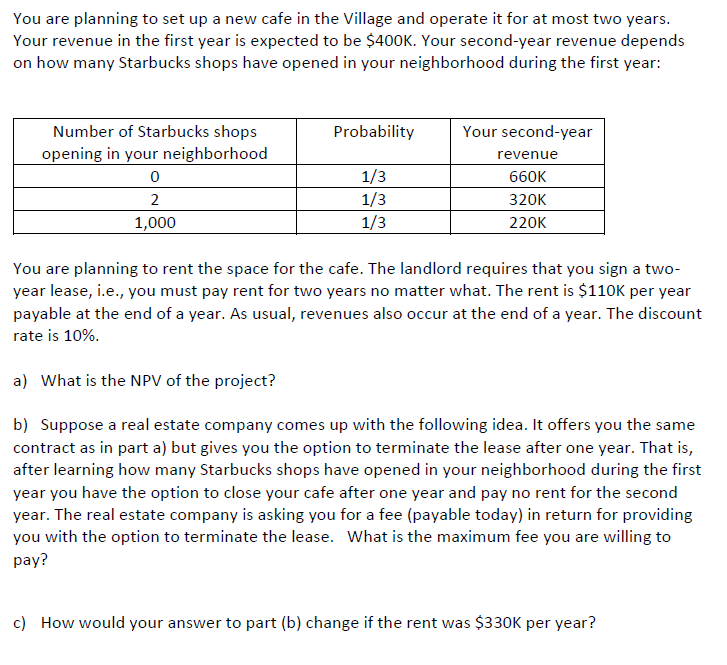

You are planning to set up a new cafe in the Village and operate it for at most two years. Your revenue in the first year is expected to be $400K. Your second-year revenue depends on how many Starbucks shops have opened in your neighborhood during the first year: You are planning to rent the space for the cafe. The landlord requires that you sign a twoyear lease, i.e., you must pay rent for two years no matter what. The rent is $110K per year payable at the end of a year. As usual, revenues also occur at the end of year. The discount rate is 10%. a) What is the NPV of the project? b) Suppose a real estate company comes up with the following idea. It offers you the same contract as in part a) but gives you the option to terminate the lease after one year. That is, after learning how many Starbucks shops have opened in your neighborhood during the first year you have the option to close your cafe after one year and pay no rent for the second year. The real estate company is asking you for a fee (payable today) in return for providing you with the option to terminate the lease. What is the maximum fee you are willing to pay? c) How would your answer to part (b) change if the rent was $330K per year? You are planning to set up a new cafe in the Village and operate it for at most two years. Your revenue in the first year is expected to be $400K. Your second-year revenue depends on how many Starbucks shops have opened in your neighborhood during the first year: You are planning to rent the space for the cafe. The landlord requires that you sign a twoyear lease, i.e., you must pay rent for two years no matter what. The rent is $110K per year payable at the end of a year. As usual, revenues also occur at the end of year. The discount rate is 10%. a) What is the NPV of the project? b) Suppose a real estate company comes up with the following idea. It offers you the same contract as in part a) but gives you the option to terminate the lease after one year. That is, after learning how many Starbucks shops have opened in your neighborhood during the first year you have the option to close your cafe after one year and pay no rent for the second year. The real estate company is asking you for a fee (payable today) in return for providing you with the option to terminate the lease. What is the maximum fee you are willing to pay? c) How would your answer to part (b) change if the rent was $330K per year