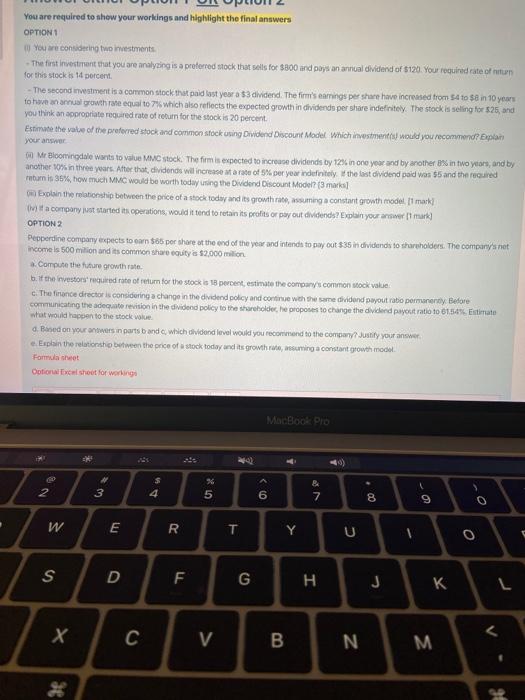

You are required to show your workings and highlight the final answers OPTION 1 You are considering two westments. The first investment that you are analyzing is a preferred stock that sells for $300 and pays an annual dividend of $120. Your required rate of ritun for this stock is a percent - The second investment is a common stock that paid last year a $3 dividend. The firm's earnings per share have increased from $4 to $8 in 10 years to have an annual growth rate equal to 7 which also reflects the expected growth in dividenda per share indefinitely. The stock is selling for $25, and you think an appropriate required rate of return for the stock is 20 percent Estimate the value of the preferred stock and corninon stock uning Dividend Discount Model which investment would you recommand? Baplati your answer on Mr Bloomingdale wants to value MC stock. The firm is expected to increase dividends by 1236 in one year and by another art in two years, and by another 10% in three years. After that, dividends will increase ata rate of SM per year definitely the last dividend paid was $5 and the recured return is 35%, how much MMC would be worth today using the Dividend Discount Model? (3 markal Explain the relationship between the price of a stock today and its growth rate, assuming a constant growth model. [1 mark) ita company it started its operations, would it tend to retain ts profits or pay out dividende? Explain your over i mark) OPTION 2 Pepperdine company expects to earn $65 por share at the end of the year and intends to pay out $35 in dividends to shareholders. The company's net income is 500 million and its common share equity is $2.000 milion Compute the future growth rate b. If the nvestors required rate of return for the stock is 18 percentestimate the company's common stock value c. The finance director is considering a change in the dividend policy and continue with the same dividend payout rabo permanenty Before communicating the adequate revision in the dividend policy to the shareholder, he proposes to change the dividend payout ratio to 016496. Estimate what would happen to the stock value . Baned on your ontwers in parts and which dividend level would you recommend to the company? Justify your answer e. Explain the relationship between the price of a stock today and its growthaming a constant growth model Formulash Cotional Excel shoot for working MacBook Pro NO 3 $ 4 % 5 6 B 7 8 9 W E R T Y 0 S D F G H J L C