You are required to prepare the following quarterly budgets and schedules with a total column, for XYZ Company:

1. Direct materials purchase budget

2. Year-end inventories budget for direct materials and finished goods

You have just been hired as a new graduate trainee management accountant at XYZ Company. As a graduate trainee, you have been given direct responsibility for all planning and budgeting. Your first task is to prepare a master budget. You have gathered the following information below.

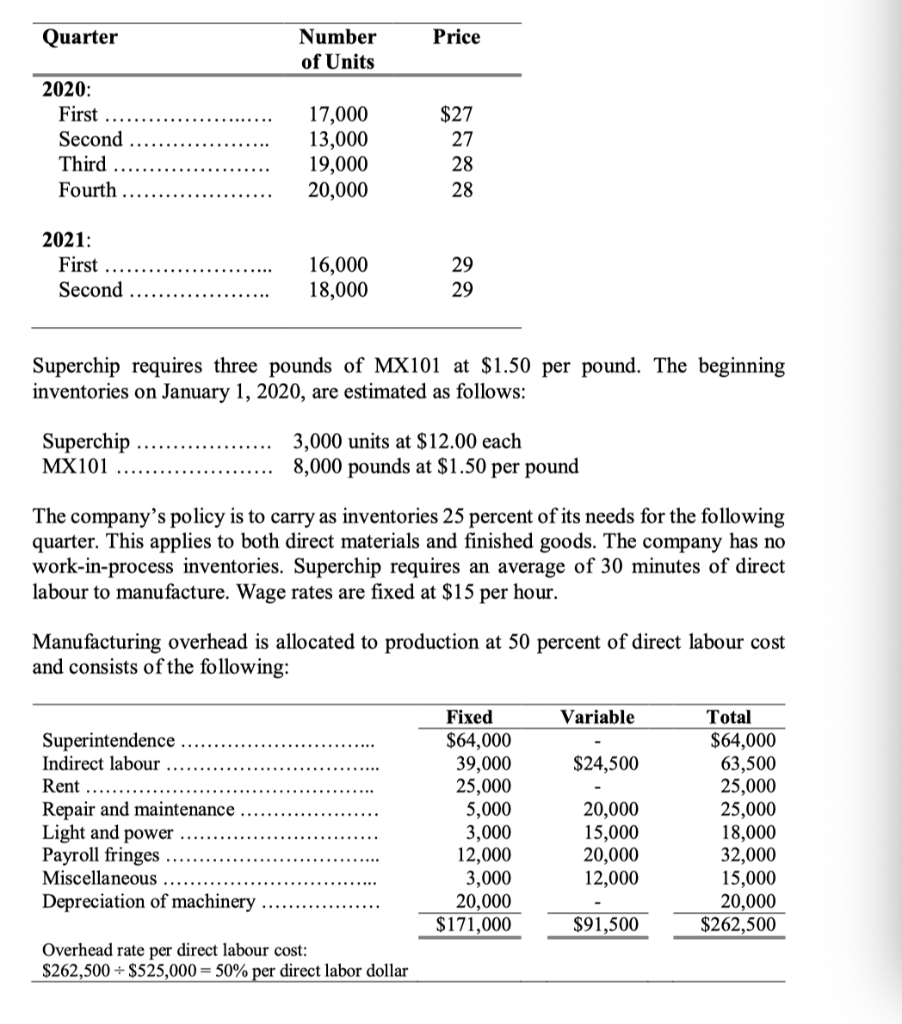

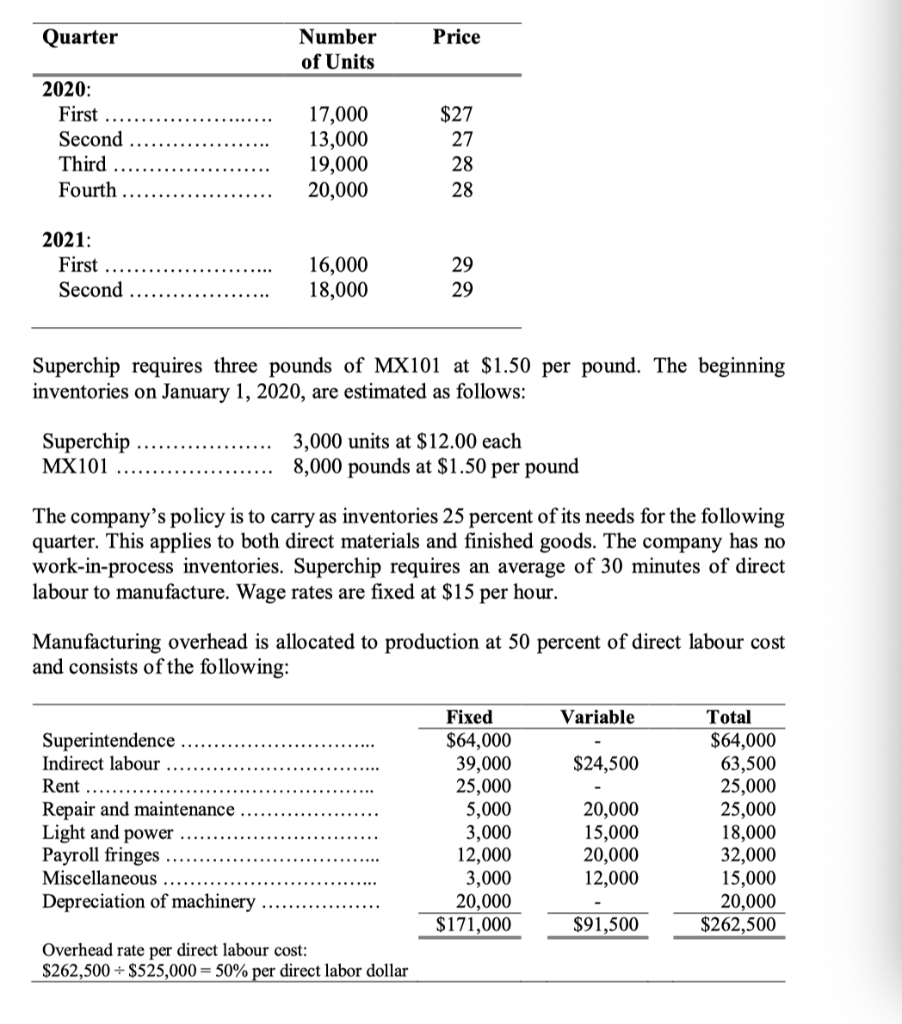

XYZ Company manufactures one product, Superchip. The sales forecast for 2020 and expected selling prices of Superchip are as follows:

