Question

you are required to prepare parts of their financial statements and perform some analysis on their equity. For the first part of the Case Study,

you are required to prepare parts of their financial statements and perform some analysis on their equity. For the first part of the Case Study, you should us the excel template provided for your responses.

Case Study - Part 1

Early in 2014, Laird Industries was formed with authorization to issue 150,000 shares of $20 par value common stock and 10,000 shares of $100 par value cumulative preferred stock. During 2014, all the preferred stock was issued at par, and 80,000 shares of common stock were sold for $35 per share. The preferred stock is entitled to a dividend equal to 6 percent of its par value before any dividends are paid on the common stock.

During its first five years of business (2014 through 2018), the company earned income totaling $3,800,000 and paid dividends of 60 cents per share each year on the common stock outstanding.

On January 2, 2016, the company purchased 1,000 shares of its own common stock in the open market for $40,000. On January 2, 2018, it reissued 600 shares of this treasury stock for $30,000. The remaining 400 shares were still held in treasury at December 31, 2018.

Required:

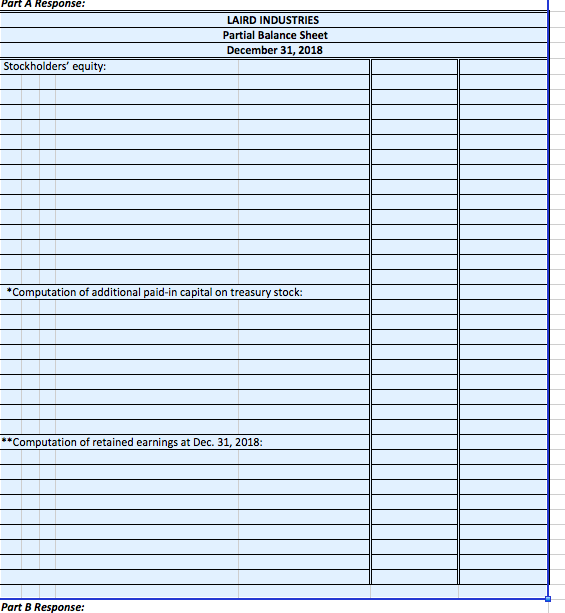

Prepare the stockholders equity section of the balance sheet at December 31, 2018. Include a supporting schedule showing (1) your computation of any paid-in capital on treasury stock and (2) retained earnings at the balance sheet date. (Hint: Dividends are not paid on shares of stock held in treasury).

As of December 31, 2018, compute the companys book value per share of common stock.

At December 31, 2018, shares of the companys common stock were trading at $56. Explain what would have happened to the market price per share had the company split its stock 2-for-1 at this date. Also explain would have happened to the par value of the common stock and to the number of common shares outstanding.

Answer Format

You will be required to use the Week 4 Case Study Template that has been included on the Case Study page in Engage. The template is an excel spreadsheet and has been set up for ease of completion and grading.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started