Answered step by step

Verified Expert Solution

Question

1 Approved Answer

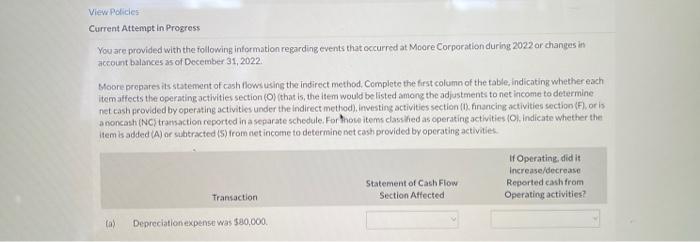

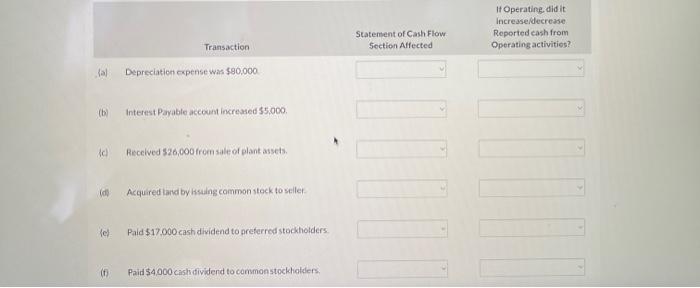

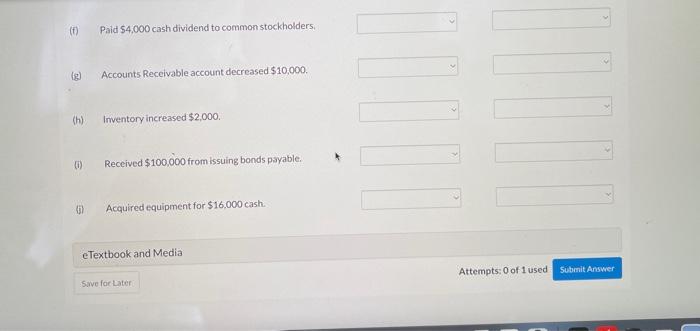

You are provided with the following information regarding events that occurred at Moore Corporation during 2022 or changes in account balances as of December 31,

You are provided with the following information regarding events that occurred at Moore Corporation during 2022 or changes in

account balances as of December 31, 2022.

Moore prepares its statement of cash flows using the indirect method. Complete the first column of the table, indicating whether each

item affects the operating activities section (O) (that is, the item would be listed among the adjustments to net income to determine

net cash provided by operating activities under the indirect method), investing activities section (I), financing activities section (F), or is

a noncash (NC) transaction reported in a separate schedule. For nose items classified as operating activities (O), indicate whether the

item is added (A) or subtracted (S) from net income to determine net cash provided by operating activities. A-J is needed.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started