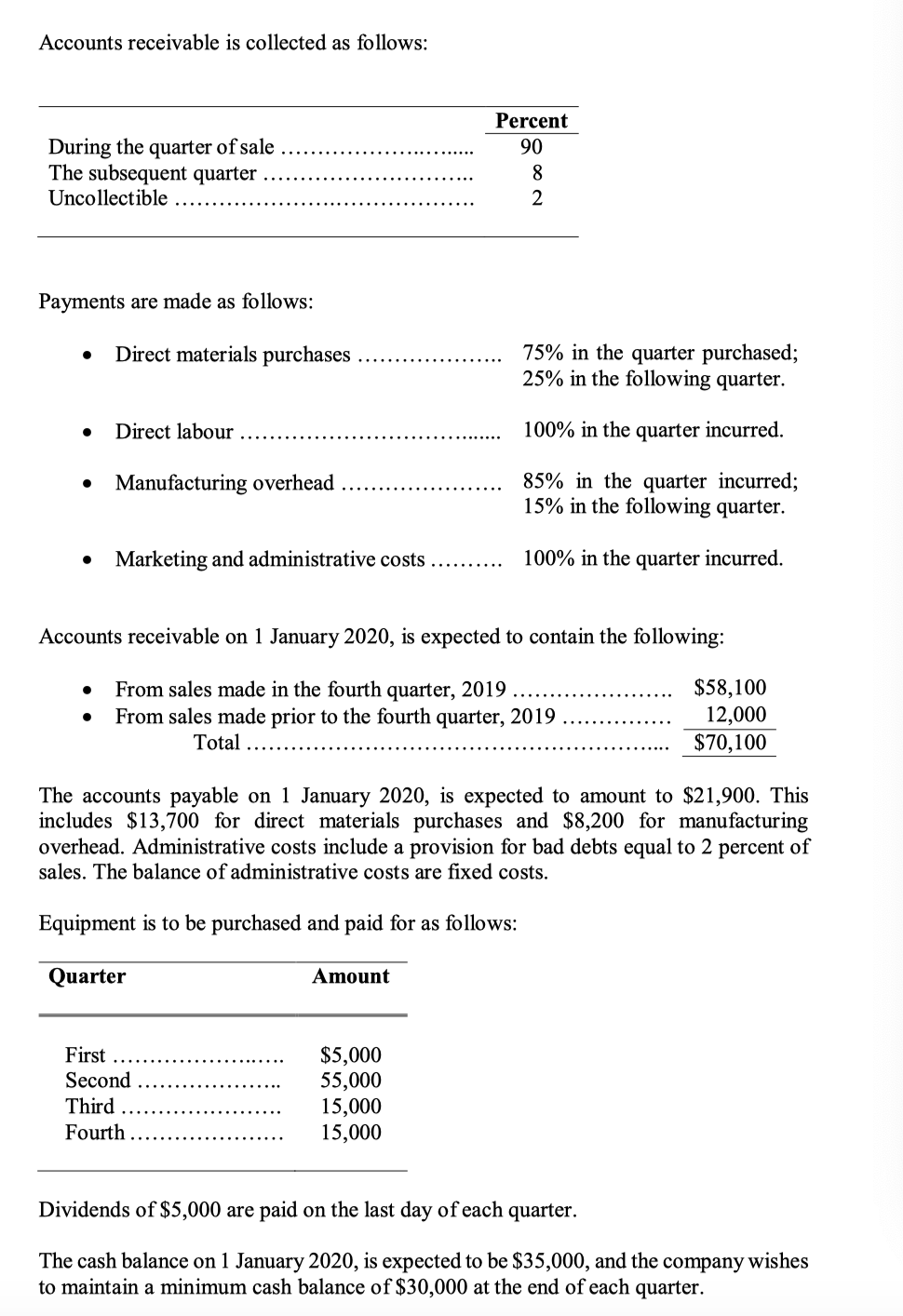

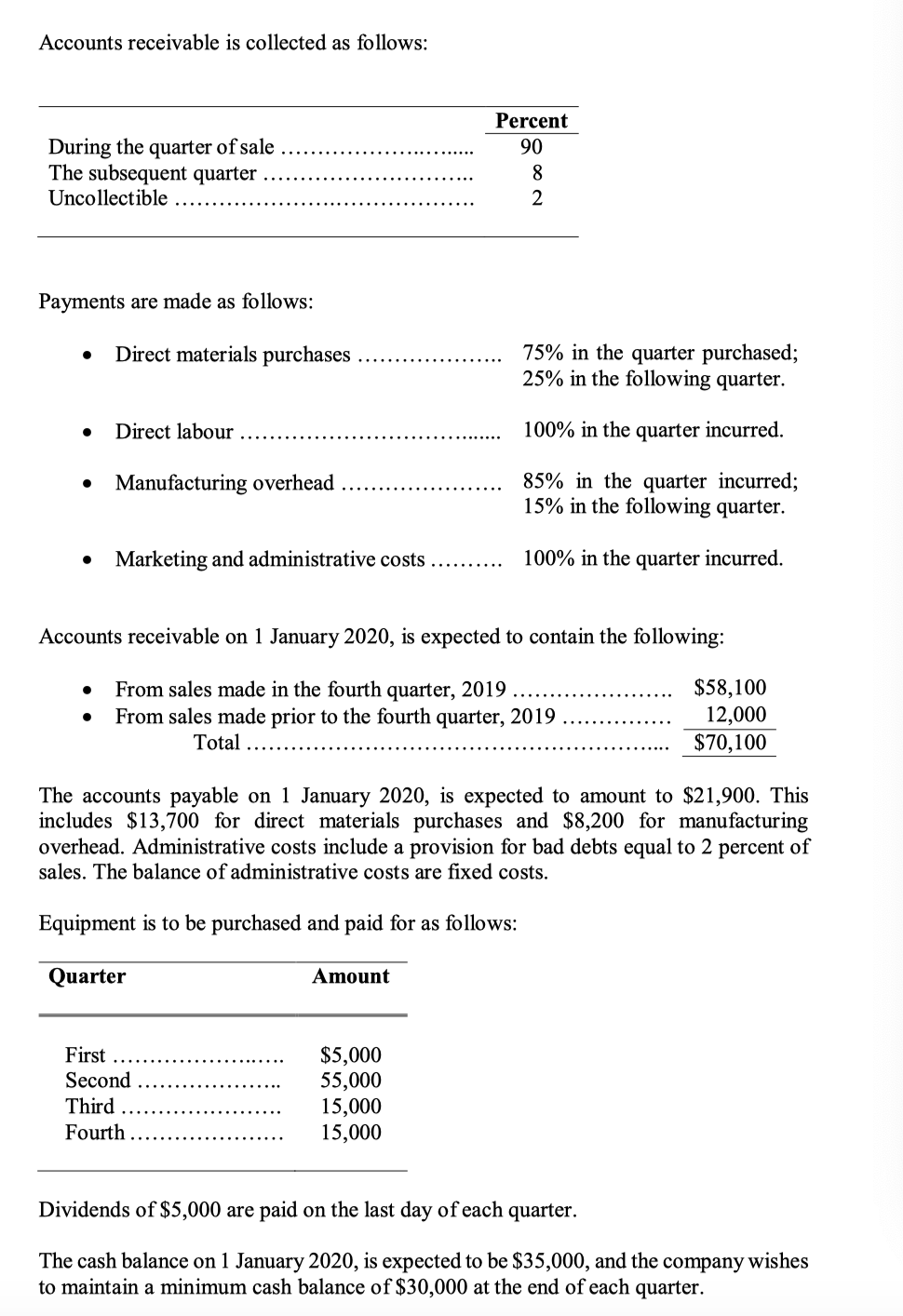

The company has an arrangement with its bank to borrow money at a 12 percent interest rate. Borrowings, if needed, are made on the last day of the quarter, and maximum repayments are made on the last day of the quarter when the cash balance exceeds $30,000.

During the year, $12,000 of accounts receivable is expected to be written off against the allowance for uncollectibles.

