Question

You are required to read carefully the scenario and answer any FIVE (5) of the questions that follow. Do not answer only theoretically; utilise the

You are required to read carefully the scenario and answer any FIVE (5) of the questions that follow. Do not answer only theoretically; utilise the given situation in your discussions, backed by appropriate examples where possible. Each question is valued 10 marks.

Favia is from a family of entrepreneurs; her father and grandfather successfully operated a grocery shop and a mini-supermarket in Kingston and St. Thomas. Shortly after high school, Favia, who has a "sweet tooth," decided to launch a home-made syrup on the market, and she aptly called it Flava's Syrup.?

At first Flava's syrup came only in strawberry then after a few months she added a cherry, a lemon and an orange flavor, which all performed fairly well on the market. During her fourth year in business, Favia launched a new lime juice, not surprisingly labeled Flava's Lime Juice.?

After ten years in the business, the innovation itch has once more infected Favia; this time she is planning to introduce to the market a new flavoured mineral bottled water - in natural, melon and lemon flavours. While Favia is excited, she also has some concerns: how will the mineral water performs? How could it possibly impact her existing product line? What about the profit potential of her existing products? She calls on you for advice.

Required:

Answer ANY FIVE (5) of the questions below; each is valued 10 marks.?

1. Explain to Favia ANY THREE (3) individual product decisions that she will have to make about the new mineral water.

2. What is brand sponsorship? Advise Favia how this applies to her new product

3. Differentiate between brand extension and line extension. How are these concepts related to Favia's business?

4. What is a product life cycle (PLC)? Construct a PLC chart for Flava's syrup and explain the stages to Favia.

5. Should Favia adapt a value-based or a cost-based approach to pricing the new product? Justify your answer.

6. Two of Favia's biggest competitors are Cal's and Lasco. If any of these entities changes their product prices, what are the possible responses that Favia could take?

7. Segmented pricing and psychological pricing: how could Favia utilize these strategies to generate more revenue from her products?

8. For the new mineral water, should Favia use direct or indirect marketing channels? Discuss the pros and cons.

9. In order to generate a bit more revenue from her syrup, Favia decided to increase the product price from $150 per bottle to $165; this resulted in monthly sales falling from 400 bottles to 320. Calculate the price elasticity of the syrup and give Favia some appropriate advice.

10. Favia introduced a new type of fruit drink to the market in the Kingston area. She needs some advice on the best price for this new product, and the ideal amount she should produce each month; here are some details:

Variable cost per bottle of fruit drink = $100; fixed costs per month = $60,000; expected sales per month = 400 bottles of drink. Favia desires a 25% return on sales (markup)

Required: Advise Favia of the following:

- The mark-up price per bottle of drink.

- The break-even number of bottles of drinks she needs to sell per month.?

(Refer to formulas below)

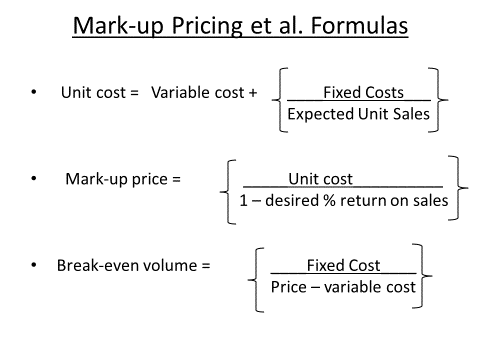

Mark-up Pricing et al. Formulas Unit cost Variable cost + Mark-up price = Break-even volume = Fixed Costs Expected Unit Sales Unit cost 1 - desired % return on sales Fixed Cost Price - variable cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Individual Product Decisions for New Mineral Water a Flavors Favia needs to decide on the flavors for her new mineral water The choice of flavors can ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started