Answered step by step

Verified Expert Solution

Question

1 Approved Answer

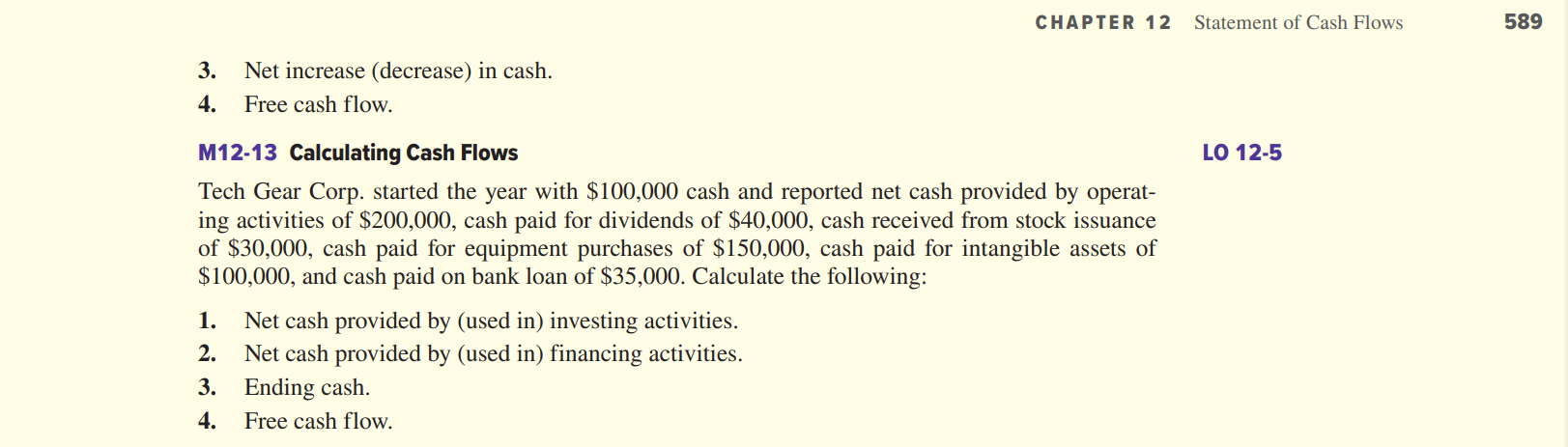

You are required to do the following: 1)Using the information provided in M12-13 Textbook p. 589, complete a Statement of Cash Flow for Tech Gear

You are required to do the following:

1)Using the information provided in M12-13 Textbook p. 589, complete a Statement of Cash Flow for Tech Gear Corporation (you may use year-end December 2021 for the date).

2) Evaluate the cash flows included in your completed statement. Refer to pp.571-573 as your guide for the evaluation. You may also be guided by the following questions:

- Does the company generate sufficient cash from the use of current assets and liabilities (or operating activities)?

- What are its major sources (inflows) and uses (outflows) of cash during the period?

- Did the companys cash balance increase or decrease during the period? How much?

- Based on the cash flows from three activities, is the company healthy overall? Why do you say so?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started