Answered step by step

Verified Expert Solution

Question

1 Approved Answer

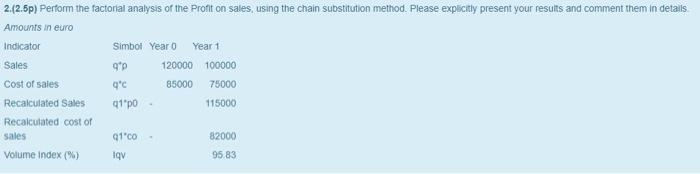

You are requested to analyze the financial situation of a company based on the following data. You will compute the most significant ratios (at least

You are requested to analyze the financial situation of a company based on the following data. You will compute the most significant ratios (at least 6) and comment on their evolution and any additional information that might be relevant in the Balance sheet and Income Statement.

Balance sheet

000euro

2019

2020

Current assets

15680

17920

Fix assets

20720

22848

Total assets

36400

40768

Equity

13216

14336

Current liabilities

12208

13888

Non-current liabilities

10976

12544

Total liabilities

23184

26432

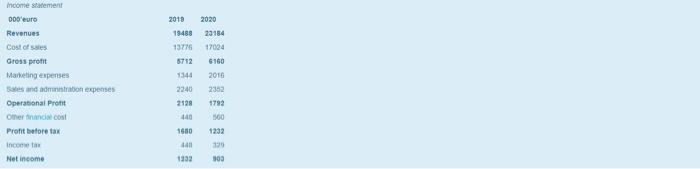

Income statement

000euro

2019

2020

Revenues

19488

23184

Cost of sales

13776

17024

Gross profit

5712

6160

Marketing expenses

1344

2016

Sales and administration expenses

2240

2352

Operational Profit

2128

1792

Other financial cost

448

560

Profit before tax

1680

1232

Income tax

448

329

Net income

1232

903

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started