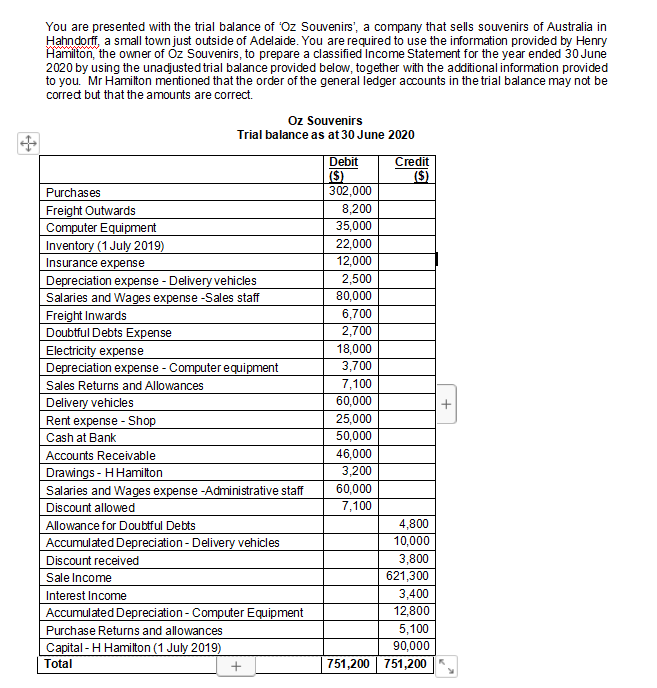

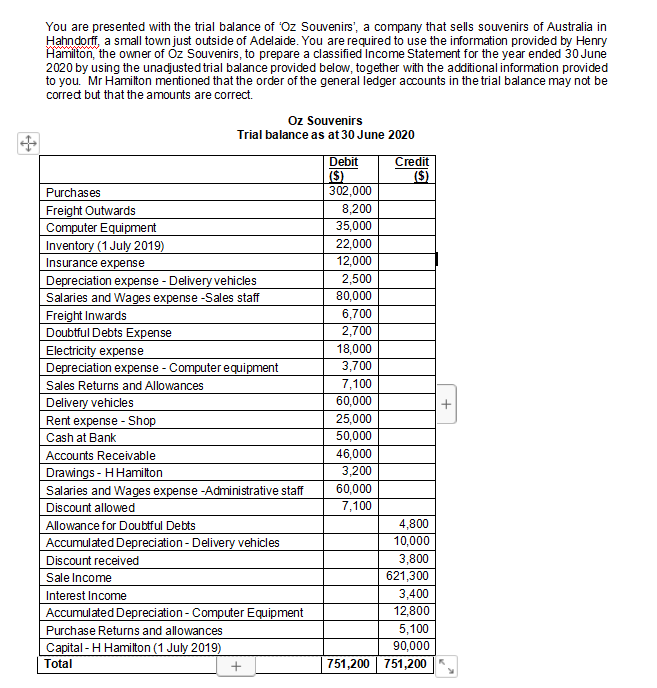

You are presented with the trial balance of Oz Souvenirs', a company that sells souvenirs of Australia in Hahndorff, a small town just outside of Adelaide. You are required to use the information provided by Henry Hamilton, the owner of oz Souvenirs, to prepare a classified Income Statement for the year ended 30 June 2020 by using the unadjusted trial balance provided below, together with the additional information provided to you. Mr Hamilton mentioned that the order of the general ledger accounts in the trial balance may not be corred but that the amounts are correct. Oz Souvenirs Trial balance as at 30 June 2020 + Purchases Freight Outwards Computer Equipment Inventory (1 July 2019) Insurance expense Depreciation expense - Delivery vehicles Salaries and Wages expense -Sales staff Freight Inwards Doubtful Debts Expense Electricity expense Depreciation expense - Computer equipment Sales Returns and Allowances Delivery vehicles Rent expense - Shop Cash at Bank Accounts Receivable Drawings - H Hamilton Salaries and Wages expense-Administrative staff Discount allowed Allowance for Doubtful Debts Accumulated Depreciation - Delivery vehicles Discount received Sale Income Interest Income Accumulated Depreciation - Computer Equipment Purchase Returns and allowances Capital - H Hamilton (1 July 2019) Total Debit Credit ($) ($) 302,000 8,200 35,000 22,000 12,000 2,500 80,000 6,700 2,700 18,000 3,700 7,100 60,000 25,000 50,000 46,000 3.200 60,000 7,100 4.800 10,000 3,800 621,300 3,400 12,800 5,100 90,000 751,200 751,200 + Additional information: 1. A stock take on 30 June 2020 revealed $17,000 worth of Inventory on hand 2. The Electricity expense is split as follows: $ 12,000 to the Shop and the remaining amount to the Administrative department. 3. The computer equipment is used in the Shop and any expenses related to computer equipment should be allocated to the Shop. 4. The delivery vehicles are used to deliver heavy souvenirs to customers. 5. The Insurance expense should be split as follows 70% to the Shop and 30% to the Administrative Department REQUIRED: You are required to prepare a fully classified Income Statement for "Oz Souvenirs for the year ending 30 June 2020 by using the template provided The template for the income statement is provided on the next page. INCOME Less: EXPENSES