Answered step by step

Verified Expert Solution

Question

1 Approved Answer

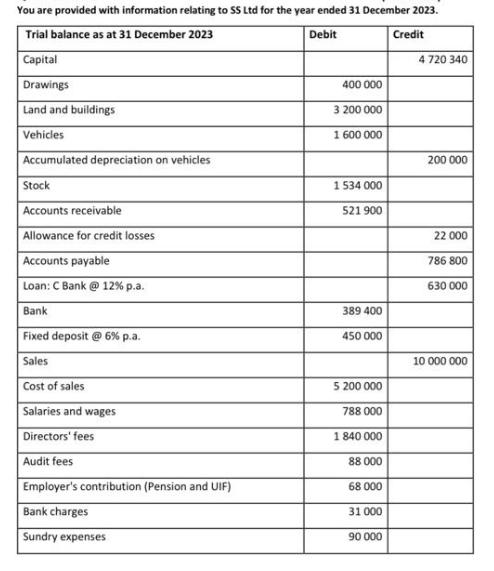

You are provided with information relating to SS Ltd for the year ended 31 December 2023. Trial balance as at 31 December 2023 Debit

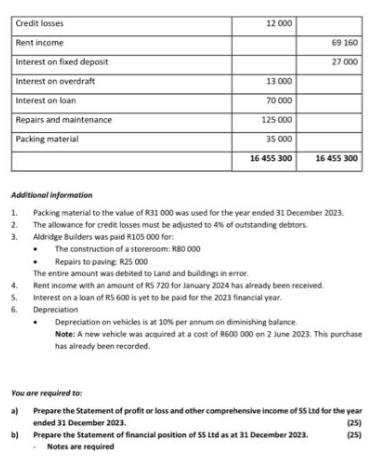

You are provided with information relating to SS Ltd for the year ended 31 December 2023. Trial balance as at 31 December 2023 Debit Credit Capital Drawings Land and buildings Vehicles Accumulated depreciation on vehicles Stock Accounts receivable Allowance for credit losses Accounts payable Loan: C Bank @ 12% p.a. Bank Fixed deposit @ 6% p.a. Sales Cost of sales Salaries and wages Directors' fees Audit fees Employer's contribution (Pension and UIF) Bank charges Sundry expenses 400 000 3 200 000 1 600 000 1 534 000 521 900 389 400 450 000 5 200 000 788 000 1 840 000 88 000 68 000 31 000 90 000 4 720 340 200 000 22 000 786 800 630 000 10 000 000 Credit losses Rent income Interest on fixed deposit Interest on overdraft Interest on loan Repairs and maintenance Packing material 1. 2. 12 000 4. 5. 6. 13 000 70 000 125 000 35 000 16 455 300 69 160 Additional information Packing material to the value of R31 000 was used for the year ended 31 December 2023. The allowance for credit losses must be adjusted to 4% of outstanding debtors Aldridge Builders was paid R105 000 for: The construction of a storeroom: R80 000 27 000 16 455 300 Repairs to paving R25 000 The entire amount was debited to Land and buildings in error. Rent income with an amount of RS 720 for January 2024 has already been received Interest on a loan of RS 600 is yet to be paid for the 2023 financial year. Depreciation Depreciation on vehicles is at 10% per annum on diminishing balance Note: A new vehicle was acquired at a cost of R600 000 on 2 June 2023. This purchase has already been recorded. You are required to: a) Prepare the Statement of profit or loss and other comprehensive income of 55 Ltd for the year ended 31 December 2023. (25) b) (25) Prepare the Statement of financial position of 55 Ltd as at 31 December 2023. Notes are required

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the Statement of Profit or Loss and Other Comprehensive Income and the Statement of Financial Position for SS Ltd as at December 31 2023 we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started