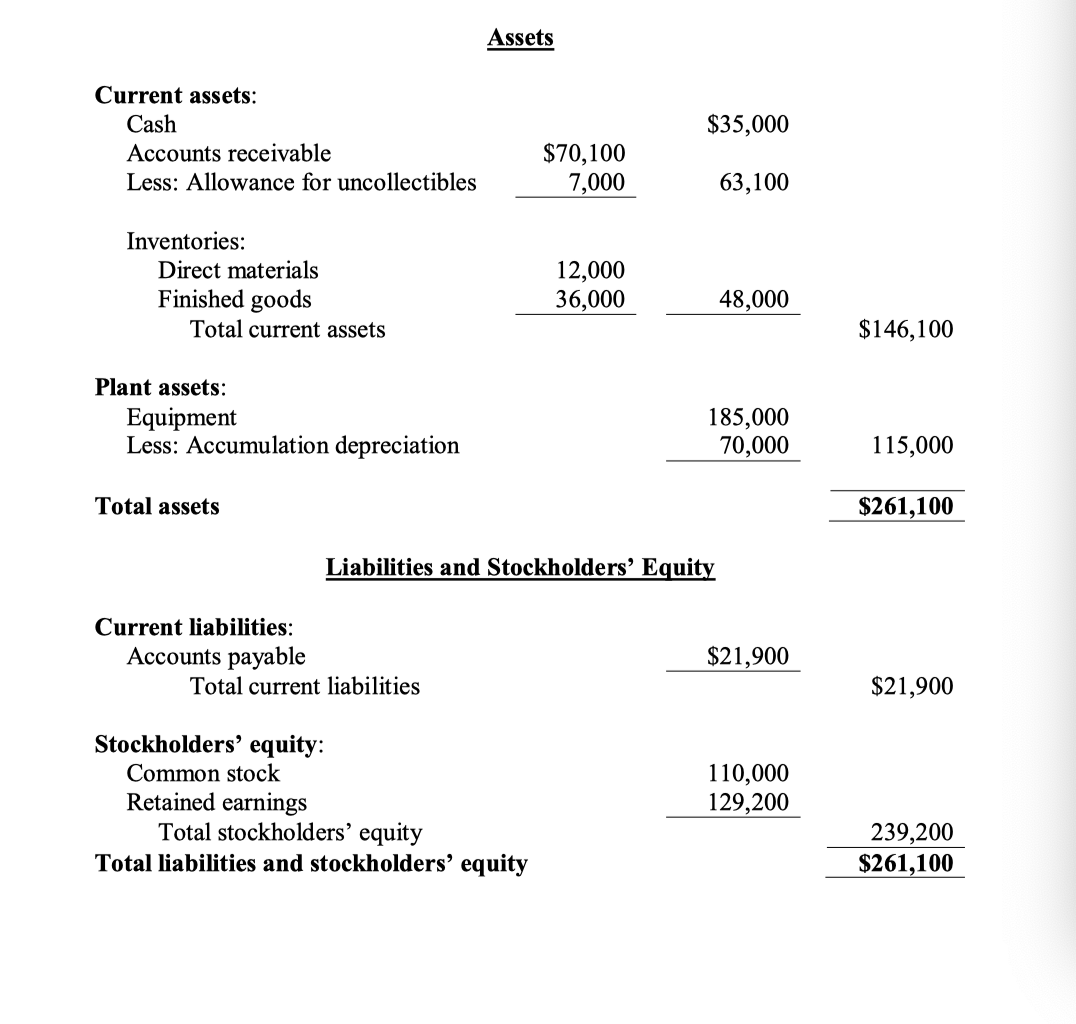

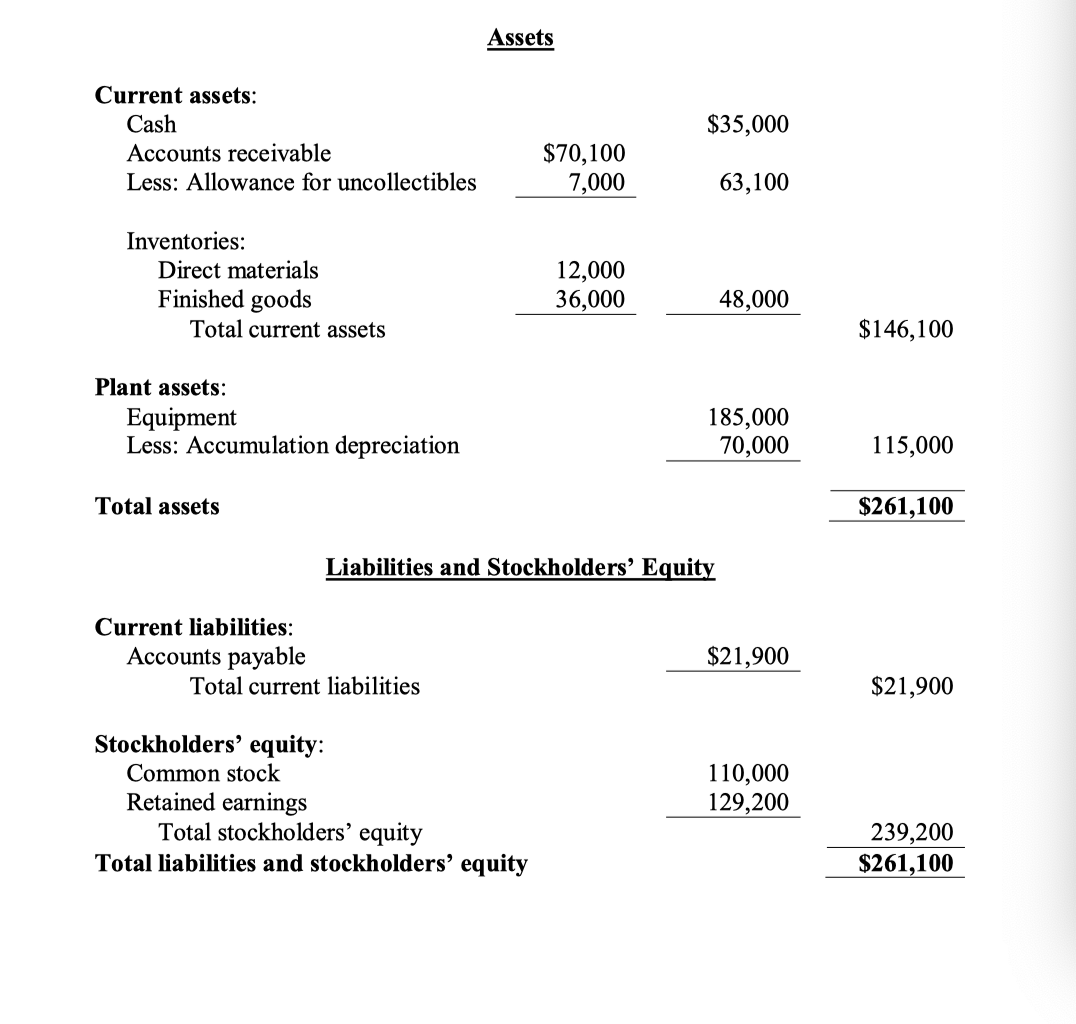

The companys budget balance sheet at 1 January 2020, is as follows:

