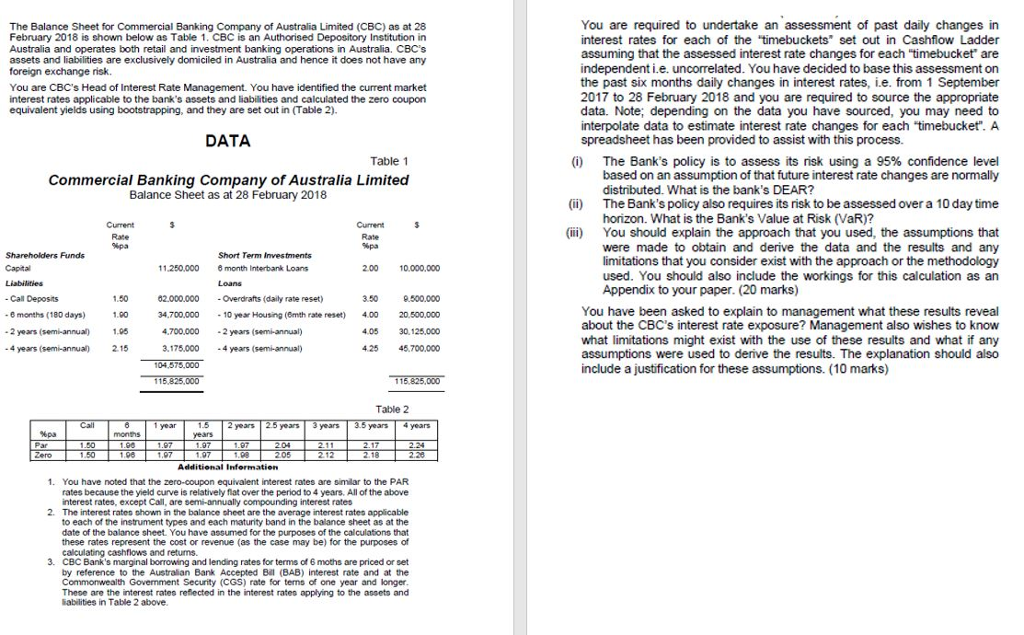

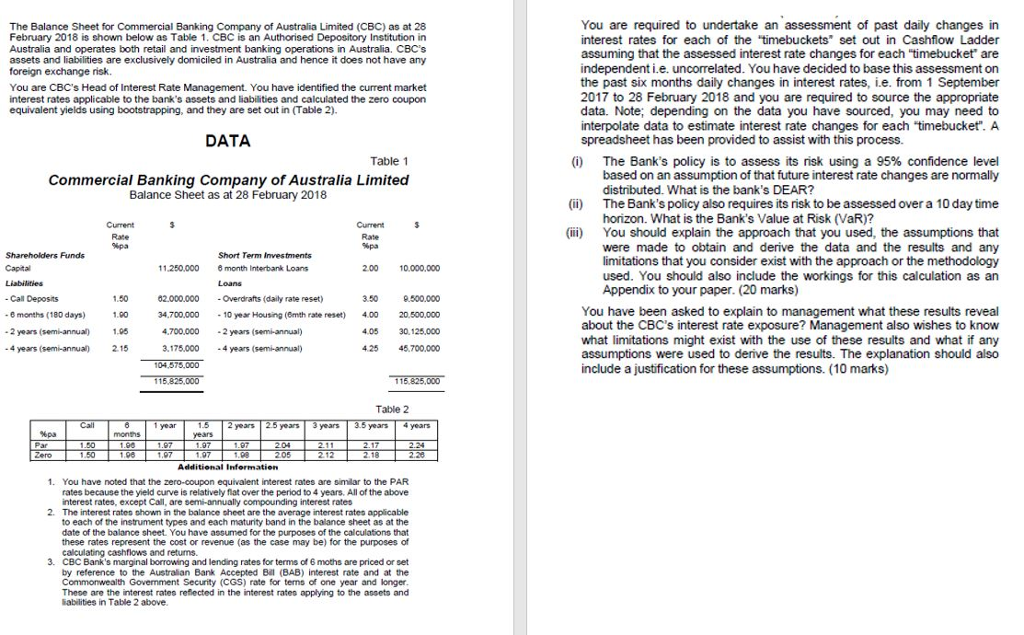

You are required to undertake an assessment of past daily changes in interest rates for each of the timebuckets" set out in Cashflow Ladder assuming that the assessed interest rate changes for each "timebucket' are independent i.e. uncorrelated. You have decided to base this assessment on the past six months daily changes in interest rates, i.e. from 1 September 2017 to 28 February 2018 and you are required to source the appropriate data. Note; depending on the data you have sourced, you may need to interpolate data to estimate interest rate changes for each "timebucket". A The Balance Sheet for Commercial Banking Company of Australia Limited (CBC) as at 28 February 2018 is shown below as Table 1. CBC is an Authorised Depository Institution in Australia and operates both retail and investment banking operations in Australia. CBC's assets and liabilities are exclusively domiciled in Australia and hence it does not have any foreign exchange risk. You are CBC's Head of Interest Rate Management. You have identified the current market interest rates applicable to the bank's assets and liabilities and calculated the zero coupon equivalent yields using bootstrapping, and they are set out in (Table 2). spreadsheet has been provided to assist with this process. (i) DATA The Bank's policy is to assess its risk using a 95% confidence level based on an assumption of that future interest rate changes are normally Table 1 Commercial Banking Company of Australia Limited Balance Sheet as at 28 February 2018 distributed. What is the bank's DEAR? (i) The Bank's policy also requires its risk to be assessed over a 10 day time horizon. What is the Bank's Value at Risk (VaR)? Current Current (i) You should explain the approach that you used, the assumptions that were made to obtain and derive the data and the results and any limitations that you consider exist with the approach or the methodology used. You should also include the workings for this calculation as an Shareholders Funds 11250.000 month Interbank Loans 2.00 10.000,000 Appendix to your paper. (20 marks) Call Deposits 6 months (180 days) 2 years (semi-annual 1.95 4 years (semi-annual 25 02.000,000 Overdrafts (daily rate reset) 34,700,00010 year Housing (omth rate reset)40020.500,000 4.05 30.125,000 425 45.700.000 You have been asked to explain to management what these results reveal about the CBC's interest rate exposure? Management also wishes to know what limitations might exist with the use of these results and what if any assumptions were used to derive the results. The explanation should also .700,000 2 years (semi-annual) 3.175.0004 years (semi-annual) 04 575,000 include a justification for these assumptions. (10 marks) 115.825,000 Table 2 %pa Zero 1. You have noted that the zero-coupon equivaient interest rates are similar to the PAR rates because the yield curve is relatively flat over the period to 4 years. All of the above interest rates, except Call, are semi-annually compounding interest rates 2. The interest rates shown in the balance sheet are the average interest rates applicable to each of the instrument types and each maturity band in the balance sheet as at the date of the balance sheet. You have assumed for the purposes of the calculations that these rates represent the cost or revenue (as the case may be) for the purposes of calculating cashflows and retuns. CBC Bank's marginal borrowing and lending rates for terms of 6 moths are priced or set by reference to the Australian Bank Accepted Bl (BAB) interest rate and at the Commonwealth Government Security(CGS) rate for ternms of one year and longer These are the interest rates relected in the interest rates applying to the asseto and abilities in Table 2 above. 