Answered step by step

Verified Expert Solution

Question

1 Approved Answer

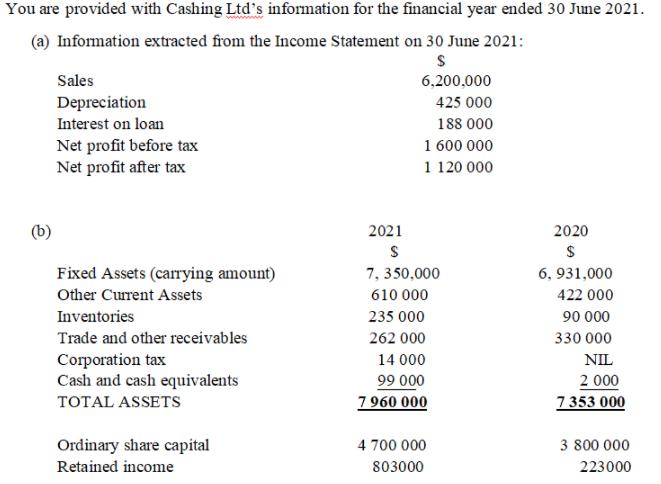

You are provided with Cashing Ltd's information for the financial year ended 30 June 2021. (a) Information extracted from the Income Statement on 30

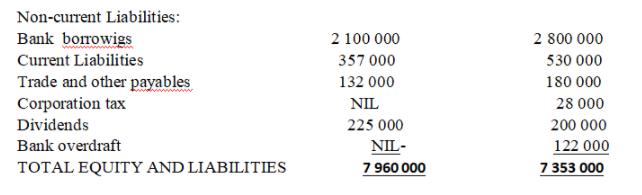

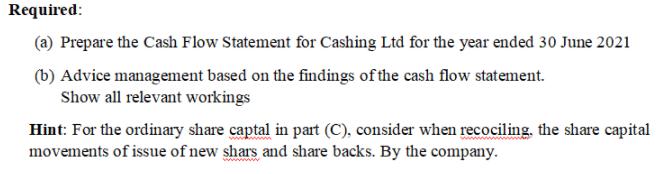

You are provided with Cashing Ltd's information for the financial year ended 30 June 2021. (a) Information extracted from the Income Statement on 30 June 2021: Sales 6,200,000 Depreciation 425 000 Interest on loan 188 000 Net profit before tax Net profit after tax 1 600 000 1 120 000 (b) 2021 2020 2$ Fixed Assets (carrying amount) 7, 350,000 6, 931,000 Other Current Assets 610 000 422 000 Inventories 235 000 90 000 Trade and other receivables 262 000 330 000 Corporation tax Cash and cash equivalents 14 000 NIL 2 000 7353 000 99 000 TOTAL ASSETS 7960 000 Ordinary share capital 4 700 000 3 800 000 Retained income 803000 223000 Non-current Liabilities: Bank borrowigs 2 100 000 2 800 000 Current Liabilities 357 000 530 000 Trade and other payables Corporation tax Dividends 132 000 180 000 NIL 28 000 225 000 200 000 Bank overdraft NIL- 7 960 000 122 000 TOTAL EQUITY AND LIABILITIES 7 353 000 Events and transactions during 2021. (1) 150, 000 new shares were issued during the year at $8 each. (2) An interim dividend of $270,000 was paid on 1 January 2021. (3) Fixed assets were sold during the year, at a carrying amount of $86,000. Additional equipment was purchased to replace the assets sold. Required: (a) Prepare the Cash Flow Statement for Cashing Ltd for the year ended 30 June 2021 (b) Advice management based on the findings of the cash flow statement. Show all relevant workings Hint: For the ordinary share captal in part (C), consider when recociling, the share capital movements of issue of new shars and share backs. By the company.

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started