XYZ Company

Budgeted Balance Sheet

As at 1 st January 2020

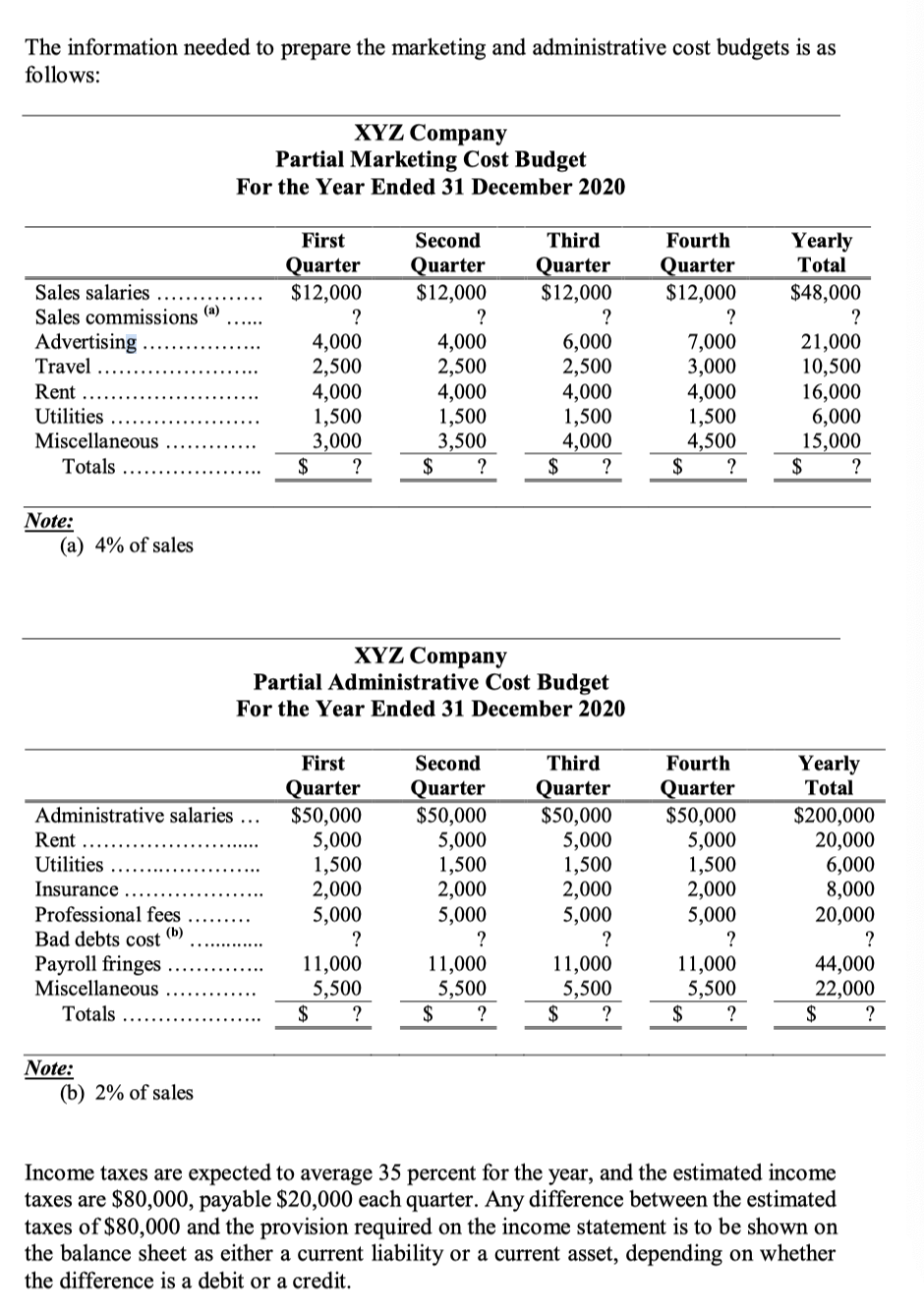

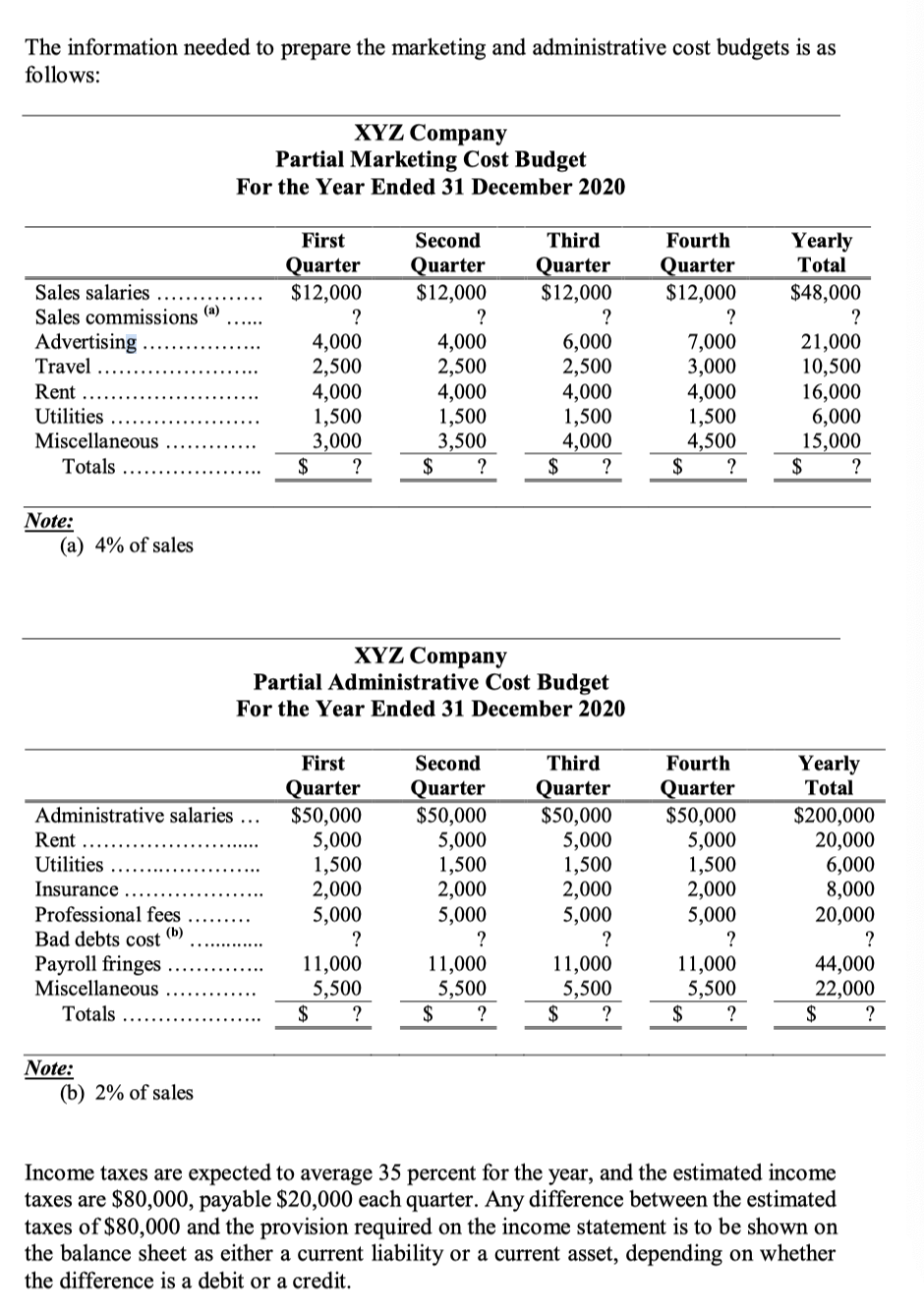

Quarter Price Number of Units $27 2020: First ..... Second Third Fourth 17,000 13,000 19,000 20,000 2021: First Second ... 16,000 18,000 Superchip requires three pounds of MX101 at $1.50 per pound. The beginning inventories on January 1, 2020, are estimated as follows: Superchip ................... 3,000 units at $12.00 each MX101 ...................... 8,000 pounds at $1.50 per pound The company's policy is to carry as inventories 25 percent of its needs for the following quarter. This applies to both direct materials and finished goods. The company has no work-in-process inventories. Superchip requires an average of 30 minutes of direct labour to manufacture. Wage rates are fixed at $15 per hour. Manufacturing overhead is allocated to production at 50 percent of direct labour cost and consists of the following: Variable Fixed $64,000 39,000 25,000 $24,500 5,000 Superintendence ...... Indirect labour. Rent ...... Repair and maintenance ... Light and power ............ Payroll fringes ...... Miscellaneous Depreciation of machinery ........... Total $64,000 63,500 25,000 25,000 18,000 32,000 15,000 20,000 $262,500 20,000 15,000 20,000 12,000 3,000 12,000 3,000 20,000 $171,000 $91,500 Overhead rate per direct labour cost: $262,500 - $525,000 = 50% per direct labor dollar The information needed to prepare the marketing and administrative cost budgets is as follows: XYZ Company Partial Marketing Cost Budget For the Year Ended 31 December 2020 First Quarter $12,000 Second Quarter $12,000 Third Quarter $12,000 Fourth Quarter $12,000 Yearly Total $48,000 2 Sales salaries ........ Sales commissions (a) .... Advertising Travel .... Rent ............. Utilities ........ Miscellaneous .... Totals ...... 4,000 2,500 4,000 1,500 3,000 $ ? 4,000 2,500 4,000 1,500 3,500 $ ? 6,000 2,500 4,000 1,500 4,000 $ ? 7,000 3,000 4,000 1,500 4,500 $ ? 21,000 10,500 16,000 6,000 15,000 $ ? Note: (a) 4% of sales XYZ Company Partial Administrative Cost Budget For the Year Ended 31 December 2020 First Second Quarter $50,000 5,000 1,500 2,000 5,000 Quarter $50,000 5,000 1,500 2,000 5,000 Third Quarter $50,000 5,000 1,500 2,000 5,000 Fourth Quarter $50,000 5,000 1,500 2,000 Yearly Total $200,000 20,000 Administrative salaries ... Rent. Utilities .............. Insurance .......... Professional fees Bad debts cost (5) Payroll fringes ...... Miscellaneous Totals .......... 6,000 8,000 20,000 5,000 11,000 5,500 $ 11,000 5,500 $ ? 11,000 5,500 $ ? 11,000 5,500 $ ? 44,000 22,000 $ ? Note: (b) 2% of sales Income taxes are expected to average 35 percent for the year, and the estimated income taxes are $80,000, payable $20,000 each quarter. Any difference between the estimated taxes of $80,000 and the provision required on the income statement is to be shown on the balance sheet as either a current liability or a current asset, depending on whether the difference is a debit or a credit. Accounts receivable is collected as follows: Percent 90 During the quarter of sale. The subsequent quarter ........ Uncollectible ...... Payments are made as follows: Direct materials purchases 75% in the quarter purchased; 25% in the following quarter. 