Question

You are purchasing insurance for your house. You have three options: Zero deductible policy that will pay 100% of all damage expenses for the year

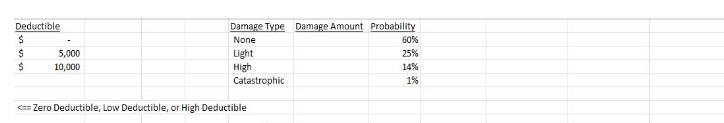

You are purchasing insurance for your house. You have three options: Zero deductible policy that will pay 100% of all damage expenses for the year costs you $350 per month. Low dedutible policy that pays out 100% of damage expenses after the first $5,000 for the year costs you $150 per month. High deductible policy that pays out 100% of damage expenses after the first $10,000 for the year costs you $80 per month. You expect house damages to this year to follow a discrete distribution as follows: 60% chance of no damages 25% chance of damages light between $3,000 and $10,000 (uniformly distributed and integer) 14% chance of high damages between $20,000 and $50,000 (uniformly distributed and integer) 1% chance of catastrophic damages equal to $250,000. What policy minimizes your expected expenses after insurance coverage for the year (i.e., your expected yearly out of pocket damage expenses plus cost of policy)?

Deductible $ $ $ 5,000 10,000 Damage Type Damage Amount Probability None Light High Catastrophic

Step by Step Solution

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To determine which policy minimizes your expected expenses after insurance coverage for the year we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started