Question

You are required to use a financial calculator to solve 10 problems (provided on page 4) related to the cost of capital. You are required

You are required to use a financial calculator to solve 10 problems (provided on page 4) related to the cost of capital. You are required to show the following three steps for each problem (a sample problem and solution is attached for guidance):

(i) Describe and interpret the assumptions related to the problem.

(ii) Apply the appropriate mathematical model to solve the problem.

(iii) Calculate the correct solution to the problem.

A companys capital structure consists of 40% debt and 60% equity. The before-tax cost of debt is 12%, the cost of retained earnings is 15%, and the tax rate is 40%. What is this companys WACC (round your answer to two decimal places)?

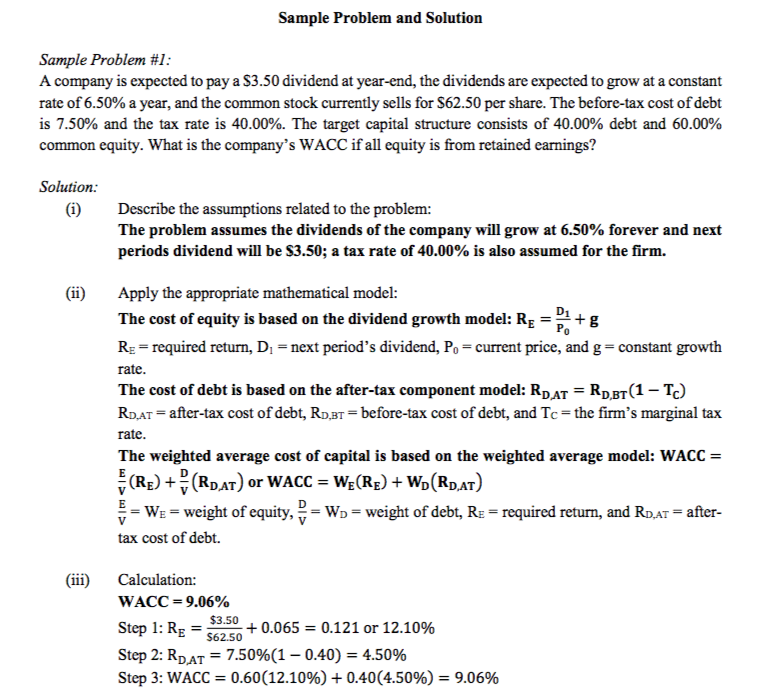

Sample Problem and Solution Sample Problem #1 A company is expected to pay a S3.50 dividend at year-end, the dividends are expected to grow at a constant rate of 6.50% a year, and the common stock currently sells for S62.50 per share. The before-tax cost ofdebt is 7.50% and the tax rate is 40.00%. The target capital structure consists of 40.00% debt and 60.00% common equity. What is the company's WACC if all equity is from retained earnings? Solution: (i)Describe the assumptions related to the problem: The problem assumes the dividends of the company will grow at 6.50% forever and next periods dividend will be S3.50; a tax rate of 40.00% is also assumed for the firm. (ii) Apply the appropriate mathematical model: The cost of equity is based on the dividend growth model: REP+g Rg required return, Dnext period's dividend, Po-current price, and gconstant growth rate The cost of debt is based on the after-tax component model: RDAT-RDBT(1-10 RDAT = after-tax cost of debt, RDB,-before-tax cost of debt, and Tc-the firm's marginal tax rate The weighted average cost of capital is based on the weighted average model: WACC- V(RRDAT) or WACC WCRE) WD(RDat) WE- weight of equity, Ws-weight of debt, R required return, and RoAT-after tax cost of debt. (ii) Calculation: WACC-9.06% $3.50 - RE = + 0.065 = 0.121 or 12.10% Step 2: RDAT-7.50%(1-040)-4.50% Step 3: WACC-0.60(12.10%) 0.40(4.50%)-9.06%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started