3. You are required to undertake an assessment of past daily changes in interest rates for each of the timebuckets" set out in Cashflow Ladder assuming that the assessed interest rate changes for each "timebucket' are independent i.e. uncorrelated. You have decided to base this assessment on the past six months daily changes in interest rates, i.e. from 1 September 2017 to 28 February 2018 and you are required to source the appropriate data. Note; depending on the data you have sourced, you may need to interpolate data to estimate interest rate changes for each "timebucket". A The Balance Sheet for Commercial Banking Company of Australia Limited (CBC) as at 28 February 2018 is shown below as Table 1. CBC is an Authorised Depository Institution in Australia and operates both retail and investment banking operations in Australia. CBC's assets and liabilities are exclusively domiciled in Australia and hence it does not have any foreign exchange risk. You are CBC's Head of Interest Rate Management. You have identified the current market interest rates applicable to the bank's assets and liabilities and calculated the zero coupon equivalent yields using bootstrapping, and they are set out in (Table 2). spreadsheet has been provided to assist with this process. (i) DATA The Bank's policy is to assess its risk using a 95% confidence level based on an assumption of that future interest rate changes are normally Table 1 Commercial Banking Company of Australia Limited Balance Sheet as at 28 February 2018 distributed. What is the bank's DEAR? (i) The Bank's policy also requires its risk to be assessed over a 10 day time horizon. What is the Bank's Value at Risk (VaR)? Current Current (i) You should explain the approach that you used, the assumptions that were made to obtain and derive the data and the results and any limitations that you consider exist with the approach or the methodology used. You should also include the workings for this calculation as an Shareholders Funds 11250.000 month Interbank Loans 2.00 10.000,000 Appendix to your paper. (20 marks) Call Deposits 6 months (180 days) 2 years (semi-annual 1.95 4 years (semi-annual 25 02.000,000 Overdrafts (daily rate reset) 34,700,00010 year Housing (omth rate reset)40020.500,000 4.05 30.125,000 425 45.700.000 You have been asked to explain to management what these results reveal about the CBC's interest rate exposure? Management also wishes to know what limitations might exist with the use of these results and what if any assumptions were used to derive the results. The explanation should also .700,000 2 years (semi-annual) 3.175.0004 years (semi-annual) 04 575,000 include a justification for these assumptions. (10 marks) 115.825,000 Table 2 %pa Zero 1. You have noted that the zero-coupon equivaient interest rates are similar to the PAR rates because the yield curve is relatively flat over the period to 4 years. All of the above interest rates, except Call, are semi-annually compounding interest rates 2. The interest rates shown in the balance sheet are the average interest rates applicable to each of the instrument types and each maturity band in the balance sheet as at the date of the balance sheet. You have assumed for the purposes of the calculations that these rates represent the cost or revenue (as the case may be) for the purposes of calculating cashflows and retuns. CBC Bank's marginal borrowing and lending rates for terms of 6 moths are priced or set by reference to the Australian Bank Accepted Bl (BAB) interest rate and at the Commonwealth Government Security(CGS) rate for ternms of one year and longer These are the interest rates relected in the interest rates applying to the asseto and abilities in Table 2 above. 3