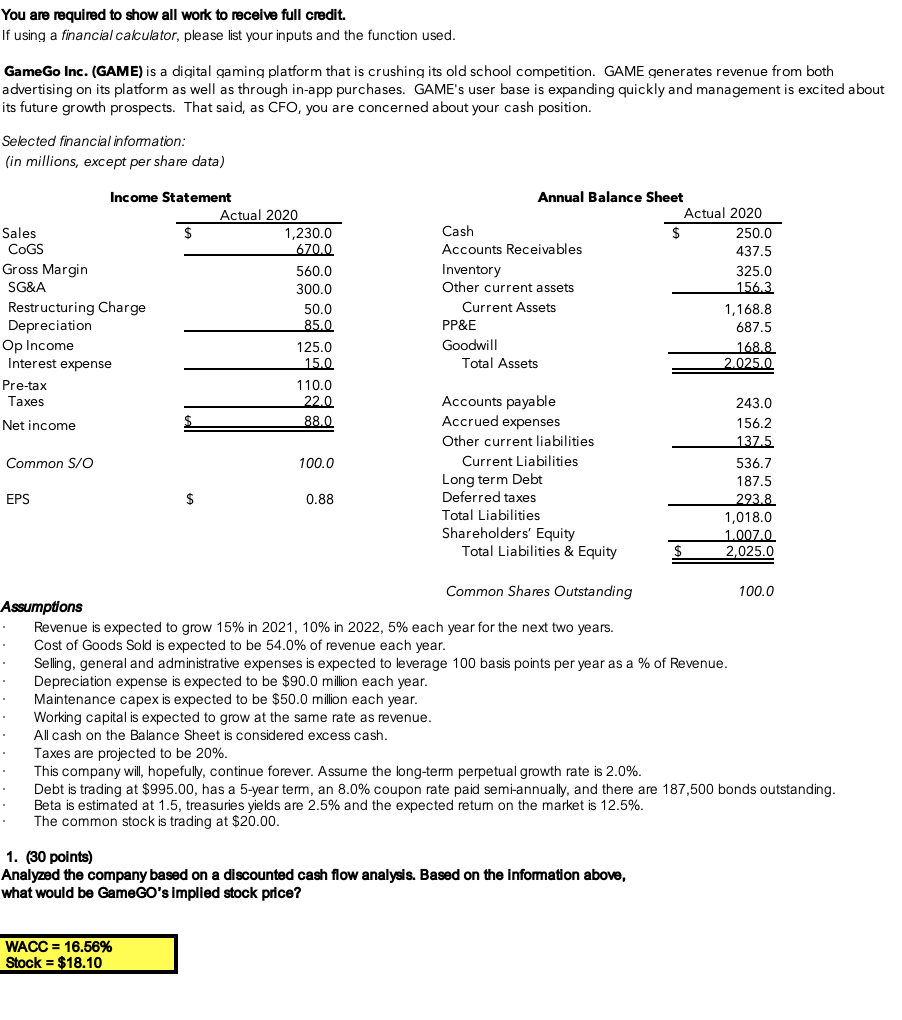

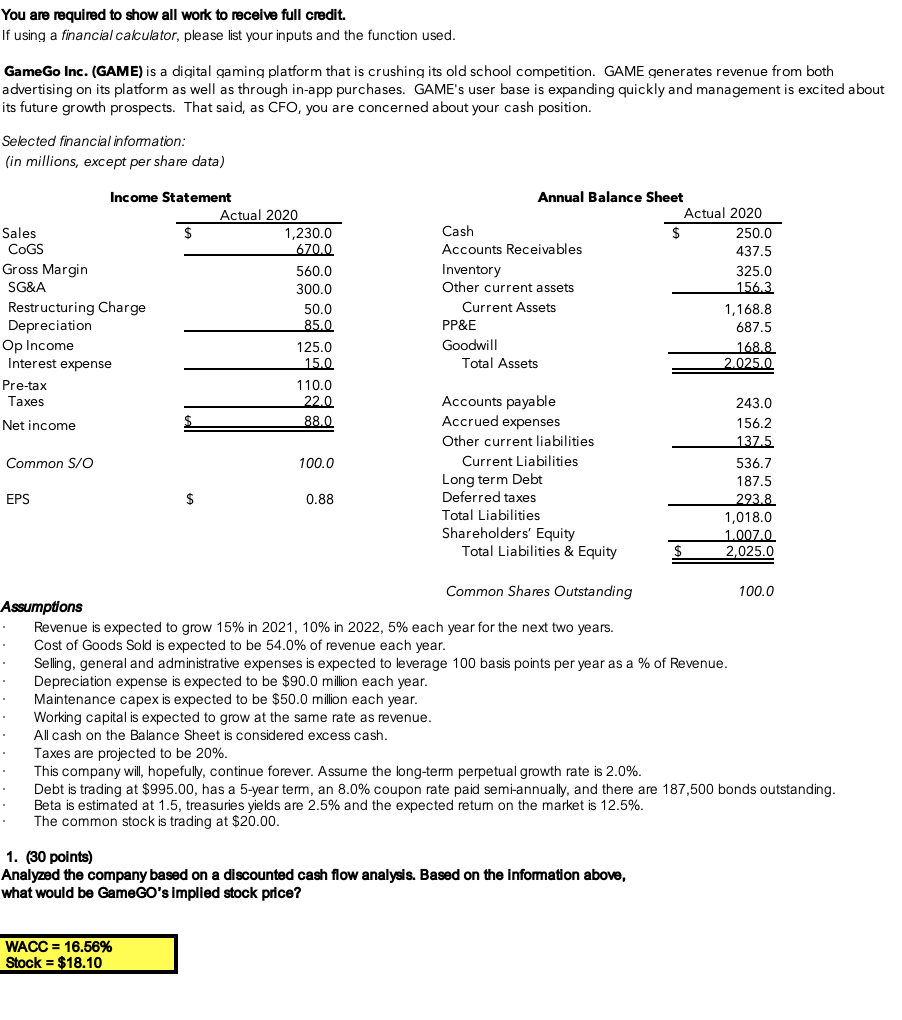

You are required to show all work to recelve full credit. If using a financial calculator, please list your inputs and the function used. GameGo Inc. (GAME) is a digital gaming platform that is crushing its old school competition. GAME generates revenue from both advertising on its platform as well as through in-app purchases. GAME's user base is expanding quickly and management is excited about its future growth prospects. That said, as CFO, you are concerned about your cash position. Selected financial information: (in millions, except per share data) Common Shares Outstanding 100.0 Assumptions Revenue is expected to grow 15% in 2021,10% in 2022,5% each year for the next two years. Cost of Goods Sold is expected to be 54.0% of revenue each year. Selling, general and administrative expenses is expected to leverage 100 basis points per year as a % of Revenue. Depreciation expense is expected to be $90.0 million each year. Maintenance capex is expected to be $50.0 million each year. Working capital is expected to grow at the same rate as revenue. All cash on the Balance Sheet is considered excess cash. Taxes are projected to be 20%. This company will, hopefully, continue forever. Assume the long-term perpetual growth rate is 2.0%. Debt is trading at $995.00, has a 5-year term, an 8.0% coupon rate paid semi-annually, and there are 187,500 bonds outstanding. Beta is estimated at 1.5 , treasuries yields are 2.5% and the expected return on the market is 12.5%. The common stock is trading at $20.00. 