Answered step by step

Verified Expert Solution

Question

1 Approved Answer

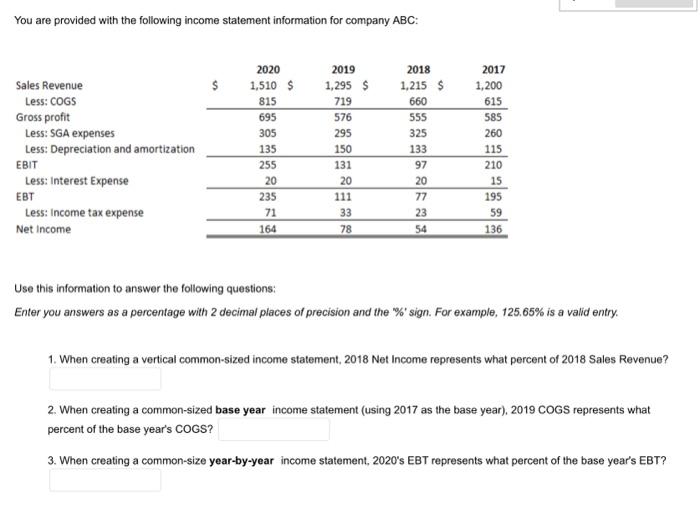

You are provided with the following income statement information for company ABC: Sales Revenue Less: COGS Gross profit Less: SGA expenses Less: Depreciation and

You are provided with the following income statement information for company ABC: Sales Revenue Less: COGS Gross profit Less: SGA expenses Less: Depreciation and amortization EBIT Less: Interest Expense EBT Less: Income tax expense Net Income 2020 1,510 $ 815 695 305 135. 255 20 235 71 164 2019 1,295 $ 719 576 295 150 131 20 111 33 78 2018 1,215 $ 660 555 325 133 97 20 77 23 54 2017 1,200 615 585 260 115 210 15 195 59 136 Use this information to answer the following questions: Enter you answers as a percentage with 2 decimal places of precision and the "%' sign. For example, 125.65% is a valid entry. 1. When creating a vertical common-sized income statement, 2018 Net Income represents what percent of 2018 Sales Revenue? 2. When creating a common-sized base year income statement (using 2017 as the base year), 2019 COGS represents what percent of the base year's COGS? 3. When creating a common-size year-by-year income statement, 2020's EBT represents what percent of the base year's EBT?

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 The percentage can be calculated as follows Net Income 2018 54 00443 or Sales ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started