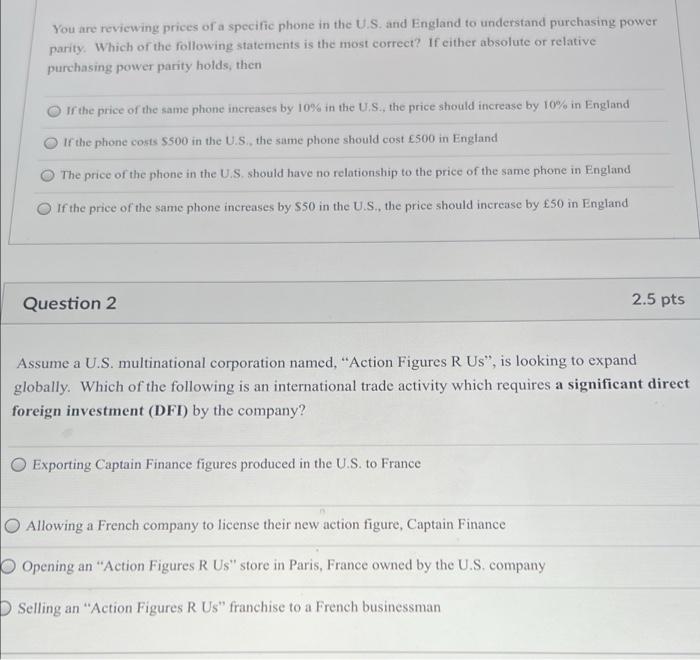

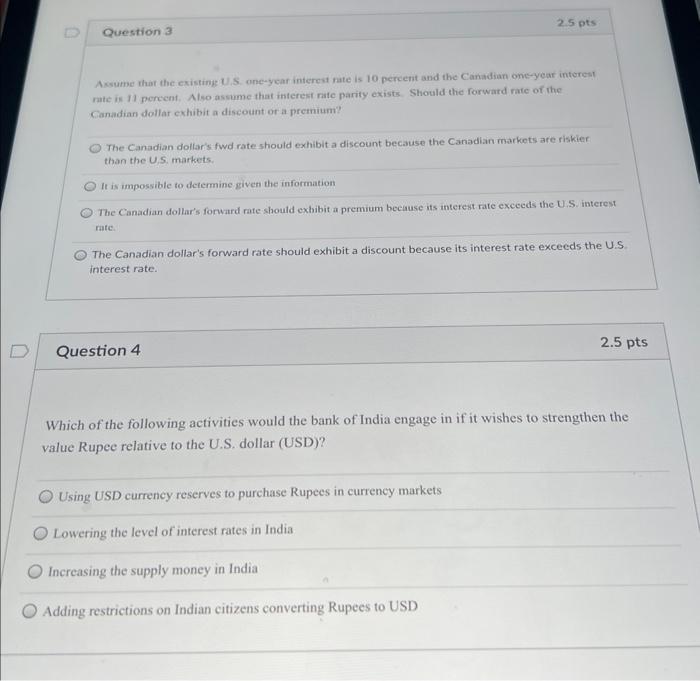

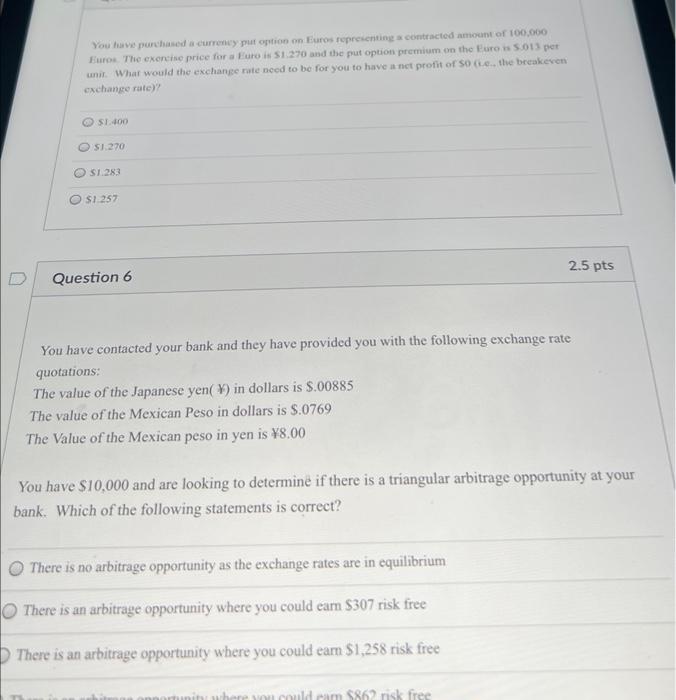

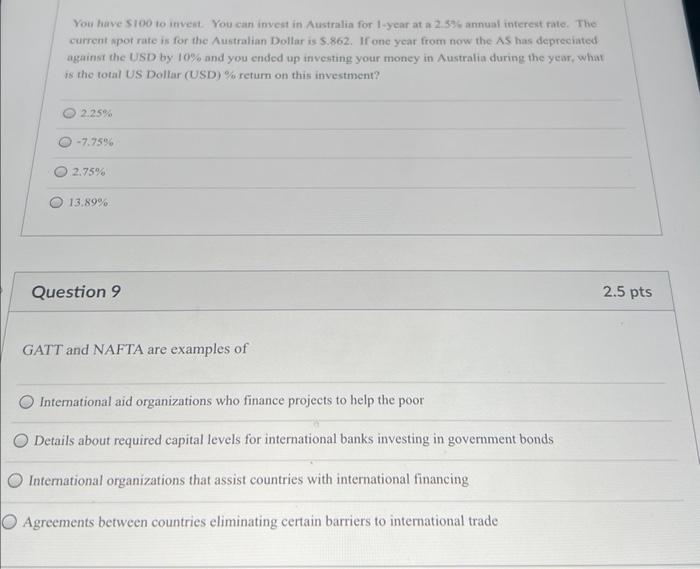

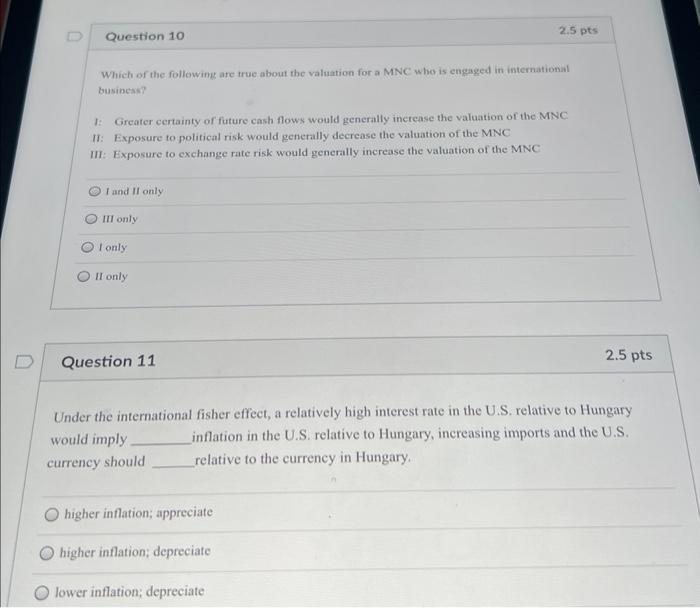

You are reviewing prices of a specific phone in the U.S. and England to understand purchasing power parity. Which of the following statements is the most correct? If either absolute or relative purchasing power parity holds; then If the price of the same phone increases by \10 in the U.S., the price should increase by \10 in England If the phone costs \\( \\$ 500 \\) in the U.S, the same phone should cost \\( 500 \\) in England The price of the phone in the U.S. should have no relationship to the price of the same phone in England If the price of the same phone increases by \\( \\$ 50 \\) in the U.S., the price should increase by \\( 50 \\) in England Question 2 \\( 2.5 \\mathrm{pts} \\) Assume a U.S. multinational corporation named, \"Action Figures R Us\", is looking to expand globally. Which of the following is an international trade activity which requires a significant direct foreign investment (DFI) by the company? Exporting Captain Finance figures produced in the U.S. to France Allowing a French company to license their new action figure, Captain Finance Opening an \"Action Figures R Us\" store in Paris, France owned by the U.S. company Selling an \"Action Figures R Us\" franchise to a French businessman Axsume that the existing U.S. one-year interest nate is 10 percent and the Canadian one-year intorest. rate is 11 pereent, Also assume that interest rate parity exists. Should the forward rate of the Canadian dollar exhibit a discount or a premium? The Canadian dollar's