Question

You are required to calculate the following: 1. Opening Capital 2. Credit sales for the year 3. Total Sales for the year 4. Credit purchase

You are required to calculate the following:

1. Opening Capital

2. Credit sales for the year

3. Total Sales for the year

4. Credit purchase for the year

5.Total purchases for the year

6.Gross profit for the year ended 31 May 2018

7.Net profit for the year ended 31 May 2018

8. Depreciation for equipment for the current year is

9. Depreciation for van for the current year is

10. Total non-current asset at the end of the year is

11.Total current asset is

12.Total current liabilities is

13.Inventories at the end of the year is

14. Capital at the end of the year is

15.Utility expenses for the year is

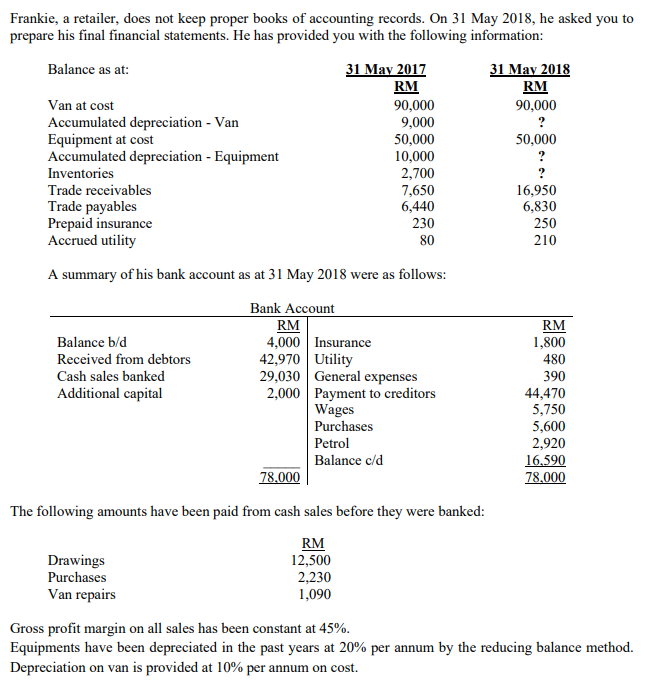

Frankie, a retailer, does not keep proper books of accounting records. On 31 May 2018, he asked you to prepare his final financial statements. He has provided you with the following information: Balance as at: 31 May 2017 31 May 2018 RM RM Van at cost 90,000 90,000 Accumulated depreciation - Van 9,000 ? Equipment at cost 50,000 50,000 Accumulated depreciation - Equipment 10,000 ? Inventories 2,700 Trade receivables 7,650 16,950 Trade payables 6,440 6,830 Prepaid insurance 230 250 Accrued utility 80 210 A summary of his bank account as at 31 May 2018 were as follows: Balance b/d Received from debtors Cash sales banked Additional capital Bank Account RM 4,000 Insurance 42,970 Utility 29,030 General expenses 2,000 Payment to creditors Wages Purchases Petrol Balance c/d 78.000 RM 1,800 480 390 44,470 5,750 5,600 2,920 16.590 78,000 The following amounts have been paid from cash sales before they were banked: RM Drawings 12,500 Purchases 2,230 Van repairs 1,090 Gross profit margin on all sales has been constant at 45%. Equipments have been depreciated in the past years at 20% per annum by the reducing balance method. Depreciation on van is provided at 10% per annum on costStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started