Question

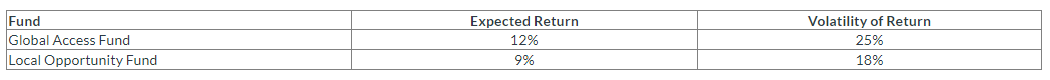

You are presented with the following information regarding two mutual funds in which you are considering investing: The risk-free rate, r f , is 3%.

You are presented with the following information regarding two mutual funds in which you are considering investing:

The risk-free rate, rf, is 3%.

a) (5 points) What is Sharpe Ratio of the Global Access Fund

b) (5 points) What is the Sharpe Ratio of the Local Opportunity Fund

c) (5 points) You would like to form a portfolio that has a volatility of 10% by investing in or borrowing at the risk-free rate and investing in only one of the two mutual funds. Which mutual fund would you choose? What is the percentage of your portfolio allocated to the risk-free rate and the percentage of your portfolio allocated to the mutual fund you choose?

d) (5 points) Suppose everyone follows the same analysis as you and hence wants to invest in the same fund. Because of this, the managers of this fund begin charging a fee, F%, so that the after-fee return that investors get is the return of the mutual fund minus F. What is the maximum fee that they can charge before people switch funds?

Fund Global Access Fund Local Opportunity Fund Expected Return 12% 9% Volatility of Return 25% 18%

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a The Sharpe Ratio of the Global Access Fund can be calculated by subtracting the riskfree rate from the annualized excess return of the fund and then dividing the result by the standard deviation of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started