fwd rate should exhibit a discount because the Canadian markets are riskier than the U,S, markets. It is impossible to determine given the information The Canadian dollar's forward rate should exhibit a premium because its interest rate exceeds the U.S. interest rate. The Canadian dollar's forward rate should exhibit a discount because its interest rate excecds the U.S. interest rate. Question 4 2.5 pts Which of the following activities would the bank of India engage in if it wishes to strengthen the value Rupee relative to the U.S. dollar (USD)? Using USD currency reserves to purchase Rupees in currency markets Lowering the level of interest rates in India Increasing the supply money in India Adding restrictions on Indian citizens converting Rupees to USD You have purshased a currency put ogntion on Euros fopresenting a contracted amount of 100,000 Furos. The ekencise price for a fure in \\( \\$ 1,270 \\) and the put option premium on the fure is 5.013 per anis. What would the exchange rate need to be for you to have a net profit of 50 (L.e. itwe breakeven exchange rate)? S1. 400 \\( \\$ 1.270 \\) s1.283 \\( \\$ 1: 257 \\) Question 6 2.5 pts You have contacted your bank and they have provided you with the following exchange rate quotations: The value of the Japanese yen \\( () \\) in dollars is \\( \\$ .00885 \\) The value of the Mexican Peso in dollars is \\( \\$ .0769 \\) The Value of the Mexican peso in yen is \\( 8.00 \\) You have \\( \\$ 10,000 \\) and are looking to determine if there is a triangular arbitrage opportunity at your bank. Which of the following statements is correct? There is no arbitrage opportunity as the exchange rates are in equilibrium There is an arbitrage