Answered step by step

Verified Expert Solution

Question

1 Approved Answer

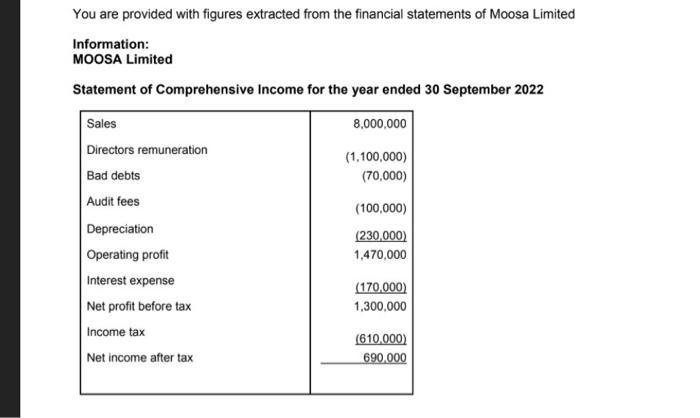

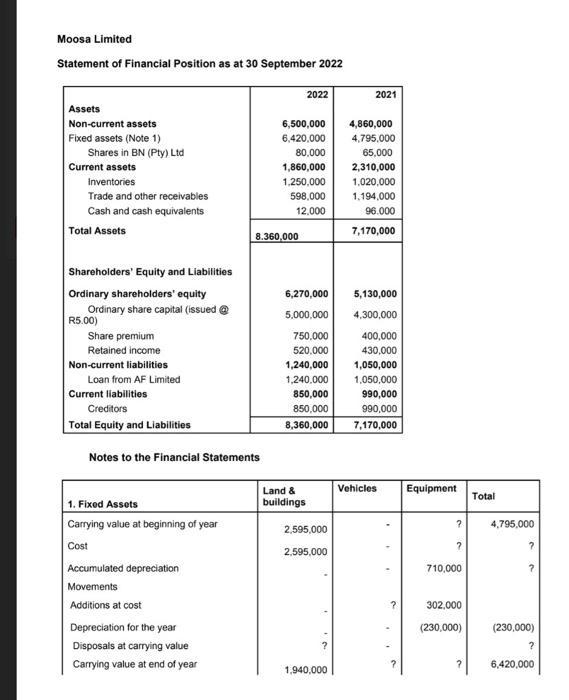

You are provided with figures extracted from the financial statements of Moosa Limited Information: MOOSA Limited Statement of Comprehensive Income for the year ended

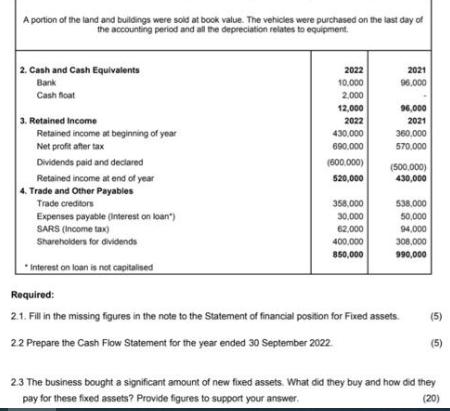

You are provided with figures extracted from the financial statements of Moosa Limited Information: MOOSA Limited Statement of Comprehensive Income for the year ended 30 September 2022 Sales Directors remuneration Bad debts Audit fees Depreciation Operating profit Interest expense Net profit before tax Income tax Net income after tax 8,000,000 (1,100,000) (70,000) (100,000) (230,000) 1,470,000 (170,000) 1,300,000 (610,000) 690,000 Moosa Limited Statement of Financial Position as at 30 September 2022 Assets Non-current assets Fixed assets (Note 1) Shares in BN (Pty) Ltd Current assets Inventories Trade and other receivables Cash and cash equivalents Total Assets Shareholders' Equity and Liabilities Ordinary shareholders' equity Ordinary share capital (issued @ R5.00) Share premium Retained income Non-current liabilities Loan from AF Limited Current liabilities Creditors Total Equity and Liabilities Notes to the Financial Statements 1. Fixed Assets Carrying value at beginning of year Cost Accumulated depreciation Movements Additions at cost Depreciation for the year Disposals at carrying value Carrying value at end of year 6,500,000 6,420,000 80,000 1,860,000 1,250,000 8.360,000 2022 598,000 12,000 Land & buildings 6,270,000 5,130,000 5,000,000 4,300,000 750,000 520,000 1,240,000 1,240,000 850,000 850,000 8,360,000 2,595,000 2,595,000 " 2021 1,940,000 4,860,000 4,795,000 65,000 2,310,000 1,020,000 1,194,000 96.000 7,170,000 400,000 430,000 1,050,000 1,050,000 990,000 990,000 7,170,000 Vehicles ? Equipment ? ? 710,000 302,000 (230,000) ? Total 4,795,000 2 (230,000) ? 6,420,000 A portion of the land and buildings were sold at book value. The vehicles were purchased on the last day of the accounting period and all the depreciation relates to equipment. 2. Cash and Cash Equivalents Bank Cash float 3. Retained Income Retained income at beginning of year Net profit after tax Dividends paid and declared Retained income at end of year 4. Trade and Other Payables Trade creditors Expenses payable (Interest on loan") SARS (Income tax) Shareholders for dividends *Interest on loan is not capitalised 2022 10,000 2,000 12,000 2022 430,000 690,000 (600,000) 520,000 358,000 30,000 62,000 400,000 850,000 2021 96,000 96,000 2021 360,000 570,000 (500,000) 430,000 538.000 50,000 94,000 308,000 990,000 Required: 2.1. Fill in the missing figures in the note to the Statement of financial position for Fixed assets. 2.2 Prepare the Cash Flow Statement for the year ended 30 September 2022 (5) (5) 2.3 The business bought a significant amount of new fixed assets. What did they buy and how did they pay for these fixed assets? Provide figures to support your answer. (20)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

21 Fill in the missing figures in the note to the Statement of financial position for Fixed assets Carrying value at beginning of year Cost Accumulate...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started