Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are responsible for the management of a large mutual fund that trades in high- grade corporate and government bonds. At the present time, the

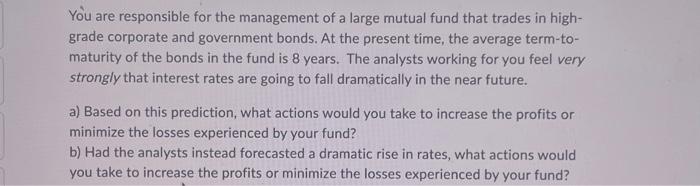

You are responsible for the management of a large mutual fund that trades in high- grade corporate and government bonds. At the present time, the average term-to- maturity of the bonds in the fund is 8 years. The analysts working for you feel very strongly that interest rates are going to fall dramatically in the near future. a) Based on this prediction, what actions would you take to increase the profits or minimize the losses experienced by your fund? b) Had the analysts instead forecasted a dramatic rise in rates, what actions would you take to increase the profits or minimize the losses experienced by your fund?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started