6. (a) The Bank Pass Book of Account No.5678 of Mrs.Rani showed an overdraft of Rs.33,575 on 31st March 2018. On going through the

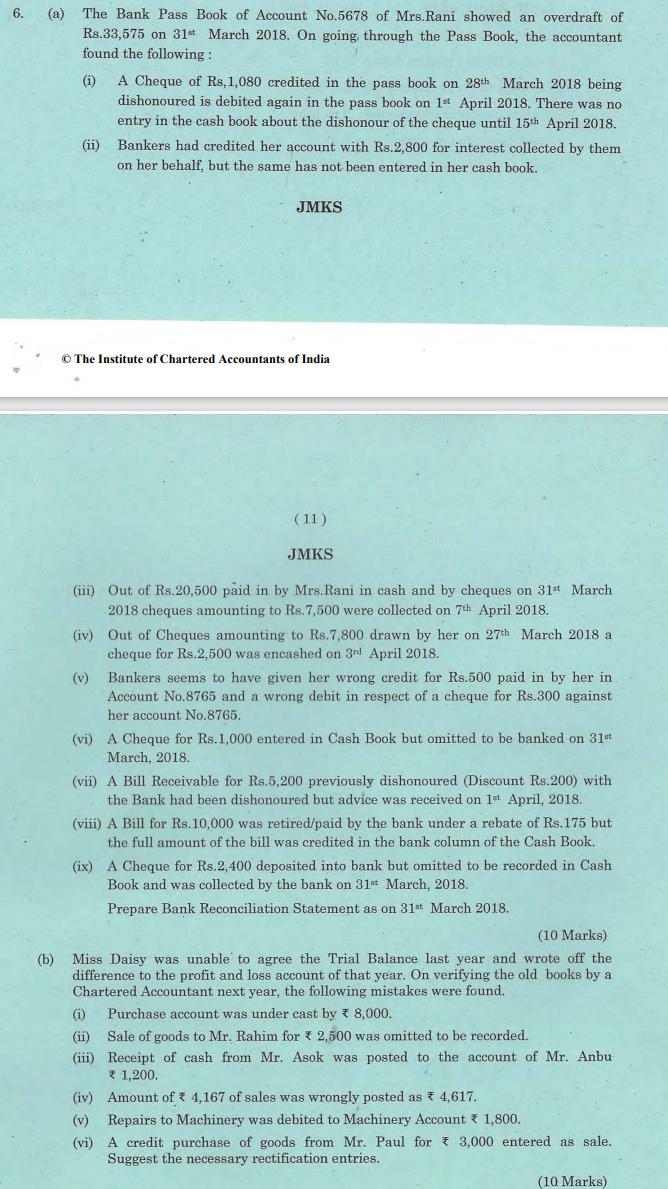

6. (a) The Bank Pass Book of Account No.5678 of Mrs.Rani showed an overdraft of Rs.33,575 on 31st March 2018. On going through the Pass Book, the accountant found the following: (b) (i) A Cheque of Rs, 1,080 credited in the pass book on 28th March 2018 being dishonoured is debited again in the pass book on 1st April 2018. There was no entry in the cash book about the dishonour of the cheque until 15th April 2018. (ii) Bankers had credited her account with Rs.2,800 for interest collected by them on her behalf, but the same has not been entered in her cash book. JMKS The Institute of Chartered Accountants of India (11) JMKS (iii) Out of Rs.20,500 paid in by Mrs.Rani in cash and by cheques on 31st March 2018 cheques amounting to Rs. 7,500 were collected on 7th April 2018. (v) (iv) Out of Cheques amounting to Rs.7,800 drawn by her on 27th March 2018 at cheque for Rs.2,500 was encashed on 3rd April 2018. Bankers seems to have given her wrong credit for Rs.500 paid in by her in Account No.8765 and a wrong debit in respect of a cheque for Rs.300 against her account No.8765. (vi) A Cheque for Rs.1,000 entered in Cash Book but omitted to be banked on 31st March, 2018. (vii) A Bill Receivable for Rs.5,200 previously dishonoured (Discount Rs.200) with the Bank had been dishonoured but advice was received on 1st April, 2018. (viii) A Bill for Rs. 10,000 was retired/paid by the bank under a rebate of Rs.175 but the full amount of the bill was credited in the bank column of the Cash Book. (ix) A Cheque for Rs.2,400 deposited into bank but omitted to be recorded in Cash Book and was collected by the bank on 31st March, 2018. Prepare Bank Reconciliation Statement as on 31st March 2018. (10 Marks) Miss Daisy was unable to agree the Trial Balance last year and wrote off the difference to the profit and loss account of that year. On verifying the old books by a Chartered Accountant next year, the following mistakes were found. (i) Purchase account was under cast by * 8,000. (ii) Sale of goods to Mr. Rahim for 2,500 was omitted to be recorded. (iii) Receipt of cash from Mr. Asok was posted to the account of Mr. Anbu 1,200. (iv) Amount of 4,167 of sales was wrongly posted as * 4,617. (v) Repairs to Machinery was debited to Machinery Account * 1,800. (vi) A credit purchase of goods from Mr. Paul for 3,000 entered as sale. Suggest the necessary rectification entries. (10 Marks)

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards