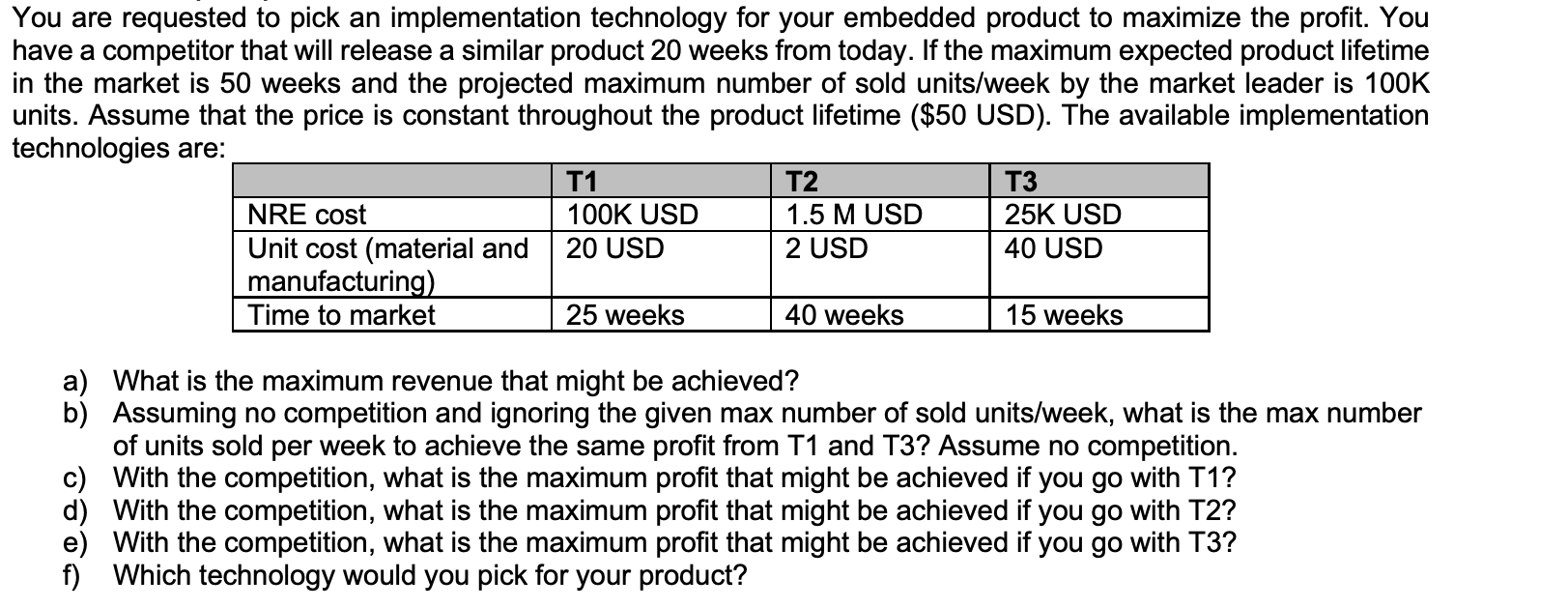

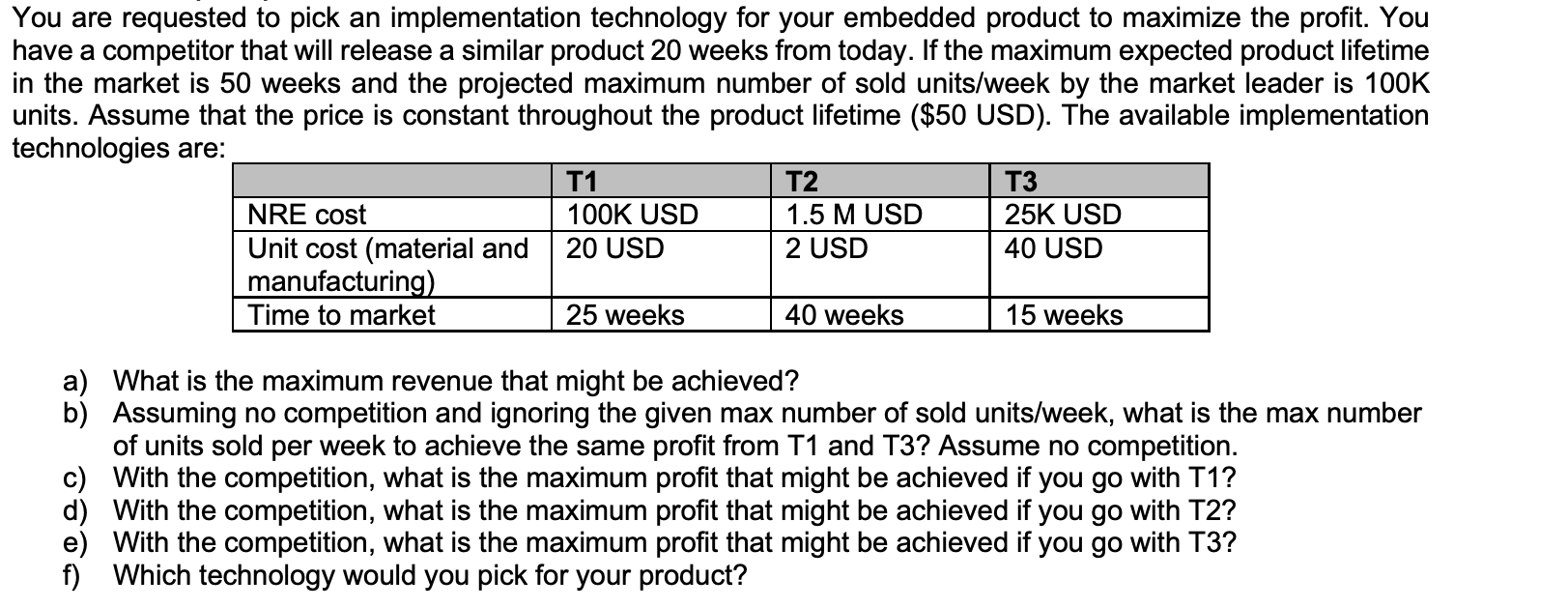

You are requested to pick an implementation technology for your embedded product to maximize the profit. You have a competitor that will release a similar product 20 weeks from today. If the maximum expected product lifetime in the market is 50 weeks and the projected maximum number of sold units/week by the market leader is 100K units. Assume that the price is constant throughout the product lifetime ($50 USD). The available implementation technologies are: T1 T2 T3 NRE cost 100K USD 1.5 M USD 25K USD Unit cost (material and 20 USD 2 USD 40 USD manufacturing) Time to market 25 weeks 40 weeks 15 weeks a) What is the maximum revenue that might be achieved? b) Assuming no competition and ignoring the given max number of sold units/week, what is the max number of units sold per week to achieve the same profit from T1 and T3? Assume no competition. c) With the competition, what is the maximum profit that might be achieved if you go with T1? d) With the competition, what is the maximum profit that might be achieved if you go with T2? e) With the competition, what is the maximum profit that might be achieved if you go with T3? f) Which technology would you pick for your product? You are requested to pick an implementation technology for your embedded product to maximize the profit. You have a competitor that will release a similar product 20 weeks from today. If the maximum expected product lifetime in the market is 50 weeks and the projected maximum number of sold units/week by the market leader is 100K units. Assume that the price is constant throughout the product lifetime ($50 USD). The available implementation technologies are: T1 T2 T3 NRE cost 100K USD 1.5 M USD 25K USD Unit cost (material and 20 USD 2 USD 40 USD manufacturing) Time to market 25 weeks 40 weeks 15 weeks a) What is the maximum revenue that might be achieved? b) Assuming no competition and ignoring the given max number of sold units/week, what is the max number of units sold per week to achieve the same profit from T1 and T3? Assume no competition. c) With the competition, what is the maximum profit that might be achieved if you go with T1? d) With the competition, what is the maximum profit that might be achieved if you go with T2? e) With the competition, what is the maximum profit that might be achieved if you go with T3? f) Which technology would you pick for your product