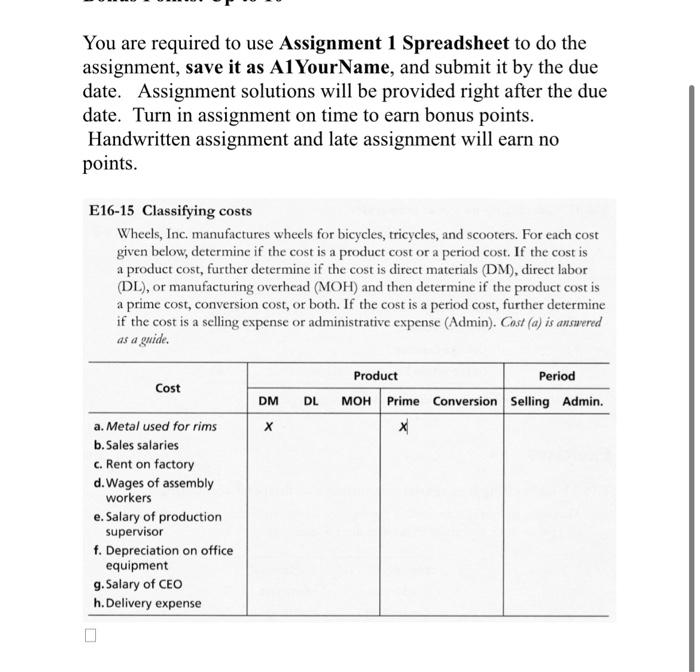

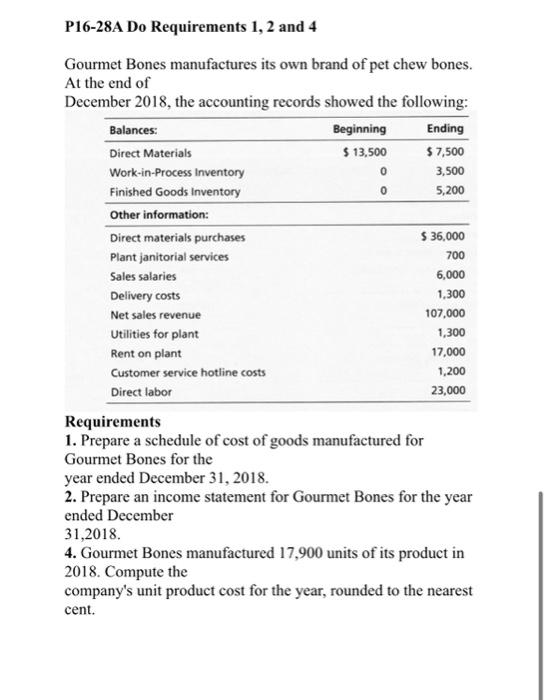

You are required to use Assignment 1 Spreadsheet to do the assignment, save it as A1 YourName, and submit it by the due date. Assignment solutions will be provided right after the due date. Turn in assignment on time to earn bonus points. Handwritten assignment and late assignment will earn no points. E16-15 Classifying costs Wheels, Inc, manufactures wheels for bicycles, tricycles, and scooters. For each cost given below, determine if the cost is a product cost or a period cost. If the cost is a product cost, further determine if the cost is direct materials (DM), direct labor (DL), or manufacturing overhead (MOH) and then determine if the product cost is a prime cost, conversion cost, or both. If the cost is a period cost, further determine if the cost is a selling expense or administrative expense (Admin). Cost (a) is answered as a guide. P16-28A Do Requirements 1,2 and 4 Gourmet Bones manufactures its own brand of pet chew bones. At the end of December 2018 , the accounting records showed the following: Requirements 1. Prepare a schedule of cost of goods manufactured for Gourmet Bones for the year ended December 31, 2018. 2. Prepare an income statement for Gourmet Bones for the year ended December 31,2018. 4. Gourmet Bones manufactured 17,900 units of its product in 2018. Compute the company's unit product cost for the year, rounded to the nearest cent. You are required to use Assignment 1 Spreadsheet to do the assignment, save it as A1 YourName, and submit it by the due date. Assignment solutions will be provided right after the due date. Turn in assignment on time to earn bonus points. Handwritten assignment and late assignment will earn no points. E16-15 Classifying costs Wheels, Inc, manufactures wheels for bicycles, tricycles, and scooters. For each cost given below, determine if the cost is a product cost or a period cost. If the cost is a product cost, further determine if the cost is direct materials (DM), direct labor (DL), or manufacturing overhead (MOH) and then determine if the product cost is a prime cost, conversion cost, or both. If the cost is a period cost, further determine if the cost is a selling expense or administrative expense (Admin). Cost (a) is answered as a guide. P16-28A Do Requirements 1,2 and 4 Gourmet Bones manufactures its own brand of pet chew bones. At the end of December 2018 , the accounting records showed the following: Requirements 1. Prepare a schedule of cost of goods manufactured for Gourmet Bones for the year ended December 31, 2018. 2. Prepare an income statement for Gourmet Bones for the year ended December 31,2018. 4. Gourmet Bones manufactured 17,900 units of its product in 2018. Compute the company's unit product cost for the year, rounded to the nearest cent