opportunity where you could earn \\$307 risk free There is an arbitrage opportunity where you could earn \\( \\$ 1,258 \\) risk free You have sioo to invent. You can invest in Australia for 1 -year at a 2.326 annual interest rate. The current apot rate is for the Australian Dollar is 5.862 . If one year from now the AS has depreciated against the USD by \10 and you ended up investing your money in Australia during the year, what is the total US Dollar (USD) \\% return on this investment? \2.25 \7.75 \2.75 \13.89 Question 9 \\( 2.5 \\mathrm{pts} \\) GATT and NAFTA are examples of International aid organizations who finance projects to help the poor Details about required capital levels for international banks investing in government bonds International organizations that assist countries with international financing Agreements between countries eliminating certain barriers to international trade Which of the following are true about the valuation for a MNC who is engaged in international busincas? 1: Greater certainty of future cash flows would generally increase the valuation of the \\( \\mathrm{MNC} \\) II: Exposure to political risk would generally decrease the valuation of the \\( \\mathrm{MNC} \\) III: Exposure to exchange rate risk would generally increase the valuation of the MNC I and II only. III only I only II only Question 11 \\( 2.5 \\mathrm{pts} \\) Under the international fisher effect, a relatively high interest rate in the U.S. relative to Hungary would imply inflation in the U.S. relative to Hungary, increasing imports and the U.S. currency should relative to the currency in Hungary. higher inflation; appreciate higher inflation; depreciate lower inflation; depreciate