Question

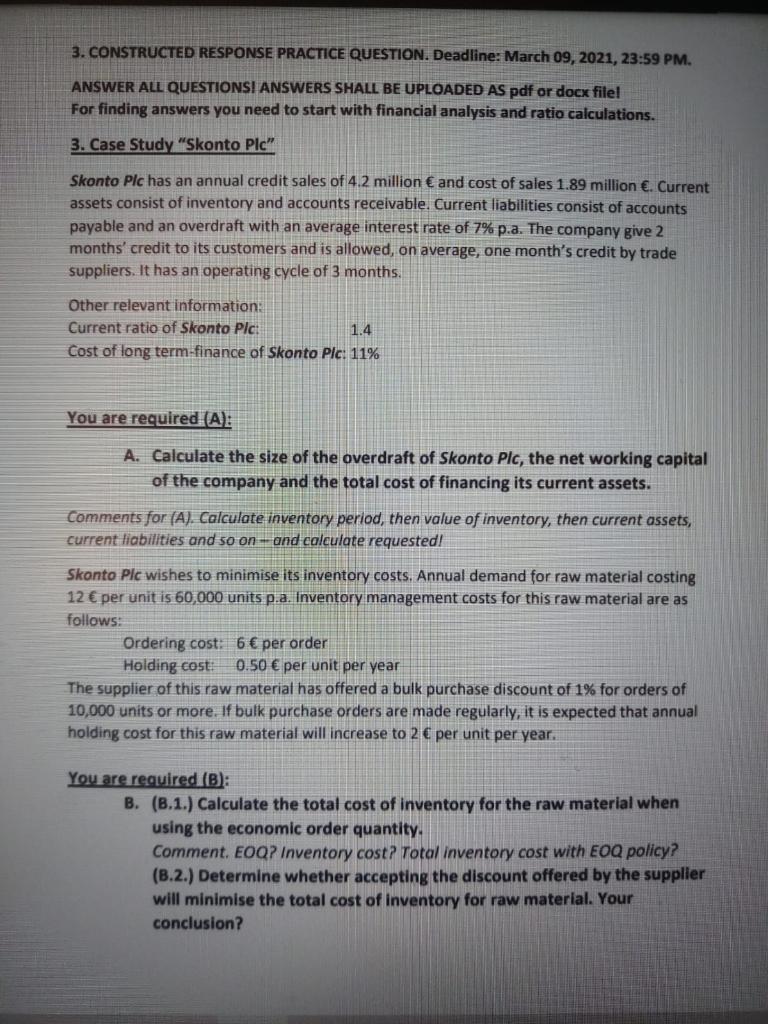

You are required (A): A. Calculate the size of the overdraft of Skonto Plc, the net working capital of the company and the total cost

You are required (A):

A. Calculate the size of the overdraft of Skonto Plc, the net working capital of the company and the total cost of financing its current assets.

Comments for (A). Calculate inventory period, then value of inventory, then current assets, current liabilities and so on and calculate requested!

Skonto Plc wishes to minimise its inventory costs. Annual demand for raw material costing 12 per unit is 60,000 units p.a. Inventory management costs for this raw material are as follows: Ordering cost: 6 per order

Holding cost: 0.50 per unit per year

The supplier of this raw material has offered a bulk purchase discount of 1% for orders of 10,000 units or more. If bulk purchase orders are made regularly, it is expected that annual holding cost for this raw material will increase to 2 per unit per year.

You are required (B):

B. (B.1.) Calculate the total cost of inventory for the raw material when using the economic order quantity.

Comment. EOQ? Inventory cost? Total inventory cost with EOQ policy?

(B.2.) Determine whether accepting the discount offered by the supplier will minimise the total cost of inventory for raw material. Your conclusion?

(B.2.) Determine whether accepting the discount offered by the supplier will minimise the total cost of inventory for raw material. Your conclusion?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started