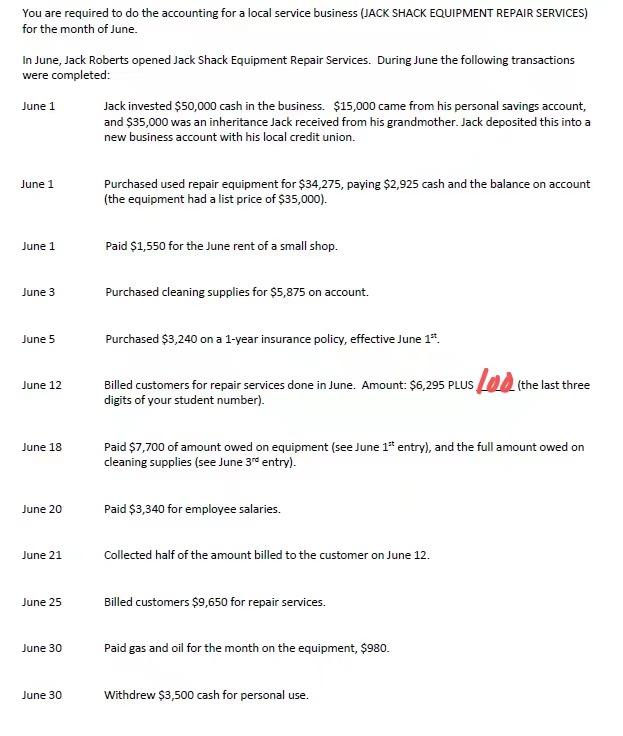

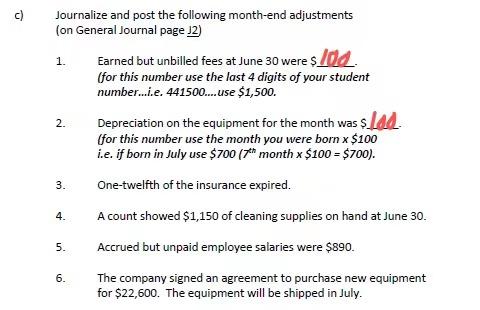

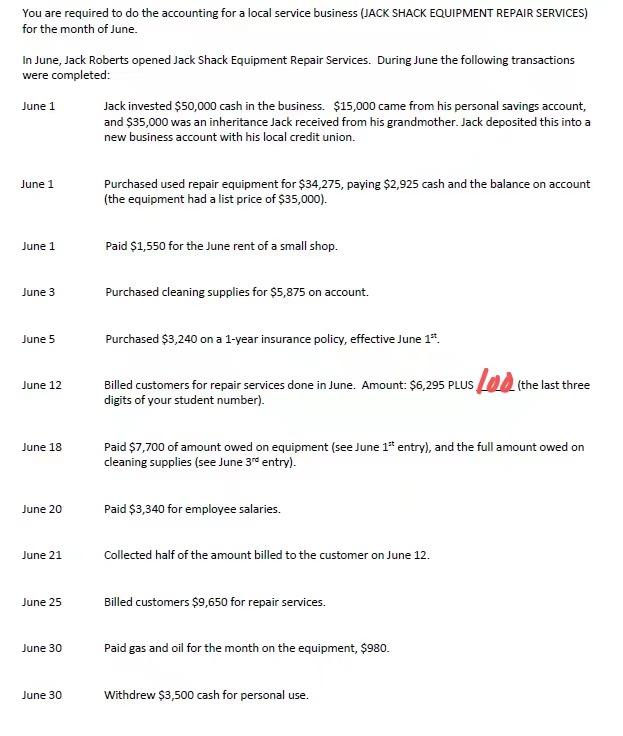

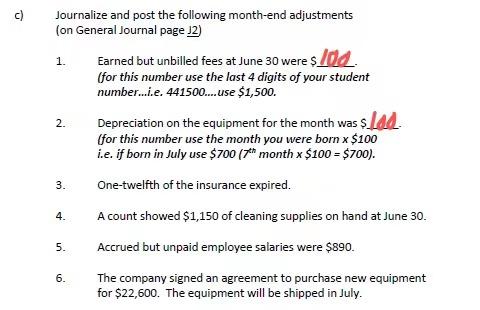

You are required to do the accounting for a local service business (JACK SHACK EQUIPMENT REPAIR SERVICES) for the month of June. In June, Jack Roberts opened Jack Shack Equipment Repair Services. During June the following transactions were completed: June 1 Jack invested $50,000 cash in the business. $15,000 came from his personal savings account, and $35,000 was an inheritance Jack received from his grandmother. Jack deposited this into a new business account with his local credit union. June 1 Purchased used repair equipment for $34,275, paying $2,925 cash and the balance on account (the equipment had a list price of $35,000). June 1 Paid $1,550 for the June rent of a small shop. June 3 Purchased cleaning supplies for $5,875 on account. June 5 Purchased $3,240 on a 1-year insurance policy, effective June 1* June 12 Lod (the last three Billed customers for repair services done in June. Amount: $6,295 PLUS digits of your student number). June 18 Paid $7,700 of amount owed on equipment (see June 1* entry), and the full amount owed on cleaning supplies (see June 30 entry). June 20 Paid $3,340 for employee salaries. June 21 Collected half of the amount billed to the customer on June 12. June 25 Billed customers $9,650 for repair services. June 30 Paid gas and oil for the month on the equipment, $980. June 30 Withdrew $3,500 cash for personal use. c) c) 1. 2. Journalize and post the following month-end adjustments (on General Journal page 12) Earned but unbilled fees at June 30 were s/dd. (for this number use the last 4 digits of your student number....e. 441500....use $1,500. Depreciation on the equipment for the month was slad (for this number use the month you were born x $100 i.e. if born in July use $ 700 (7" month x $100 = $700). One-twelfth of the insurance expired. 4. A count showed $1,150 of cleaning supplies on hand at June 30. Accrued but unpaid employee salaries were $890. . 3. 5. . 6. The company signed an agreement to purchase new equipment for $22,600. The equipment will be shipped in July. JACK SHACK EQUIPMENT REPAIR SERVICES Adjusted Trial Balance June 30th