Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are required to select a large company listed in any of the global Stock Exchanges ( real company ) . It is important that

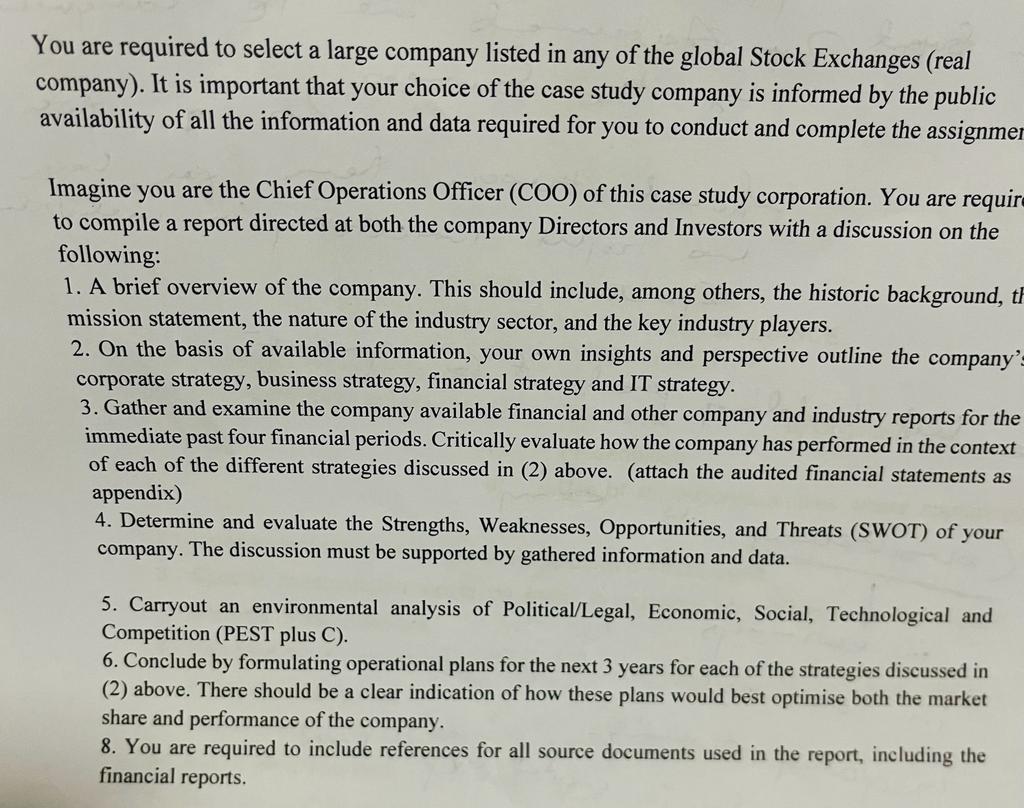

You are required to select a large company listed in any of the global Stock Exchanges real

company It is important that your choice of the case study company is informed by the public

availability of all the information and data required for you to conduct and complete the assignmer

Imagine you are the Chief Operations Officer COO of this case study corporation. You are requir

to compile a report directed at both the company Directors and Investors with a discussion on the

following:

A brief overview of the company. This should include, among others, the historic background,

mission statement, the nature of the industry sector, and the key industry players.

On the basis of available information, your own insights and perspective outline the company'

corporate strategy, business strategy, financial strategy and IT strategy.

Gather and examine the company available financial and other company and industry reports for the

immediate past four financial periods. Critically evaluate how the company has performed in the context

of each of the different strategies discussed in above. attach the audited financial statements as

appendix

Determine and evaluate the Strengths, Weaknesses, Opportunities, and Threats SWOT of your

company. The discussion must be supported by gathered information and data.

Carryout an environmental analysis of PoliticalLegal Economic, Social, Technological and

Competition PEST plus C

Conclude by formulating operational plans for the next years for each of the strategies discussed in

above. There should be a clear indication of how these plans would best optimise both the market

share and performance of the company.

You are required to include references for all source documents used in the report, including the

financial reports.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started