Question

You are purchasing a 15,000 square foot commercial industrial building in July of this year for $3,000,000. The appraised value of the acquisition placed $2,500,000

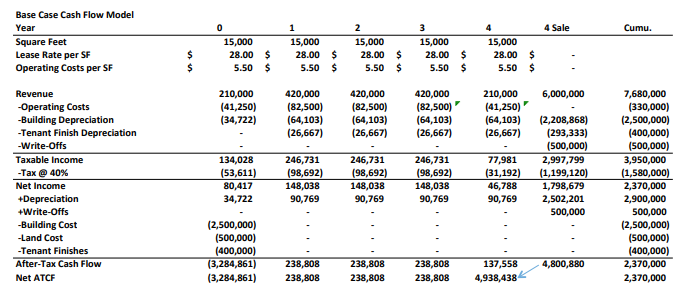

You are purchasing a 15,000 square foot commercial industrial building in July of this year for $3,000,000. The appraised value of the acquisition placed $2,500,000 of this purchase in the building for depreciation purposes and $500,000 contributed to the land. Both costs are charged below at time zero. You have pre-negotiated a lease with a tenant for 100% of the square footage of the property at an annual rate of $28.00 per square foot and you expect to recognize operating expenses of $5.50 per square foot. Since the lease payments are beginning of period values, six months payments are allocated in time zero along with an equal component of operating costs with the balance allocated to year four. As part of the lease negotiations, you have agreed to complete $400,000 in tenant finishes with this work being considered an additional time zero capital cost. While commercial properties are depreciated over 39 years, tenant finishes may be depreciated more rapidly over 15 years using the straight-line methodology. Begin depreciating the building immediately, (at time zero) utilizing the mid-month convention. Assume the building goes into service in June of the calendar tax year. Begin depreciating the tenant finishes in year one with a half-year deduction in that year. This property will be held and operated for four years and then will be sold at the end of the fourth year for an estimated $6,000,000. Finally, assume a 40% tax rate, 10% after-tax discount rate, and other income exists against which to utilize all deductions in the year they are incurred.

a) (Time 1 is today) Based on the same cash flows provided for part A, assume you have spent the year zero cash flows. You just received an offer to sell the property for $4,500,000 at year 1. You can either accept the sell offer or realize the remaining cash flows (1-4 and 4 sale). Would you suggest selling or continuing with owning the business? Please make an after-tax NPV analysis to support your decision assuming your company has other income and uses a minimum 10% aftertax rate of return.

b) Using the model from question (B) what company sale value in year 1 would make you economically indifferent between continuing with development or selling the property today? Use an after-tax minimum rate of return of 10% to evaluate your decision.

Base Case Cash Flow Model 4 Sale Operating Costs per SF s.5o $5.50 5.so $ 210,000 (41,250) 420,000(82.5001(64103)293333)so.00 210,000 6,000,000 -Operating Costs -Building Depreciation Taxable Income 246,731 77,981 2,997,799 46,788 1,798,679 (2,500,000) (500,000) (400,000) After-Tax Cash Flow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started