100% in the quarter incurred. Direct labour Manufacturing overhead .................... 85% in the quarter incurred; 15% in the following quarter. Marketing and administrative costs .......... 100% in the quarter incurred. Accounts receivable on 1 January 2020, is expected to contain the following: From sales made in the fourth quarter, 2019 ........ From sales made prior to the fourth quarter, 2019 ..... Total $58,100 12,000 .. $70,100 The accounts payable on 1 January 2020, is expected to amount to $21,900. This includes $13,700 for direct materials purchases and $8,200 for manufacturing overhead. Administrative costs include a provision for bad debts equal to 2 percent of sales. The balance of administrative costs are fixed costs. Equipment is to be purchased and paid for as follows: Quarter Amount First ....... Second .. Third ................ Fourth ........ $5,000 55,000 15,000 15,000 Dividends of $5,000 are paid on the last day of each quarter. The cash balance on 1 January 2020, is expected to be $35,000, and the company wishes to maintain a minimum cash balance of $30,000 at the end of each quarter. Assets Current assets: Cash Accounts receivable Less: Allowance for uncollectibles $35,000 $70,100 7,000 63,100 Inventories: Direct materials Finished goods Total current assets 12,000 36,000 48,000 $146,100 Plant assets: Equipment Less: Accumulation depreciation 185,000 70,000 115,000 Total assets $261,100 Liabilities and Stockholders' Equity Current liabilities: Accounts payable Total current liabilities $21,900 $21,900 Stockholders' equity: Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 110,000 129,200 239,200 $261,100