Question

You are reviewing the account balances on the balance sheet in QBO at the end of January 20x1. The balance on the balance sheet for

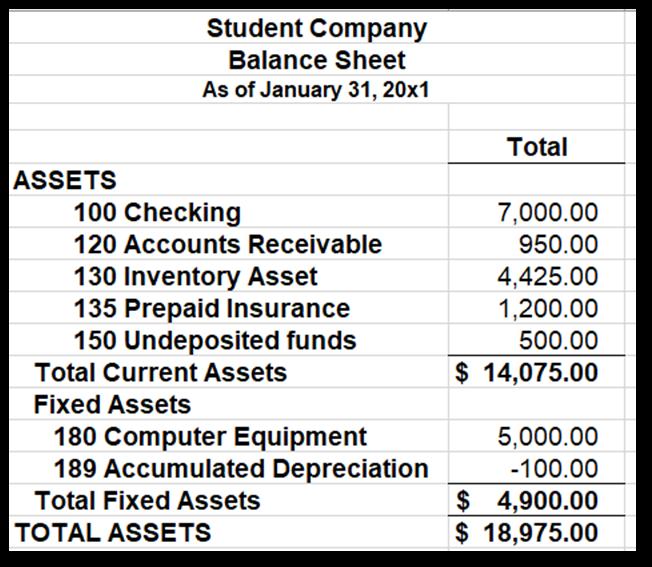

You are reviewing the account balances on the balance sheet in QBO at the end of January 20x1. The balance on the balance sheet for the checking account seems low to you. You know that you have personally taken all the checks and cash to the bank and deposited them with the bank. Based on the partial balance sheet below, what might be a reason your checking account balance in QBO appears low?

Teacher feedback: Look at the scenario again, is there something within QBO that perhaps the accountant thought they did but really didn't. Ask your self if the person said all the checks were taken to the bank, why are there undeposited funds? How do you fix that?

Student Company Balance Sheet As of January 31, 20x1 Total ASSETS 100 Checking 7,000.00 950.00 120 Accounts Receivable 130 Inventory Asset 135 Prepaid Insurance 150 Undeposited funds 4,425.00 1,200.00 500.00 Total Current Assets $ 14,075.00 Fixed Assets 180 Computer Equipment 189 Accumulated Depreciation 5,000.00 -100.00 $ 4,900.00 $ 18,975.00 Total Fixed Assets TOTAL ASSETS

Step by Step Solution

3.54 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Based on the partial balance sheet the following observations can be drawn to show the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started