Answered step by step

Verified Expert Solution

Question

1 Approved Answer

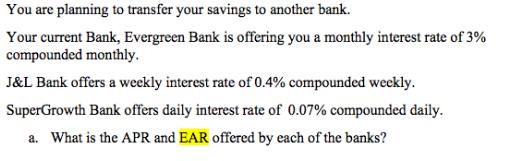

You are planning to transfer your savings to another bank. Your current Bank, Evergreen Bank is offering you a monthly interest rate of 3%

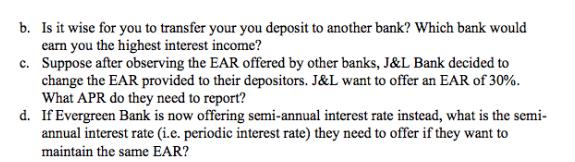

You are planning to transfer your savings to another bank. Your current Bank, Evergreen Bank is offering you a monthly interest rate of 3% compounded monthly. J&L Bank offers a weekly interest rate of 0.4% compounded weekly. SuperGrowth Bank offers daily interest rate of 0.07% compounded daily. a. What is the APR and EAR offered by each of the banks? b. Is it wise for you to transfer your you deposit to another bank? Which bank would earn you the highest interest income? c. Suppose after observing the EAR offered by other banks, J&L Bank decided to change the EAR provided to their depositors. J&L want to offer an EAR of 30%. What APR do they need to report? d. If Evergreen Bank is now offering semi-annual interest rate instead, what is the semi- annual interest rate (i.e. periodic interest rate) they need to offer if they want to maintain the same EAR?

Step by Step Solution

★★★★★

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a The APR and EAR offered by Evergreen Bank is 3 and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started