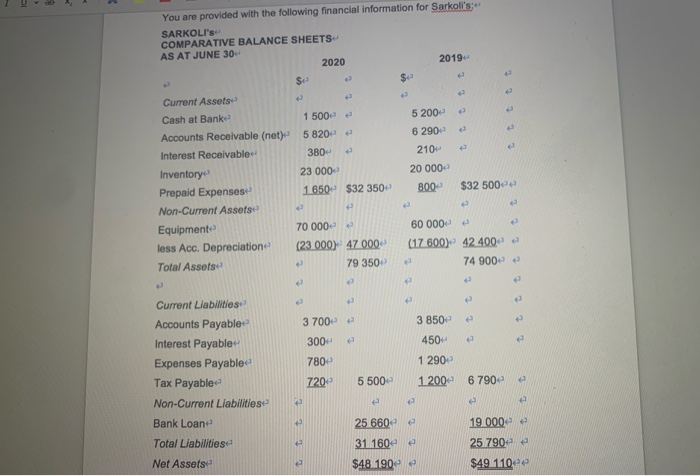

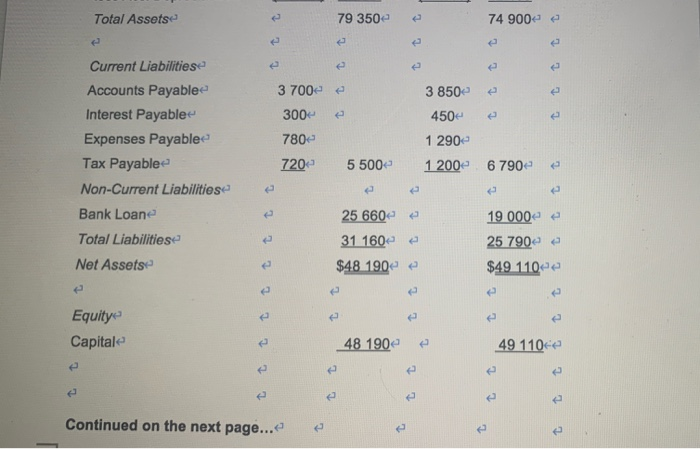

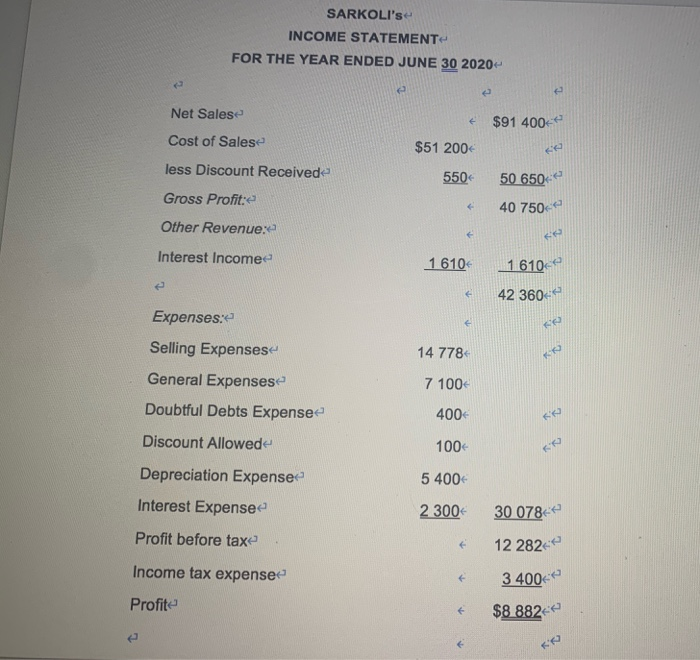

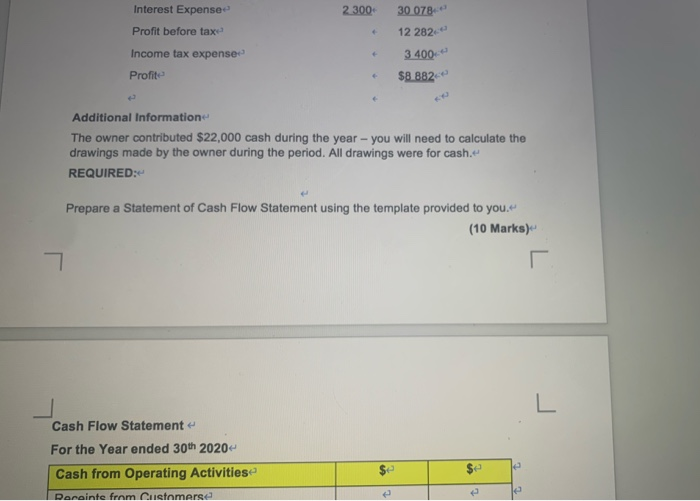

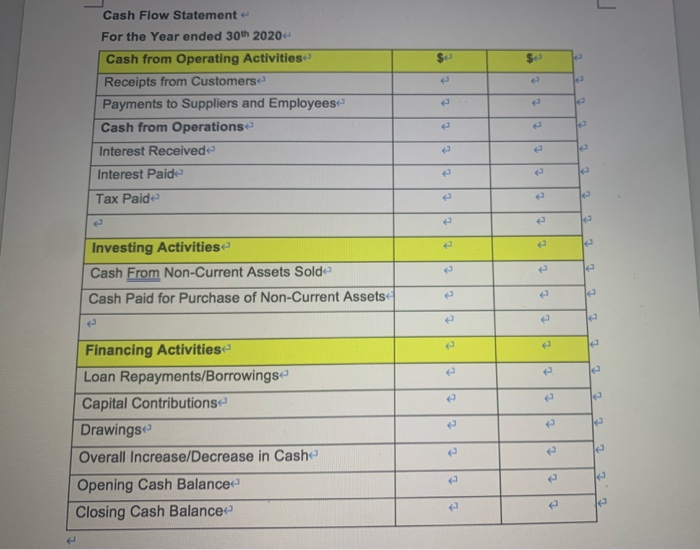

$ You are provided with the following financial information for Sarkoli's; SARKOLI'S COMPARATIVE BALANCE SHEETS AS AT JUNE 30 2020 2019 $ Current Assets Cash at Bank 1 500 e 5 200- Accounts Receivable (net) 5820 6 290 Interest Receivable 380 2104 Inventory 23 000 20 000 Prepaid Expenses 1 650 $32 350 800 $32 500 Non-Current Assets Equipment 70 000 60 000 e less Acc. Depreciatione (23 000) 47 000 (17 600) 42.400 Total Assets 79 350 74 900 - t CC 3 700 3 850 300 450 780 Current Liabilities Accounts Payable Interest Payable Expenses Payable Tax Payable- Non-Current Liabilities Bank Loane Total Liabilitiese Net Assetse 1 290- 1 200 6790 720 5 500 e 25 6600 e 19.000 e 25 7900 e 31 160e $48.190 $49.110ee Total Assets 79 350 74 9004 e 3 7004 e 3 850 4504 300 Current Liabilitiese Accounts Payabled Interest Payable Expenses Payable Tax Payable Non-Current Liabilities 7804 1 290 7204 5 500 1 200 6790 Bank Loane 25 6604 Total Liabilities 31 160 e 19 000 e 25 790 e $49 1100 Net Assets $48 190 - Equity Capitale 48 190 49 1106 e t tt Continued on the next page... e e SARKOLI's INCOME STATEMENT FOR THE YEAR ENDED JUNE 30 2020- Net Sales $91 400 Cost of Salese $51 200 less Discount Received 550 50 650 Gross Profit: Other Revenue: 40 750 Interest Income 1 610 1 610- 42 360- 14 7784 Expenses: Selling Expenses General Expenses Doubtful Debts Expense- 7 100 4004 Discount Allowed 100 5 400 Depreciation Expense Interest Expensee 2 300 30 0784 Profit before taxe 12 282 Income tax expenses 3.400 Profite $8 882 2 300- Interest Expense Profit before taxe 30 078 12 282 3 400 $8.882 Income tax expense- Profite Additional Information The owner contributed $22,000 cash during the year - you will need to calculate the drawings made by the owner during the period. All drawings were for cash. REQUIRED: Prepare a Statement of Cash Flow Statement using the template provided to you. (10 Marks) 7 L Cash Flow Statement For the Year ended 30th 2020 Cash from Operating Activities $ Raceinte from Customerse Cash Flow Statement For the Year ended 30th 2020 Cash from Operating Activities Receipts from Customers Payments to Suppliers and Employees Cash from Operations Interest Received Interest Paide tt e e t Tax Paide t Investing Activities Cash From Non-Current Assets Solde Cash Paid for Purchase of Non-Current Assets e e le e Financing Activities Loan Repayments/Borrowings- Capital Contributions Drawings Overall Increase/Decrease in Cash Opening Cash Balance Closing Cash Balance e e le t