Answered step by step

Verified Expert Solution

Question

1 Approved Answer

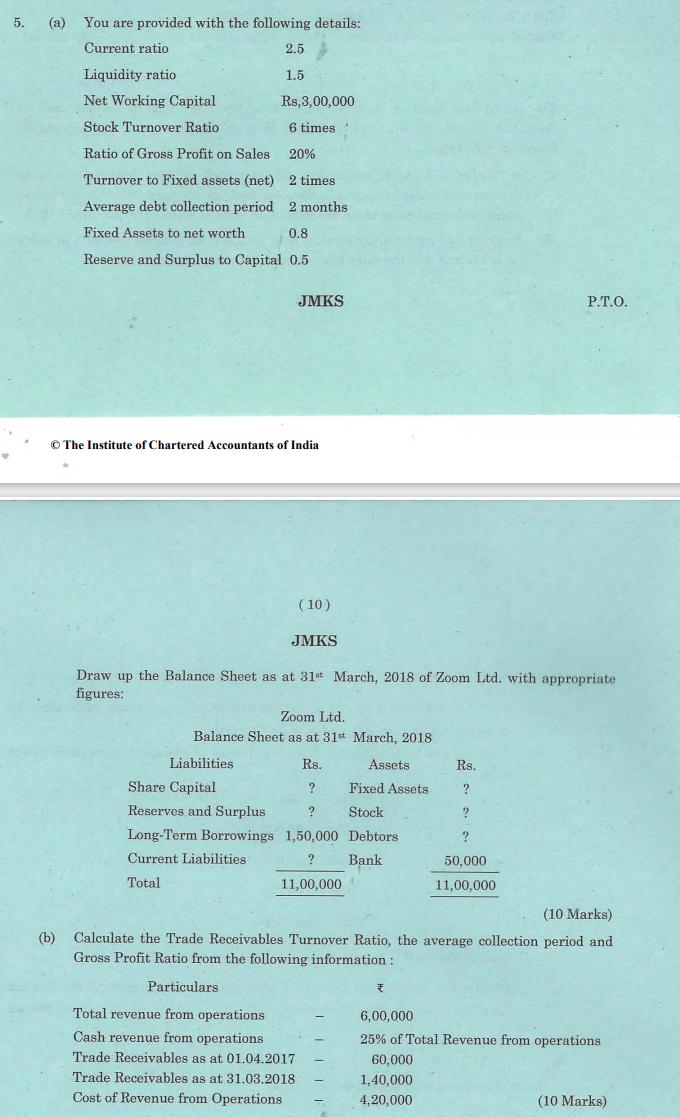

You are provided with the following details: Current ratio 2.5 Liquidity ratio Net Working Capital Stock Turnover Ratio Ratio of Gross Profit on Sales

You are provided with the following details: Current ratio 2.5 Liquidity ratio Net Working Capital Stock Turnover Ratio Ratio of Gross Profit on Sales 20% Turnover to Fixed assets (net) 2 times Average debt collection period 2 months Fixed Assets to net worth 0.8 Reserve and Surplus to Capital 0.5 1.5 The Institute of Chartered Accountants of India Liabilities Rs,3,00,000 6 times. Share Capital Reserves and Surplus Long-Term Borrowings Current Liabilities Total JMKS Draw up the Balance Sheet as at 31st March, 2018 of Zoom Ltd. with appropriate figures: Zoom Ltd. Balance Sheet as at 31st March, 2018 Rs. Assets ? Fixed Assets ? Stock 1,50,000 Debtors ? Bank 11,00,000 (10) JMKS Particulars Total revenue from operations Cash revenue from operations Trade Receivables as at 01.04.2017 Trade Receivables as at 31.03.2018 Cost of Revenue from Operations P.T.O. Rs. ? ? ? 50,000 11,00,000 (10 Marks) (b) Calculate the Trade Receivables Turnover Ratio, the average collection period and Gross Profit Ratio from the following information: 6,00,000 25% of Total Revenue from operations. 60,000 1,40,000 4,20,000 (10 Marks)

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started