You are required to prepare the following for the month of December 2020 from the business transactions and additional information given above:

- Journal Entries for the month of December2020

- Adjusting Entries as at 31st December2020

- Ledger Accounts, posting of journal and adjusting entries thereof

- Unadjusted trial balance 31 December '2020.

- Adjusted Trial Balance 31st December2020

- Income Statement for the period ended 31st December2020

- Statement of Retained Earnings as at 31st December2020

- Balance Sheet as on 31st December2020

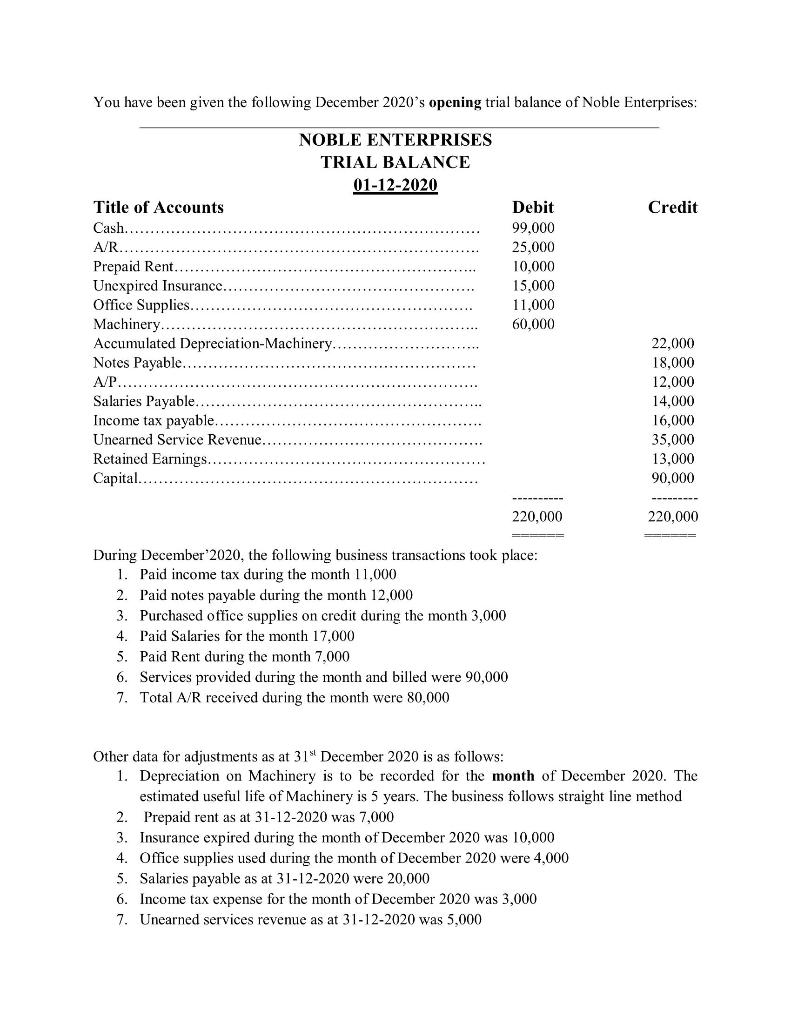

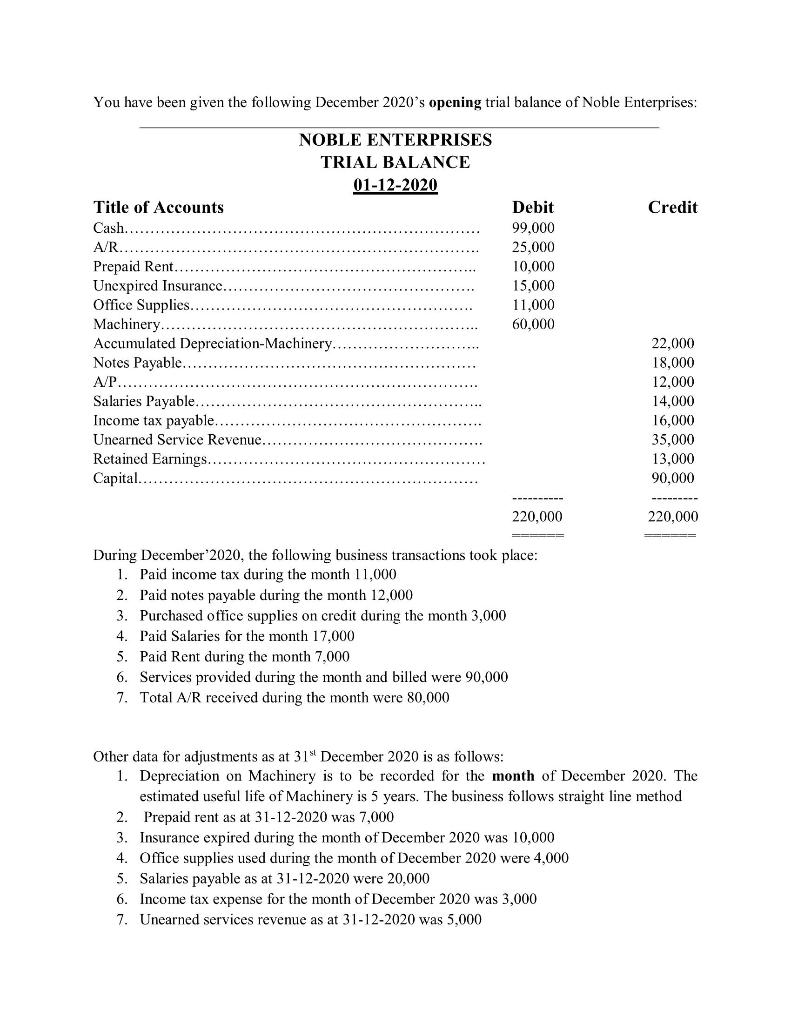

You have been given the following December 2020's opening trial balance of Noble Enterprises: Credit NOBLE ENTERPRISES TRIAL BALANCE 01-12-2020 Title of Accounts Cash. A/R. Prepaid Rent. Unexpired Insurance. Office Supplies...... Machinery..... Accumulated Depreciation-Machinery Notes Payable.. A/P. Salaries Payable. Income tax payable.. Unearned Service Revenue. Retained Earnings.... Capital. Debit 99.000 25,000 10,000 15,000 11,000 60.000 22.000 18,000 12,000 14,000 16,000 35,000 13,000 90,000 220,000 220,000 == During December 2020, the following business transactions took place: 1. Paid income tax during the month 11,000 2. Paid notes payable during the month 12,000 3. Purchased office supplies on credit during the month 3,000 4. Paid Salaries for the month 17,000 5. Paid Rent during the month 7,000 6. Services provided during the month and billed were 90,000 7. Total A/R received during the month were 80,000 Other data for adjustments as at 31 December 2020 is as follows: 1. Depreciation on Machinery is to be recorded for the month of December 2020. The estimated useful life of Machinery is 5 years. The business follows straight line method 2. Prepaid rent as at 