Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are provided the following trades and transactions: - March 1: Buy 13,993 shares of ABC at a price of $18.29/ share, and sell SHORT

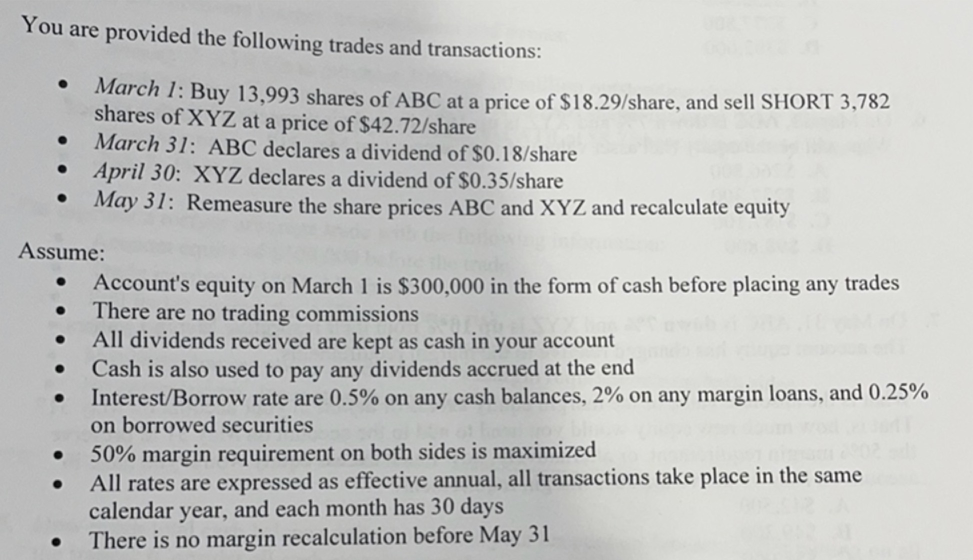

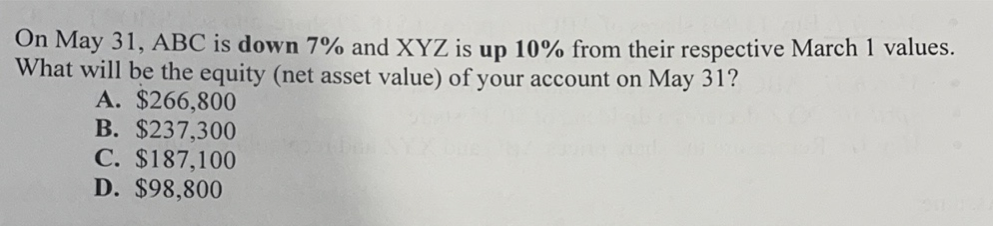

You are provided the following trades and transactions: - March 1: Buy 13,993 shares of ABC at a price of $18.29/ share, and sell SHORT 3,782 shares of XYZ at a price of $42.72/ share - March 31: ABC declares a dividend of $0.18/ share - April 30: XYZ declares a dividend of $0.35/ share - May 31: Remeasure the share prices ABC and XYZ and recalculate equity Assume: - Account's equity on March 1 is $300,000 in the form of cash before placing any trades - There are no trading commissions - All dividends received are kept as cash in your account - Cash is also used to pay any dividends accrued at the end - Interest/Borrow rate are 0.5% on any cash balances, 2% on any margin loans, and 0.25% on borrowed securities - 50% margin requirement on both sides is maximized - All rates are expressed as effective annual, all transactions take place in the same calendar year, and each month has 30 days - There is no margin recalculation before May 31 On May 31,ABC is down 7% and XYZ is up 10% from their respective March 1 values. What will be the equity (net asset value) of your account on May 31 ? A. $266,800 B. $237,300 C. $187,100 D. $98,800

You are provided the following trades and transactions: - March 1: Buy 13,993 shares of ABC at a price of $18.29/ share, and sell SHORT 3,782 shares of XYZ at a price of $42.72/ share - March 31: ABC declares a dividend of $0.18/ share - April 30: XYZ declares a dividend of $0.35/ share - May 31: Remeasure the share prices ABC and XYZ and recalculate equity Assume: - Account's equity on March 1 is $300,000 in the form of cash before placing any trades - There are no trading commissions - All dividends received are kept as cash in your account - Cash is also used to pay any dividends accrued at the end - Interest/Borrow rate are 0.5% on any cash balances, 2% on any margin loans, and 0.25% on borrowed securities - 50% margin requirement on both sides is maximized - All rates are expressed as effective annual, all transactions take place in the same calendar year, and each month has 30 days - There is no margin recalculation before May 31 On May 31,ABC is down 7% and XYZ is up 10% from their respective March 1 values. What will be the equity (net asset value) of your account on May 31 ? A. $266,800 B. $237,300 C. $187,100 D. $98,800

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started