1. (30 points) Analyzed the company based on a discounted cash flow analysis. Based on the information above, what would be GameGO's implied stock price? You are required to show all work to recelve full credit. If using a financial calculator, please list your inputs and the function used. GameGo Inc. (GAME) is a digital gaming platform that is crushing its old school competition. GAME generates revenue from both advertising on its platform as well as through in-app purchases. GAME's user base is expanding quickly and management is excited about its future growth prospects. That said, as CFO, you are concerned about your cash position. Selected financial information: (in millions, except per share data) Common Shares Outstanding 100.0 Assumptions Revenue is expected to grow 15% in 2021,10% in 2022,5% each year for the next two years. Cost of Goods Sold is expected to be 54.0% of revenue each year. Selling, general and administrative expenses is expected to leverage 100 basis points per year as a % of Revenue. Depreciation expense is expected to be $90.0 million each year. Maintenance capex is expected to be $50.0 million each year. Working capital is expected to grow at the same rate as revenue. All cash on the Balance Sheet is considered excess cash. Taxes are projected to be 20%. This company will, hopefully, continue forever. Assume the long-term perpetual growth rate is 2.0%. Debt is trading at $995.00, has a 5-year term, an 8.0% coupon rate paid semi-annually, and there are 187,500 bonds outstanding. Beta is estimated at 1.5 , treasuries yields are 2.5% and the expected return on the market is 12.5%. The common stock is trading at $20.00. 1. (30 points) Analyzed the company based on a discounted cash flow analysis. Based on the information above, what would be GameGO's implied stock price