Question

You are provided with historical data on the risk characteristics of TAMC and Kaisa. Beta TAMC 0.78 Annual standard deviation of 21 return (%)

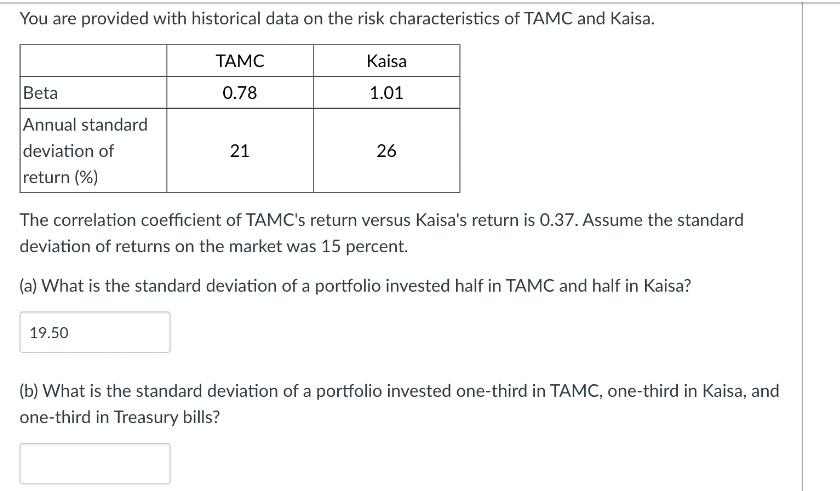

You are provided with historical data on the risk characteristics of TAMC and Kaisa. Beta TAMC 0.78 Annual standard deviation of 21 return (%) Kaisa 1.01 26 The correlation coefficient of TAMC's return versus Kaisa's return is 0.37. Assume the standard deviation of returns on the market was 15 percent. (a) What is the standard deviation of a portfolio invested half in TAMC and half in Kaisa? 19.50 (b) What is the standard deviation of a portfolio invested one-third in TAMC, one-third in Kaisa, and one-third in Treasury bills?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The standard deviation of a portfolio invested half in TAMC and half in Kaisa can be calculated usin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Corporate Finance

Authors: Richard A. Brealey, Stewart C. Myers, Franklin Allen

10th Edition

9780073530734, 77404890, 73530735, 978-0077404895

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App