31-12-2020 was 7,000 3. Insurance expired during the month of December 2020 was 10,000 4. Office supplies used during the month of December 2020 were 4,000 5. Salaries payable as at 31-12-2020 were 20,000 6. Income tax expense for the month of December 2020 was 3,000 7. Unearned services revenue as at 31-12-2020 was 5,000 You have been given the following December 2020's opening trial balance of Noble Enterprises: Credit NOBLE ENTERPRISES TRIAL BALANCE 01-12-2020 Title of Accounts Cash. A/R. Prepaid Rent. Unexpired Insurance. Office Supplies...... Machinery..... Accumulated Depreciation-Machinery Notes Payable.. A/P. Salaries Payable. Income tax payable.. Unearned Service Revenue. Retained Earnings.... Capital. Debit 99.000 25,000 10,000 15,000 11,000 60.000 22.000 18,000 12,000 14,000 16,000 35,000 13,000 90,000 220,000 220,000 == During December 2020, the following business transactions took place: 1. Paid income tax during the month 11,000 2. Paid notes payable during the month 12,000 3. Purchased office supplies on credit during the month 3,000 4. Paid Salaries for the month 17,000 5. Paid Rent during the month 7,000 6. Services provided during the month and billed were 90,000 7. Total A/R received during the month were 80,000 Other data for adjustments as at 31 December 2020 is as follows: 1. Depreciation on Machinery is to be recorded for the month of December 2020. The estimated useful life of Machinery is 5 years. The business follows straight line method 2. Prepaid rent as at 31-12-2020 was 7,000 3. Insurance expired during the month of December 2020 was 10,000 4. Office supplies used during the month of December 2020 were 4,000 5. Salaries payable as at 31-12-2020 were 20,000 6. Income tax expense for the month of December 2020 was 3,000 7. Unearned services revenue as at 31-12-2020 was 5,000